Untitled - Banco Mercantil

Untitled - Banco Mercantil

Untitled - Banco Mercantil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

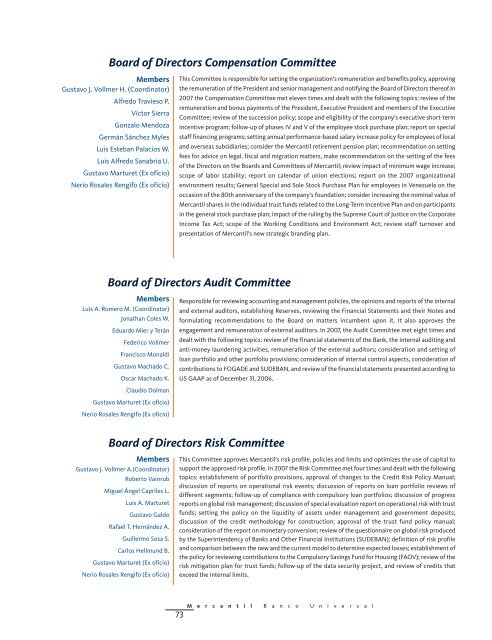

Board of Directors Compensation Committee<br />

Members<br />

Gustavo J. Vollmer H. (Coordinator)<br />

Alfredo Travieso P.<br />

Víctor Sierra<br />

Gonzalo Mendoza<br />

Germán Sánchez Myles<br />

Luis Esteban Palacios W.<br />

Luis Alfredo Sanabria U.<br />

Gustavo Marturet (Ex oficio)<br />

Nerio Rosales Rengifo (Ex oficio)<br />

Members<br />

Luis A. Romero M. (Coordinator)<br />

Jonathan Coles W.<br />

This Committee is responsible for setting the organization’s remuneration and benefits policy, approving<br />

the remuneration of the President and senior management and notifying the Board of Directors thereof.In<br />

2007 the Compensation Committee met eleven times and dealt with the following topics: review of the<br />

remuneration and bonus payments of the President, Executive President and members of the Executive<br />

Committee; review of the succession policy; scope and eligibility of the company’s executive short-term<br />

incentive program; follow-up of phases IV and V of the employee stock purchase plan; report on special<br />

staff financing programs; setting annual performance-based salary increase policy for employees of local<br />

and overseas subsidiaries; consider the <strong>Mercantil</strong> retirement pension plan; recommendation on setting<br />

fees for advice on legal, fiscal and migration matters, make recommendation on the setting of the fees<br />

of the Directors on the Boards and Committees of <strong>Mercantil</strong>; review impact of minimum wage increase;<br />

scope of labor stability; report on calendar of union elections; report on the 2007 organizational<br />

environment results; General Special and Sole Stock Purchase Plan for employees in Venezuela on the<br />

occasion of the 80th anniversary of the company’s foundation; consider increasing the nominal value of<br />

<strong>Mercantil</strong> shares in the individual trust funds related to the Long-Term Incentive Plan and on participants<br />

in the general stock purchase plan; impact of the ruling by the Supreme Court of Justice on the Corporate<br />

Income Tax Act; scope of the Working Conditions and Environment Act; review staff turnover and<br />

presentation of <strong>Mercantil</strong>’s new strategic branding plan.<br />

Board of Directors Audit Committee<br />

Eduardo Mier y Terán<br />

Federico Vollmer<br />

Francisco Monaldi<br />

Gustavo Machado C.<br />

Oscar Machado K.<br />

Claudio Dolman<br />

Gustavo Marturet (Ex oficio)<br />

Nerio Rosales Rengifo (Ex oficio)<br />

Members<br />

Gustavo J. Vollmer A.(Coordinator)<br />

Roberto Vainrub<br />

Miguel Ángel Capriles L.<br />

Luis A. Marturet<br />

Gustavo Galdo<br />

Rafael T. Hernández A.<br />

Guillermo Sosa S.<br />

Carlos Hellmund B.<br />

Gustavo Marturet (Ex oficio)<br />

Nerio Rosales Rengifo (Ex oficio)<br />

Responsible for reviewing accounting and management policies, the opinions and reports of the internal<br />

and external auditors, establishing Reserves, reviewing the Financial Statements and their Notes and<br />

formulating recommendations to the Board on matters incumbent upon it. It also approves the<br />

engagement and remuneration of external auditors. In 2007, the Audit Committee met eight times and<br />

dealt with the following topics: review of the financial statements of the Bank, the internal auditing and<br />

anti-money laundering activities, remuneration of the external auditors; consideration and setting of<br />

loan portfolio and other portfolio provisions; consideration of internal control aspects, consideration of<br />

contributions to FOGADE and SUDEBAN, and review of the financial statements presented according to<br />

US GAAP as of December 31, 2006.<br />

Board of Directors Risk Committee<br />

This Committee approves <strong>Mercantil</strong>’s risk profile, policies and limits and optimizes the use of capital to<br />

support the approved risk profile. In 2007 the Risk Committee met four times and dealt with the following<br />

topics: establishment of portfolio provisions, approval of changes to the Credit Risk Policy Manual;<br />

discussion of reports on operational risk events; discussion of reports on loan portfolio reviews of<br />

different segments; follow-up of compliance with compulsory loan portfolios; discussion of progress<br />

reports on global risk management; discussion of special evaluation report on operational risk with trust<br />

funds; setting the policy on the liquidity of assets under management and government deposits;<br />

discussion of the credit methodology for construction; approval of the trust fund policy manual;<br />

consideration of the report on monetary conversion; review of the questionnaire on global risk produced<br />

by the Superintendency of Banks and Other Financial Institutions (SUDEBAN); definition of risk profile<br />

and comparison between the new and the current model to determine expected losses; establishment of<br />

the policy for reviewing contributions to the Compulsory Savings Fund for Housing (FAOV); review of the<br />

risk mitigation plan for trust funds; follow-up of the data security project, and review of credits that<br />

exceed the internal limits.<br />

M e r c a n t i l B a n c o U n i v e r s a l<br />

73