Annual Report 2006/07 (3841 kb) - City of Playford - SA.Gov.au

Annual Report 2006/07 (3841 kb) - City of Playford - SA.Gov.au

Annual Report 2006/07 (3841 kb) - City of Playford - SA.Gov.au

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong><strong>2006</strong>/<strong>07</strong>

ContentsWelcome 1Message from Mayor and CEO 2Financial Performance 3Highlights <strong>of</strong> <strong>2006</strong>/<strong>07</strong> 5Elected Members and Ward Map 11Council <strong>Gov</strong>ernance 12Organisational Structure 22Strategic Planning 23<strong>Annual</strong> Performance Statement 25Organisational Excellence 30- Community Engagement 30- Awards 30Organisational Accountability 31- Auditor’s Payment 31- Workforce Pr<strong>of</strong>ile 31- Freedom <strong>of</strong> Information 35- Ombudsman <strong>Report</strong> 36- Corporate <strong>Gov</strong>ernance Documents andPolicies38- Procurement Services 40- Community Land Management Plans 40Appendices 41- 1. <strong>Annual</strong> Audited Financial Statements- 2. Rating Policy- 3. Subsidiary <strong>Annual</strong> <strong>Report</strong>s- 3.1 Gawler River Flood ManagementAuthority (GRFMA)- 3.2 Northern Adelaide WasteManagement Authority (NAWMA)- 3.3 Waterpro<strong>of</strong>ing Northern AdelaideRegional Subsidiary (WNARS)

Welcome to the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> <strong>Annual</strong> <strong>Report</strong> for <strong>2006</strong>/<strong>07</strong>Communicating Council’s activities in an open and transparent way is one <strong>of</strong> our highest priorities. We ensurethat information access and distribution is timely, relevant, respectful, and acknowledges the diversity <strong>of</strong><strong>Playford</strong>'s community.This year we have developed an abridged version <strong>of</strong> the annual report which will contain the informationrequired to satisfy our legislative obligations. It will also include some additional information which Councilconsiders important to have as a historical record <strong>of</strong> the past year. This report will be accompanied by acommunity focused supplement report which will tell the story <strong>of</strong> key highlights from <strong>2006</strong>/<strong>07</strong> through the eyes<strong>of</strong> the community. This supplement will be distributed to the community via Council’s Community Newspaper inJanuary 2008.General Council elections were held during the reporting period (November <strong>2006</strong>), with a new Council electedfor a four year term. This Council listens to the community and works together toward achieving the communityvision and goals. <strong>City</strong> <strong>of</strong> <strong>Playford</strong> is committed to engaging with the community in setting priorities for actionand contributing to decision making that affects the community. The <strong>Annual</strong> <strong>Report</strong> is our principle way <strong>of</strong> beingaccountable to the community; it informs our residents, ratepayers, stakeholders, staff, government agenciesand any other interested parties <strong>of</strong> the projects and achievements against our strategic and financial plans.1

Message from the Mayor and CEOIn May 20<strong>07</strong>, Council celebrated 10 years as the <strong>City</strong> <strong>of</strong> <strong>Playford</strong>. This milestone provided us with anopportunity to reflect on the changes we have seen within our community. The <strong>City</strong> has grown significantly - wehave expanded our horizons and welcomed an increase in people choosing to live in our city bec<strong>au</strong>se <strong>of</strong> ourvibrant regional and district centres and investment in rural areas through improved infrastructure.To ensure we continue developing in this manner, Council has worked together with the community to setpriorities for future action. The development <strong>of</strong> the <strong>Playford</strong> Community Plan articulates a shared vision andgoals for the community. The plan is underpinned by a commitment made across the three tiers <strong>of</strong> governmentto achieve our vision <strong>of</strong> real and measurable outcomes for the community.In the last financial year, Council implemented an investment strategy based on its goals <strong>of</strong> CommunityWellbeing, Economic Prosperity and Environmental Care. This expenditure is demonstrated through the state <strong>of</strong>the art Northern Sound System facility, a commitment to the redevelopment <strong>of</strong> the Aquadome, Roads toRecovery initiative, a strong focus on community engagement and investment in roads and stormwaterinfrastructure in our rural areas.This annual report provides an overview <strong>of</strong> how the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> has managed its responsibilities andresources for its community over the last financial year and <strong>of</strong>fers an insight into what lies ahead for the future.We would like to thank the community, dedicated elected members, staff and hundreds <strong>of</strong> volunteers for theirongoing commitment and contribution to the development <strong>of</strong> our <strong>City</strong>.Martin LindsellMayorTim JacksonChief Executive Officer2

Financial PerformanceThe 20<strong>07</strong> Income Statement reports an operating surplus before capital amounts <strong>of</strong> $521k representing animprovement <strong>of</strong> $2.9m over the original budgeted deficit <strong>of</strong> ($2.4m). After capital amounts a “Net Surplus” <strong>of</strong>$11.3m is reported this is an improvement <strong>of</strong> $1.1m on the Net Surplus reported in <strong>2006</strong>.Summarised Income StatementIncome 49,401 46,379Expenses 50,627 47,414Operating Surplus (deficit) before Capital Amounts & Significant Item (1,226) (1,035)20<strong>07</strong>$Significant Item 1,747Operating Surplus (deficit) before Capital Amounts 521 (1,035)Capital Amounts 10,803 11,235Net Surplus/(Deficit) 11,324 10,200<strong>2006</strong>$Care must be taken in interpreting this Operating Surplus before Capital Amounts <strong>of</strong> $521k, in terms <strong>of</strong> what itmeans for Councils on-going financial sustainability.This result is primarily due to a large “Significant Item” being our Share <strong>of</strong> Pr<strong>of</strong>it - Gawler River FloodManagement Authority (GRFMA) for 20<strong>07</strong>. This substantial “pr<strong>of</strong>it” generated by GRFMA is not cash pr<strong>of</strong>it butis an accounting entry to take up our share <strong>of</strong> the change in net assets <strong>of</strong> GRFMA. Without this item, Councilwould have recorded an Operating Deficit before Capital Amounts <strong>of</strong> $1.2m.Further to this Operating Income <strong>of</strong> $49,401 includes $1.9m for items that would previously have beenclassified as Capital Amounts. This new format for reporting <strong>of</strong> income has been brought about by changes tothe required financial reporting format for Local <strong>Gov</strong>ernment in South Australia.3

The graph below shows the actual Operating Surplus (Deficit) for the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> since amalgamation inboth the old and new reporting format. The 20<strong>07</strong>/08 value is based on the current revised budget.Dollars $000'sOPERATING SURPLUS (DEFICIT)New FormatTargetOld Format97/98 98/99 99/00 00/01 01/02 02/03 03/04 04/05 05/06 06/<strong>07</strong>3000200010000-1000-2000-3000-4000-5000-6000-7000-8000-9000-10000Balance Sheet (Appendix 1, page 4)Council’s Total Equity or Net Assets have increased from $341.4m to $370.4m due to a combination <strong>of</strong> theoperating result after capital revenues above ($11.3m) and a revaluation upwards <strong>of</strong> Infrastructure assets <strong>of</strong>$17.7m.Summarised Balance Sheet20<strong>07</strong>$<strong>2006</strong>$Current Assets 10,125 9,117Non-Current Assets 411,314 376,645Total Assets 421,439 385,762Current Liabilities 20,754 17,643Non-Current Liabilities 30,308 26,753Total Liabilities 51,062 44,396NET ASSETS 370,377 341,366TOTAL EQUITY 370,377 341,3664

Highlights <strong>of</strong> <strong>2006</strong>/<strong>07</strong>The following section includes a snapshot <strong>of</strong> highlights from across the three goal areas <strong>of</strong> CommunityWellbeing, Economic Prosperity and Environmental Care, as well as highlights from a corporate perspective.Community Wellbeing<strong>City</strong> <strong>of</strong> <strong>Playford</strong> is committed to improving and supporting the wellbeing, health and safety <strong>of</strong> the<strong>Playford</strong> community. In <strong>2006</strong>/<strong>07</strong>, Council’s major community wellbeing initiatives included thedevelopment <strong>of</strong> the state <strong>of</strong> the art Northern Sound System facility, <strong>Playford</strong> North communityengagement initiatives such as the Peachey Trailer and Charette design process and a $15.6mcommitment to the redevelopment <strong>of</strong> the Aquadome.Marni Waeindi – Indigenous Transition Pathways CentreMarni Waeindi engages Aboriginal young people through a range <strong>of</strong> activities tailored to meaningful learningexperiences while developing linkages to employment in the future. The Vocational Education and Training inSchools Introduction to Hair and Be<strong>au</strong>ty Course is one <strong>of</strong> Marni Waeindi’s successful engagement programswhich are <strong>of</strong>fered at Elizabeth TAFE. 10 Indigenous students from the <strong>Playford</strong> region attended a course forone day a week for 10 weeks.The program aims to prepare the students for a future in hairdressing by providing them with the theoretical andpractical skills, abilities and hands on experience. The course covers Certificate I and II in Hair and Be<strong>au</strong>ty and<strong>of</strong>fers transition opportunities for a variety <strong>of</strong> options such as Advanced Level, Pre Vocational Full Time Study,School Based Apprenticeships, Hairdressing Apprenticeships and/or employment.Liberty SwingA Liberty Swing and other new equipment installed at Fremont Park in November <strong>2006</strong> have made the parkmore accessible for a diverse range <strong>of</strong> community users, including people with a disability.The Liberty Swing is designed specifically for use by people in wheelchairs and enables them, for the first time,to enjoy and participate in the experience <strong>of</strong> using a swing. Along with the swing, other accessible playgroundequipment has also been installed in the park to provide additional opportunities for children in wheelchairs toplay inclusively with other children. Fremont Park is one <strong>of</strong> the few in the state to have a Liberty Swing andamong the leaders in installing accessible play equipment.The collaboration between the Community Services and Parks teams has achieved great outcomes for childrenwith a disability who are now able to participate fully with their families and peers in activities at Fremont Park,which has become a great place for the whole community5

Northern Sound System (NSS)Council’s youth focused community music centre opened its doors for business in February 20<strong>07</strong>. Four eventswere held between March and June as well as several one-<strong>of</strong>f workshops. The rehearsal room has been verypopular. Recordings have also been popular if not exceeded expectations with on average recordingsoccurring twice a week for demos and CDs!A Reference Group was formed in May <strong>2006</strong> and has continued to meet monthly throughout the planning andimplementation phase. The Reference Group is made up <strong>of</strong> both young and other community members. Theirinput has been extremely valuable as it guided some <strong>of</strong> the fit-out design issues. By the end <strong>of</strong> June 20<strong>07</strong>, 28community members signed up as volunteers. Volunteers undertake daily tasks such as band liaison,mentoring young bands, operating the lighting desk, organising events, working behind the bar and in thekitchen and reception duties. Volunteers have been invaluable in the implementation and ongoing operations <strong>of</strong>NSS.“Books R4 Babies 2” - An Early Childhood Literacy Program and Family Reading CentreBooks R4 Babies 2 is an exciting and innovative Early Childhood Literacy Program developed in collaborationbetween the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> Library Service, <strong>City</strong> <strong>of</strong> Salisbury Library Service and the University <strong>of</strong> SouthAustralia.Following the pilot program, which ran in <strong>2006</strong>, this highly successful program continued in 20<strong>07</strong> rolling out to24 sites from the initial 19 in <strong>2006</strong>. Planning is currently underway between the Library Services and theUniversity <strong>of</strong> South Australia to ensure sustainability and development <strong>of</strong> the program for the next three years.A further outcome <strong>of</strong> the program has been the development <strong>of</strong> the Family Reading Centres which are locatedat the Civic Centre Library, Elizabeth and the Len Beadell Library, Salisbury. Situated in the Children’s area <strong>of</strong>each library, the Family Reading Centres bring together a broad cross section <strong>of</strong> resources to support parentsin their parenting role. The collections include books, DVDs, brochures, fact sheets, and individual copies <strong>of</strong> theLapsit Outreach Literacy Program folders.Economic ProsperityCouncil is committed to improving the economic prosperity <strong>of</strong> the region through forming strongrelationships with government, business and education and training sectors. In <strong>2006</strong>/<strong>07</strong> majoreconomic initiatives included the work on the Elizabeth Regional Activity Centre, ensuring that it retainsits position as the north’s most significant retail, commercial, community, educational and regional huband the strong investment in the rural infrastructure program.20<strong>07</strong> Regional Prosperity ConferenceThe 20<strong>07</strong> Regional Prosperity Conference held at the <strong>Playford</strong> Civic Centre on Wednesday 27 June was anoutstanding success with a 57% increase in participation. Support from sponsors was the key to allowingNorthern Adelaide Business Enterprise Centre to advance some <strong>of</strong> the constructive ideas from last year’sconference. These changes included 4 bus tours (94 people toured the region), four workshops (115 peopleattended four very diverse topics) and 12 companies made Fast Presentations (12 minutes each).6

Three Key Note speakers delivered strong presentations on Lean Business Procedures during the morningsession and another lunch time Key Note address featured marketing and style in business. Over 250 peopleattended these prime addresses in the Shedley Theatre. Our Trade Exhibit displayed the goods and services <strong>of</strong>38 traders and filled the function room at the Civic Centre.The support <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> (as the major sponsor) was accompanied by support from ANZ Bank,Mission Australia, Adelaide Plains Marketing, Salisbury Export Centre, Inner West & Inner Southern BusinessEnterprise Centres as well as Centre for Innovation and Business Dynamics. Three Business Awards werepresented to local businesses in the categories <strong>of</strong> Business <strong>of</strong> the Year, Best New Business and YoungBusiness Owner <strong>of</strong> the Year.Elizabeth Regional CentreCouncil has taken a proactive approach to the development <strong>of</strong> the Regional Centre since 2000. Key outcomesfrom <strong>2006</strong>/<strong>07</strong> include:• A Master Plan for Fremont Park that will guide the future development <strong>of</strong> this significant regional reserve• Council commitment to the redevelopment <strong>of</strong> the Aquadome• Upgrading <strong>of</strong> the pavement and resealing <strong>of</strong> the road on Elizabeth Way• Significant funding sourced from both local and state government to fund a strategic development plan forGreater Edinburgh Parks• Development <strong>of</strong> the Northern Sound System.<strong>Annual</strong> Civil Works ProgramIn <strong>2006</strong>/<strong>07</strong>, annual programs were developed for the upgrade, maintenance and/or replacement <strong>of</strong> road andfootpath assets. A number <strong>of</strong> capital projects were included in the <strong>City</strong> Plan to fund this work. Additionally,Council developed a program to create new road assets (sealing <strong>of</strong> current unsealed roads) and new footpathassets (as required in new land divisions). Highlights include:• Road Reseal and Rehabilitation Program• Rural Road Construction Program• Craigmore Road Stage 3• Curtis Road Roundabout – (Intersection <strong>of</strong> Stebonheath & Curtis Roads)• Footpath Upgrade Programme.7

Environmental CareCouncil is committed to securing a sustainable future for <strong>Playford</strong>’s community and environmentthrough leadership, innovation, collaboration and engagement. In <strong>2006</strong>/<strong>07</strong>, major environmentalinitiatives included the Waterpro<strong>of</strong>ing <strong>Playford</strong> Stormwater Harvesting and Recycling Project in AdamsCreek, significant revegetation initiatives carried out on both Council and private land and the <strong>Playford</strong>North Urban Regeneration Project which aims to achieve significantly improved economic, social andenvironmental sustainability in an area <strong>of</strong> high social and economic disadvantage.Green CorpsThis project has given young people a training opportunity and life changing experience to break generationalunemployment and place young people in work. The Green Corps team have been involved in the followingactivities this year:• Vegetation survey <strong>of</strong> the Boral site section <strong>of</strong> the Hills Face Vegetation Corridor• Control <strong>of</strong> Wild Olive and Coolatai Grass (two <strong>of</strong> Adelaide’s most serious weed threats)• Vegetation monitoring for baseline data• Tube stock planting and direct seeding <strong>of</strong> reserves• Collection and processing <strong>of</strong> native plant seed• Replanting and weed control at Roadside Marker System sites• Fencing <strong>of</strong> endangered indigenous vegetation.Northern Foothills Land Management ProjectThis project seeks to empower and educate landholders in the project area by subsidising the owner to improvetheir properties for land management benefits. Activities include revegetation to reduce the risks associatedwith salinity, buffering remnant stands <strong>of</strong> vegetation and fencing to protect remnant vegetation and watercourses from stock. The <strong>City</strong> <strong>of</strong> <strong>Playford</strong> hosts this project, which is fully funded by the Mount L<strong>of</strong>ty RangesIntegrated Resources Management Group and the Northern Adelaide Barossa Catchment Water ManagementBoard.The Waterpro<strong>of</strong>ing <strong>Playford</strong> Stormwater Harvesting and Recycling projectThe Waterpro<strong>of</strong>ing <strong>Playford</strong> Stormwater Harvesting and Recycling project is a visionary plan that will implementa sustainable urban water management system which integrates the utilisation <strong>of</strong> rain water, stormwater andground water. Key project activities in <strong>2006</strong>/<strong>07</strong> include:• Prime Minister Howard announced $38m grant to the regional project• Board <strong>of</strong> regional subsidiary was formed• Integration with <strong>Playford</strong> North project progressed well with details <strong>of</strong> the Waterpro<strong>of</strong>ing Projectprovided to Land Management Corporation for integration with its work• Design consultant engaged and concept design completed with four options for the Stebonheath Site• Community bores drilling program.8

CorporateCouncil has a strong commitment to strategic planning and corporate management. In <strong>2006</strong>/<strong>07</strong>Council’s major corporate highlights included the election <strong>of</strong> a new Council, organisationalcommitment to community engagement through the formation <strong>of</strong> a dedicated community engagementteam and the <strong>Playford</strong> Partnership.Corporate Intranet SiteAn internal project was instigated by Information Services, People Services and Community Engagement toimplement a corporate intranet site to obtain improved productivity and better access to information acrossCouncil. The vision for the site, in line with the Knowledge Management Strategy, was to provide a single point<strong>of</strong> access to information, applications and resources used by staff in the performance <strong>of</strong> their daily tasks. Thedevelopment <strong>of</strong> the site was performed through the collaboration <strong>of</strong> three business units to deliver:• A staff Intranet that enhances corporate process and fosters a sense <strong>of</strong> staff community• Opportunities for and encouraging partnerships between all major stakeholders• A system that can grow and develop to allow Council to respond to the changing needs <strong>of</strong> staff• Access for all, utilising the availability <strong>of</strong> common access PCs at central locations for field and outdoor staff• Easy development <strong>of</strong> new information by all staff using common s<strong>of</strong>tware such as MS Word.Staff Relocation to <strong>Playford</strong> Operations CentreIn <strong>2006</strong>, Council brought all operational staff (<strong>of</strong>fice and field based) into a single location, the <strong>Playford</strong>Operation Centre. Significant emphasis was placed on involving as many staff as possible in finding ways tomake the new workplace more efficient and more enjoyable. Staff involvement laid the foundation for broadcultural change across the organisation. Cultural change does take time but the following examplesdemonstrate significant operational benefits experienced in <strong>2006</strong>/<strong>07</strong>:• Individual hard copy filing requirements halved, electronic filing now standard• Photocopying and printing equipment costs halved via a centralised utilities area• Paper recycling improved, reduced waste to landfill• Reduced power and water consumption through a four Star Green Building rating• Greater availability <strong>of</strong> Council’s car pool fleet• Reduction in stationery expenditure• Staff pride in their new facility.Health and Wellbeing Staff InitiativesDuring <strong>2006</strong>/<strong>07</strong>, Council continued to provide Health and Wellbeing, Employee Assistance and Chaplin ServicePrograms for employees. These programs aim to enhance the health and wellbeing <strong>of</strong> staff, promote familyfriendly work practices and facilitate a secure working environment. Significant initiatives from <strong>2006</strong>/<strong>07</strong> include:• Weight watchers at work, which assists employees to work towards and maintain healthy eatinghabits. To date, 17% <strong>of</strong> staff has taken the opportunity to participate in this program. An added bonus tothis program has been the interaction <strong>of</strong> normally self contained work groups• Walking Groups have been encouraged during lunch-time9

• Breastfeeding facilities have been established in the first aid room and include a suitable chair forbreastfeeding, privacy screen and washing and storage facilities.Community EngagementThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong> has recognised that community engagement is an area <strong>of</strong> ongoing development andlearning. <strong>2006</strong>/<strong>07</strong> saw the evolution <strong>of</strong> the Community Engagement Team, formerly known as Communications,Strategy and <strong>Gov</strong>ernance.In <strong>2006</strong>/<strong>07</strong> the Community Engagement Team developed a community newsletter for all residents, businessesand ratepayers in the council area to ensure the entire community was well informed about council activitiesand services. The newspaper also celebrated the wonderful work that the community has been involved in.Several well attended community and civic events were held throughout <strong>2006</strong>/<strong>07</strong> including:• Australia Day• Anzac Day• Science World Sunday• Citizenship Ceremonies• Tourism Forum• L<strong>au</strong>nch <strong>of</strong> Adams Creek WetlandThe <strong>Playford</strong> Partnership group continued to meet throughout the year and worked on developing the revised<strong>Playford</strong> Community Plan to reflect our diverse community’s hopes and desires to establish a positive future forthe area. Several partnership meetings were held throughout <strong>2006</strong>/<strong>07</strong> and two ‘What’s Happening in <strong>Playford</strong>Events’ were held for key partners.10

Elected Members and Wards (June 20<strong>07</strong>)

Council <strong>Gov</strong>ernanceCouncil ElectionsGeneral Council elections were held during the reporting period (November <strong>2006</strong>), with a new Council electedfor a four year term.Mayor Marilyn Baker and Councillor Shirley Wissell were unsuccessful in retaining their positions in this election.We thank Marilyn and Shirley for their many tireless years <strong>of</strong> service to the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> (26 and 14 yearsrespectively).Accordingly, in November, we welcomed Mayor Martin Lindsell and Councillor Gay Smallwood-Smith to theElected Member team.Mayor Martin LindsellTerm in <strong>of</strong>fice commencedNovember <strong>2006</strong>Mayor Marilyn Baker26 years <strong>of</strong> serviceTerm in <strong>of</strong>fice endedNovember <strong>2006</strong>Cr Gay Smallwood-SmithTerm in <strong>of</strong>fice commencedNovember <strong>2006</strong>Cr Shirley Wissell14 years <strong>of</strong> serviceTerm in <strong>of</strong>fice endedNovember <strong>2006</strong>12

Council and Committee MeetingsCouncil meetings are held in the Council Chambers at:<strong>Playford</strong> Civic Centre, 10 <strong>Playford</strong> Boulevard, ElizabethThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong>’s <strong>Gov</strong>ernance Architecture consists <strong>of</strong>:Type <strong>of</strong> MeetingAustralia Day Event CommitteeChief Executive Officer’s PerformanceReview Panel<strong>City</strong> <strong>of</strong> <strong>Playford</strong> FoundationCommunity & Environment CommitteeCorporate <strong>Gov</strong>ernance CommitteeOrdinary CouncilCouncil Development Assessment PanelEconomic & Corporate CommitteeElizabeth Regional Centre Strategic AdvisoryCommittee<strong>Gov</strong>ernance Structure Review CommitteeInformal GatheringsNext Generation Buildings CommitteeSpecial CouncilWhen Meetings were HeldFirst Wednesday <strong>of</strong> each monthAt least twice each year or as business needsrequireAt least quarterlySecond Tuesday <strong>of</strong> the monthAt least quarterlyFourth Tuesday <strong>of</strong> the monthThird Monday <strong>of</strong> the monthSecond Tuesday <strong>of</strong> the monthAs business needs arise (no meetings <strong>of</strong> thiscommittee were held during <strong>2006</strong>/<strong>07</strong>)Third Tuesday <strong>of</strong> the monthAs business needs requireFirst Monday <strong>of</strong> the monthThird Tuesday <strong>of</strong> the monthDecisions made by CouncilDecisions made by Council2003/04 2004/05 2005/06 <strong>2006</strong>/<strong>07</strong>resolution 119 187 127 134<strong>Report</strong>s considered andresolved by the CouncilDevelopment AssessmentPanel2003/04 2004/05 2005/06 <strong>2006</strong>/<strong>07</strong>44 40 31 2013

Use <strong>of</strong> Confidential Provisions within the Local <strong>Gov</strong>ernment Act & Development ActUnder the Local <strong>Gov</strong>ernment Act 1999, Committees, Ordinary Council and Special Council Meetings maydiscuss matters <strong>of</strong> a confidential nature in a closed session. The Development Act provides the direction for theCouncil Development Assessment Panel to exclude the public, where necessary, from Panel meetings.The table below provides an overview <strong>of</strong> the number <strong>of</strong> times the public were excluded from <strong>Gov</strong>ernancemeetings and when documents were maintained in a confidential state.Type <strong>of</strong> MeetingNumber <strong>of</strong> times thepublic was excludedfrom attendance atmeetingsNumber <strong>of</strong> timesdiscussion, reports,minutes and orattachments were keptconfidential for a specifiedperiodOrdinary Council Meetings 14 13Special Council Meetings 5 5Chief Executive Officer’s PerformanceReview Panel2 2Council Development Assessment Panel 1 1Economic and Corporate Committee 1 1Total 23 22The <strong>City</strong> <strong>of</strong> <strong>Playford</strong> close meetings to the public only when matters are <strong>of</strong> a sensitive nature and fall within oneor more <strong>of</strong> the confidential test conditions outlined in the Local <strong>Gov</strong>ernment Act or the Development Act for theCouncil Development Assessment Panel.Throughout the year, 83% <strong>of</strong> Council business was conducted in an open forum enabling the public to be part<strong>of</strong> the decision-making process and participate in community affairs.The following table outlines the reasons for conducting meetings in a closed session:Local <strong>Gov</strong>ernment Act - Section 90(3)(a) information concerning the personal affairs <strong>of</strong> a person 5(b) commercial advantage <strong>of</strong> a group <strong>of</strong> people with whom the Council isproposing to conduct business2(d) commercial information <strong>of</strong> a confidential nature 10(h) legal advice 1(i) actual litigation involving the Council or an employee <strong>of</strong> the Council 4Development Act - Section 56A(12)(v) legal advice 1TOTAL 2314

Elected Members Allowances & BenefitsThe Local <strong>Gov</strong>ernment (Members Allowances and Benefits) Regulations came into operation from 1 January2000, and set the minimum and maximum amounts which a Council could fix annual allowances payable toElected Members.Elected Members received the following allowances for the period July <strong>2006</strong> - November <strong>2006</strong>:• Mayor $29,120• Deputy Mayor $9,100• Presiding Members $8,350• Councillors $7,280.On 31 August <strong>2006</strong>, amendments to the Local <strong>Gov</strong>ernment (Members Allowances and Benefits) Regulationswere gazetted. These amended regulations came into operation on 13 November <strong>2006</strong>, with new maximumallowances for Council Members.At the Council meeting on 21 November <strong>2006</strong>, Elected Members agreed to set their annual allowances at themaximum amount, as follows:• Mayor $60,000*• Deputy Mayor $18,750• Presiding Members$18,750• Councillors $15,000These allowances were set for a period <strong>of</strong> 12 months and will be reviewed in November 20<strong>07</strong>.* While the Mayor received $60,000, he indicated that he would contribute $35,000 (less the tax payable) <strong>of</strong> hisallowance toward charitable and community projects.Elected Members are each provided with a combined printer and facsimile machine, laptop computer andmobile telephone to assist them in their Elected Member role.The Mayor has access to a vehicle for Council business and civic duties and also has <strong>of</strong>fice space andadministrative support.Elected Members may seek reimbursement for travel and childcare expenses when undertaking Councilbusiness.During <strong>2006</strong>/<strong>07</strong>, some Elected Members received reimbursements in accordance with the Elected MembersSupport Policy. The total amounts are as follows:• Mileage: $738.00• Childcare: $0.0015

Training and development is provided to Elected Members where the training is relevant to the role <strong>of</strong> theElected Member or linked to the Local <strong>Gov</strong>ernment industry.The following Elected Members undertook specific Training and Development in the following areas during theyear:Elected Member Training / Conference Training ProviderMayor LindsellCr CraigCr DochertyCr FedericoCr GooleyCr Levitt• New Council Members Residential Seminar• Developing Public Speaking Skills for ElectedMembers• Media Training for Council Spokespersons inthe event <strong>of</strong> an Emergency• Institute <strong>of</strong> Company Directors NonResidential Course• Confidently Say What You Really Want ToSay• Media Interaction Awareness Course• Confident and Persuasive Presentations• Council Members Residential Seminar• Strategic Planning Seminar• National General Assembly <strong>of</strong> AustralianLocal <strong>Gov</strong>ernment• Developing Public Speaking Skills for ElectedMembers• Media Training for Council Spokespersons inthe event <strong>of</strong> an Emergency• Institute <strong>of</strong> Company Directors NonResidential Course• Development Assessment Panel MemberTraining• National General Assembly <strong>of</strong> AustralianLocal <strong>Gov</strong>ernment• Council and Committee Meeting Proceduresand Chairing Skills• International Council for Local EnvironmentalInitiatives (ICLEI) Conference• Local <strong>Gov</strong>ernment Association• Local <strong>Gov</strong>ernment Association• Local <strong>Gov</strong>ernment Association• Institute <strong>of</strong> Company Directors• Pr<strong>of</strong>essional and ContinuingEducation, University <strong>of</strong> Adelaide• Local <strong>Gov</strong>ernment Association• Pr<strong>of</strong>essional and ContinuingEducation, University <strong>of</strong> Adelaide• Local <strong>Gov</strong>ernment Association• Local <strong>Gov</strong>ernment Association• Australian Local <strong>Gov</strong>ernmentAssociation• Local <strong>Gov</strong>ernment Association• Local <strong>Gov</strong>ernment Association• Institute <strong>of</strong> Company Directors• Local <strong>Gov</strong>ernment Association• Australian Local <strong>Gov</strong>ernmentAssociation• Local <strong>Gov</strong>ernment Association• ICLEICr Smallwood-Smith • New Council Members Residential Seminar • Local <strong>Gov</strong>ernment AssociationA full Training and Development Plan for all Elected Members will be implemented in the 20<strong>07</strong>/08 period.Elected Member Code <strong>of</strong> Conduct AllegationsNo Code <strong>of</strong> Conduct allegations were made against Elected Members this year.16

Independent MembersCouncil Development Assessment PanelOn 22 June <strong>2006</strong>, the Development (Panels) Assessment Bill <strong>2006</strong> was passed by the State <strong>Gov</strong>ernment. Thenew legislation required each Council to set up Development Assessment Panels (DAP’s) that consist <strong>of</strong> seven(7) members, and further stipulated that a minimum four (4) members must be independent <strong>of</strong> Council (that is,not Elected Members or staff) and up to three (3) Elected Members or Council staff. Each Council was notifiedthat the new membership composition <strong>of</strong> the Panel should be in existence no later than February 20<strong>07</strong>.At the Council meeting on 27 February 20<strong>07</strong>, it was agreed to pay the four (4) independent members <strong>of</strong> theCouncil Development Assessment Panel a sitting fee <strong>of</strong> $300 per meeting attended, payable upon presentation<strong>of</strong> a tax invoice.The attendance records <strong>of</strong> the four (4) independent members are shown below.Independent MemberCouncil DevelopmentAssessment PanelTotal meetings for year 12Ms Ceravolo 3 (4)Ms Matysek 4 (4)Mr Muncey 4 (4)Mr Whimpress 3 (4)The Council Development Assessment Panel comprises seven (7) members in total; the above four (4)independent members and Crs Federico, Ryan and Smallwood-Smith.Representation on External OrganisationsElected Members have been endorsed by Council resolution to represent the <strong>City</strong> <strong>of</strong> <strong>Playford</strong>’s interests on thefollowing external organisations:External OrganisationGawler River Floodplain Management AuthorityLocal <strong>Gov</strong>ernment AssociationLocal <strong>Gov</strong>ernment Finance AuthorityElected Member RepresentationCr Max O’RiellyCr Don Levitt (proxy)Mayor Marilyn Baker (until Nov <strong>2006</strong>)Mayor Martin Lindsell (from Nov <strong>2006</strong>)Mayor Marilyn Baker (until Nov <strong>2006</strong>)Mayor Martin Lindsell (from Nov <strong>2006</strong>)17

External OrganisationMurray Darling AssociationNorthern Foothills Land Management AuthorityElected Member RepresentationCr Max O’RiellyCr Don LevittCr Joe Federico<strong>Playford</strong> District Bushfire Prevention Committee<strong>City</strong> <strong>of</strong> <strong>Playford</strong> Foundation<strong>Playford</strong> Partnership Elected Members ForumCr Julie Norris (until Nov <strong>2006</strong>)Cr Glenn Docherty (from Dec <strong>2006</strong>)Cr Coral Gooley (from Dec <strong>2006</strong>)Mayor Marilyn Baker (until Nov <strong>2006</strong>)Mayor Martin Lindsell (from Nov <strong>2006</strong>)Cr Max O’RiellyMayor Marilyn Baker (until Nov <strong>2006</strong>)Mayor Martin Lindsell (from Nov <strong>2006</strong>)Cr Glenn Docherty<strong>Playford</strong> Partnership Executive Mayor Marilyn Baker (until Nov <strong>2006</strong>)<strong>Playford</strong>/South Australian Housing Trust ExecutiveVirginia Horticulture Centre IncorporatedMayor Marilyn Baker (until Nov <strong>2006</strong>)Mayor Martin Lindsell (from Nov <strong>2006</strong>)Cr Dino MusolinoElected Attendance at MeetingsThe following provides a summary <strong>of</strong> Elected Members and their participation at Ordinary Council, SpecialCouncil, Committees <strong>of</strong> Council and Council Development Assessment Panel meetings.NB where the Elected Member was not a member <strong>of</strong> the Committee for the entire duration <strong>of</strong> the reportingperiod, the total number <strong>of</strong> meetings applicable to that Elected Member are featured in brackets adjacent to theactual number <strong>of</strong> meetings attended.18

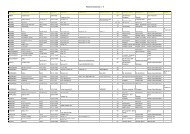

Elected MemberTotal meetings foryearOrdinaryCouncilSpecialCouncilMeetingAustralia DayEventCommittee17 16 7ChiefExecutiveOfficer’sPerformanceReview PanelCommunity andEnvironmentCommitteeCouncilDevelopmentAssessmentPanelEconomic andCorporateCommittee<strong>Gov</strong>ernanceStructureReviewCommittee2 7 12 8 8Next GenerationBuildingsCommittee5Mayor Baker 4 (4) 5 (5) * 1 (1) * 5 (5) 4 (4) * 2 (4)Mayor Lindsell 13 (13) 11 (11) 3 (3) 1 (1) 1 (4) 2 (3) * 8 1 (1)Cr Boundy 14 14 * * 4 (4) * 2 (4) * *Cr Cava 16 12 * * 4 (4) 7 (8) 3 (4) * *Cr Craig 15 14 * * 6 * * * *Cr Docherty 16 16 * 1 (1) 7 7 (8) * * *Cr Federico 17 16 * * * 12 8 * *Cr Gooley 15 16 7 * 7 * * * *Cr Hamilton 10 6 * * 2 (3) * 2 (4) 5 *Cr Levitt 17 15 * * * 8 (8) 8 * 5Cr MacMillan 16 13 * 2 * * 7 * 5Cr Musolino 15 10 * 1 (1) * * 6 * *Cr Norris 11 8 * * 3 (3) 8 (8) 0 (4) * *Cr O’Rielly 16 13 * * 3 (3) * 4 (4) * *Cr Ryan 16 16 * * 7 12 * * *Cr Shaw 17 14 * * * * 8 7 *Cr Smallwood-Smith12 (13) 9 (11) * * 4 (4) 4 (4) * * *Cr Wissell 4 (4) 5 (5) 4 (4) * 3 (3) * * * 3 (4)* Elected Member not appointed to the committee and therefore not required to attend.

Electoral RepresentationComparison <strong>of</strong> <strong>Playford</strong> Elector Ratios with some other Metropolitan CouncilsCouncilElected Members(including Mayor)ElectorsRatioWest Torrens 15 47,179 1:3145Mitcham 14 51,289 1:3663PLAYFORD 16 51,633 1:3227Marion 13 65,975 1:5<strong>07</strong>5Information derived from the Local <strong>Gov</strong>ernment Association Circular 32.1 dated 7/08/<strong>07</strong>.A review <strong>of</strong> the <strong>City</strong>’s electoral representation was concluded on 27 August 2002 with the new ward boundariescoming into effect at the May 2003 General Council Elections. As appropriate, ward quota ratios weremaintained during this period. Council did not undertake a periodic review <strong>of</strong> electors and ward distributionsduring <strong>2006</strong>/<strong>07</strong>.Under the current Local <strong>Gov</strong>ernment Act, a review <strong>of</strong> electoral representation is required to be conducted everyeight years or where it exceeds 10% <strong>of</strong> quota. The next review is scheduled for the year 2010.Section 28 <strong>of</strong> the Local <strong>Gov</strong>ernment Act states that a group <strong>of</strong> at least 20 eligible residents may make asubmission to Council for consideration to:• Alter the boundaries <strong>of</strong> the Council• Alter the composition <strong>of</strong> the Council or the representative structure <strong>of</strong> the Council (including by thecreation, alteration or abolition <strong>of</strong> wards)• Incorporate within the area <strong>of</strong> the Council a part <strong>of</strong> the State that is not within the area <strong>of</strong> a Council.During the reporting period, the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> did not receive any submissions from eligible residents on thematters listed in Section 28 <strong>of</strong> the Local <strong>Gov</strong>ernment Act.20

Establishment <strong>of</strong> Corporate <strong>Gov</strong>ernance CommitteeOne <strong>of</strong> the key initiatives from the Local <strong>Gov</strong>ernment Association’s Independent Financial Sustainability Inquirywas the establishment <strong>of</strong> “Audit Committee’s” by Councils. This requirement was incorporated into anamendment <strong>of</strong> the Local <strong>Gov</strong>ernment Act 1999 and was required to be in place by 1 July 20<strong>07</strong>.Council endorsed the Charter for <strong>Playford</strong>’s in<strong>au</strong>gural Corporate <strong>Gov</strong>ernance Committee (Audit Committee) inMay 20<strong>07</strong> and appointed 3 independent members and 2 elected members in June 20<strong>07</strong>.The committee’s primary role is to provide suggestions and recommendations to Council about matters relatedto Corporate <strong>Gov</strong>ernance. Its terms <strong>of</strong> reference include review and recommendations in relation to:• Financial <strong>Report</strong>ing• Internal Controls and Risk Management Systems• Whistle Blowing• Internal Audit• External Audit.The following committee members were appointed by Council in June 20<strong>07</strong>:• Mayor Martin Lindsell• Cr Glenn Docherty• Mr Phil Plummer• Mr Tony Higginbottom• Mr Martin White.21

Organisation Structure - March 20<strong>07</strong>

Strategic PlanningThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong> has a strong commitment to strategic planning and corporate management. An integratedframework underpins all <strong>of</strong> Council’s strategic plans. This framework ensures that there are strong linkagesacross Council departments and across Council’s key strategic focus areas. Council’s essential strategicplanning documents are the:• <strong>Playford</strong> Plan• Goal Plans• Corporate Management Plan• Long Term Financial Plan• <strong>City</strong> Plan.<strong>Playford</strong> PlanThe <strong>Playford</strong> Plan is Council’s key long-term planning document. This plan is unique in comparison to strategicplans <strong>of</strong> many other Councils, in that it is a plan for the <strong>City</strong> and not just for the Council administration itself. Atthe local level, the <strong>City</strong> <strong>of</strong> <strong>Playford</strong>, its business and residential communities and its political representativesfrom all levels <strong>of</strong> government actively established our strategic direction through this document, the <strong>Playford</strong>Plan.The <strong>Playford</strong> Plan sets the direction for the <strong>City</strong> over a 10-year period. The Plan is based around three goals(Community Wellbeing, Economic Prosperity and Environmental Care) with objectives and strategies set foreach <strong>of</strong> these. The Plan is updated every three years to ensure its continued relevance as external factors(political, social, environmental, economic and technological) and changing community priorities necessitatechanges in strategic direction from time to time.Goal PlansThe Goal Plans have been developed in partnership with business and residential communities. These workingdocuments have a five-year time horizon. They provide a framework <strong>of</strong> strategies and actions as well as thedetailed background information necessary to achieve the <strong>Playford</strong> Plan vision. The three goals are:• Community Wellbeing—to improve and support the wellbeing, health and safety <strong>of</strong> the <strong>Playford</strong>community• Economic Prosperity—to improve economic prosperity <strong>of</strong> the region• Environmental Care—to secure a sustainable future for <strong>Playford</strong>’s community and environmentthroughleadership innovation, collaboration and engagementCorporate Management PlanThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong> Corporate Management Plan is firmly established around the following objectives:* Organisational Culture * Communication and Decision-making * Financial and Risk Management* Customer Focus * Partnerships23

Strategic Planning Architecture24

<strong>Annual</strong> Performance Statement <strong>2006</strong>/<strong>07</strong>Council’s long-term focus is to achieve the <strong>Playford</strong> Plan while remaining financially sustainable. To enable theongoing measurement <strong>of</strong> progress against delivery <strong>of</strong> the <strong>Playford</strong> Plan a statement <strong>of</strong> annual performancemeasures has been developed.The <strong>Annual</strong> Performance Statement contains a number <strong>of</strong> performance measures linked to the three <strong>Playford</strong>Plan Goals <strong>of</strong> Community Wellbeing, Economic Prosperity and Environmental Care. In addition, a set <strong>of</strong>Corporate performance measures linked to the Corporate Management Plan have also been included to ensurethat the <strong>Annual</strong> Performance Statement covers the full breadth <strong>of</strong> Council operations.The performance measures contained within the <strong>Annual</strong> Performance Statement are by definition short-termmeasures which have been developed to track performance against Council’s priorities over the next year inworking towards the achievement <strong>of</strong> the <strong>Playford</strong> Plan. Progress is reported quarterly through the QuarterlyCouncil Performance <strong>Report</strong> and annually through the <strong>Annual</strong> <strong>Report</strong>. The <strong>Annual</strong> Performance Statementalso forms a part <strong>of</strong> the annual performance review mechanism for Council’s leadership positions.SummaryNo. % Measures19 (56%) Exceeded Target 4 (12%) Met Target 23 (68%) Sub Total - Exceeded/Met Target11 (32%) Did not Meet Target x34 (100%) Total Number <strong>of</strong> Measures for <strong>2006</strong>/<strong>07</strong>14 measures did not have a target but results sourcedCommunity WellbeingWhile there was excellent attendance at Youth Week events, the target <strong>of</strong> youth involved in planning activitiesand membership on the Youth Advisory Committee (YAC) was not met. This can be attributed to changes inthe youth team over the last year in terms <strong>of</strong> new staff, adjustment for the YAC that was impacted by staffchanges and the shift to Northern Sound System facility and increased responsibilities for staffing the centre.However, a comprehensive recruitment drive for new YAC members is planned and integration <strong>of</strong> the YouthDevelopment Program at NSS is complete.The sale <strong>of</strong> meal packs has almost doubled over the last year and is a clear indication <strong>of</strong> the acceptance <strong>of</strong> thisitem and the contribution it makes to supporting health and wellbeing in the community.25

Community Wellbeing <strong>Annual</strong> Statement Measures and <strong>2006</strong>/<strong>07</strong> Results<strong>Playford</strong>PlanObjectiveIndicatorMeasureActual Target Target YTD2005/06 <strong>2006</strong>/<strong>07</strong> 20<strong>07</strong>/08 <strong>2006</strong>/<strong>07</strong>ResultAgainstTargetYouth Week Attendance 450 400 400 400 Community InvolvementYouth Involved in Organising YouthWeek14 15 15 12 x3.4Youth Advisory Committee Average 12 Average 12 Average 12 Average 8 xChild & Youth LibraryMembershipChild and Youth membership <strong>of</strong>library (Youth – 17 years and under)71% 68% 70% 79%(14,312members)(15,812members)3.6 Home Assist3.3Sporting/RecreationFacilities andCommunity HealthProvision <strong>of</strong> social support to olderpeople and people with disabilitiesNumber <strong>of</strong> attendances toAquadomeNo. <strong>of</strong> attendances to North LakesGolf Course370 Clients 400 Clients 750 Clients 257 Clients x9,993 hours 7,500 Hours8,000Services12,<strong>07</strong>6 Hours 148,892 150,000 150,000 162,599 26,904 29,000 30,000 25,172 x3.5 Community Involvement No. <strong>of</strong> Volunteers 425 480 500 480 3.1 Graffiti Graffiti Tag Removals 36,526 38,000 36,000 39,340 3.6 Health & WellbeingGrenville Centre Overall <strong>Annual</strong>AttendanceNo. <strong>of</strong> Nutritionally Balanced MealPacks PurchasedSmithfield Co-op123,118 127,500 129,500 128,153 4,437 2,380 2,620 8,589 3.3Health & WellbeingNo. <strong>of</strong> Nutritionally Balanced MealPacks PurchasedElizabeth Downs Co-opNo. <strong>of</strong> Healthy School RecessPacks PurchasedSmithfield Co-op1,632 950 1,045 2,881 4,894 2,640 2,900 6,422 No. <strong>of</strong> Healthy School RecessPacks PurchasedElizabeth Downs Co-op839 265 290 1509 Economic ProsperityEconomic Prosperity has seen some good results in the last financial year, particularly in employmentoutcomes and support provided to small business. These results reflect community interest in alternativetraining and employment programs <strong>of</strong>fered through Council sponsored programs. These initiatives are a directresponse to community need.Use <strong>of</strong> the Advanced Manufacturing Design Centre reduced significantly this past year. This is due to the focus<strong>of</strong> local companies on tendering for mining and defence contracts and less for <strong>au</strong>tomotive contracts. Differents<strong>of</strong>tware is required for mining and defence industries than the design centre currently <strong>of</strong>fers.26

Economic Prosperity <strong>Annual</strong> Statement Measures and <strong>2006</strong>/<strong>07</strong> Results<strong>Playford</strong>PlanObjectiveIndicatorMeasureActual Target Target YTD2005/06 <strong>2006</strong>/<strong>07</strong> 20<strong>07</strong>/08 <strong>2006</strong>/<strong>07</strong>ResultAgainstTargetNumber <strong>of</strong> new business1.1 Business Collaboration networks and alliances (structures 5 5 5 1 xfor collaboration in place)1.1(1.1.7)Number <strong>of</strong> Businessesusing AdvancedManufacturing DesignCentreNo. <strong>of</strong> new businesses involvedeach year.24 20 20 8 x1.2Direct Support to smallbusiness in partnershipwith BECNumber <strong>of</strong> businesses receivingsupport.355 200 200 293 1.2Number <strong>of</strong> schoolbased apprenticeshipsNumber <strong>of</strong> apprenticeshipsoccurring each year.9 20 23 23 1.2 EmploymentNo <strong>of</strong> people progressed inemployability and employmentdirectly through Councilsponsored programs300 60 60 109 Safety / Risk - Potholes 1760 N/A N/A 2,3151.31.3<strong>City</strong> InfrastructureService Levels -ROADS<strong>City</strong> InfrastructureService Levels -FOOTPATHSSafety / Risk - Repair Costs $90k N/A N/A $101kAppearance / Quality - Acceptable N/A N/A N/A 7<strong>07</strong>.84Appearance / Quality -UnacceptableN/A N/A N/A 81.2Coverage / Function - Sealed 664 N/A N/A 681Coverage / Function - Unsealed N/A N/A N/A 106Life Cycle Costing $2.27k N/A N/A$5735.26 /km *Safety / Risk - Incidents N/A N/A N/A 480Safety / Risk - Cost <strong>of</strong> Insurance N/A N/A N/A $4kAppearance / Quality - Acceptable N/A N/A N/A 228.2 kmAppearance / Quality -UnacceptableN/A N/A N/A 335.6 kmCoverage / Function - Constructed N/A N/A N/A 529.3 kmCoverage / Function -Unconstructed16 N/A N/A 34.6 kmLife Cycle Costing $1.0m N/A N/A $960k* Measurement method for Roads Life Cycle Costing changed during 20<strong>07</strong>/08.27

Environmental CareCouncil's current kerbside waste collection service is for rubbish and recycling. Green waste collection isoptional and is a user pays system. Thus it is unlikely that waste diversion from landfill target can be reachedas not enough homes have taken up the user pay option, and green waste is being diverted into landfill viarubbish bins. For Council to improve upon this rate, a subsided green waste service would need to be providedto residents. The negotiation <strong>of</strong> new contracts and service level review in the next financial year will provide anopportunity for Council to review its kerbside services.A 'Boxing-Up Day' was held in June 20<strong>07</strong> in which 8,400 plants were put in multiple species boxes ready fordistribution by 25 scheme participant property owners and <strong>Playford</strong> Greening Volunteers. Council has workedwith schools and the Northern NRM Project in Virginia to ensure more Indigenous plants were planted.Environmental Care <strong>Annual</strong> Statement Measures and <strong>2006</strong>/<strong>07</strong> Results<strong>Playford</strong>PlanObjectiveIndicatorMeasureActual Target Target YTD2005/06 <strong>2006</strong>/<strong>07</strong> 20<strong>07</strong>/08 <strong>2006</strong>/<strong>07</strong>ResultAgainstTarget2.1EnvironmentalSustainabilityProportion <strong>of</strong> waste diverted fromlandfill.35% 40% 45% 32% x2.2 BiodiversityThe number <strong>of</strong> indigenous plantsplanted by Council staff, volunteersand contractors and distributed tolandowners under the Buffers toBushland Program.The number <strong>of</strong> species <strong>of</strong>indigenous plants grown/propagatedas proportion <strong>of</strong> those available inthe region.45,190 15,000 10,000 18,384 19.5%(98)20.1%(101)20.5%(103)20.1%(101)CorporateWhilst the Workforce Planning Framework has been completed, the implementation will be undertaken during20<strong>07</strong>/08 on a trial basis with the Civil Maintenance and Construction Teams.The resource allocation methodology was changed to a service review process. Although the methodologyprocess was not fully completed, numerous discussions were held with Elected Members and subsequently ajoint reference group was formed to progress the service review process.The Workers Compensation Injury Frequency Rate was well over the average <strong>of</strong> other Group A Councils butthere are many factors that have a negative influence on <strong>Playford</strong>’s rating. One factor is <strong>Playford</strong>’s groupingwith Group A Councils where there is a significant difference in FTE (Full Time Equivalent) staff numbers.<strong>Playford</strong>’s FTE is 283 compared to 405 for Group A Councils (if we had more FTEs, this would reduce ourInjury Frequency Rate as the ratio would change). Also, the rating is dependent on all councils keeping theirreimbursements up to date.28

Corporate <strong>Annual</strong> Statement Measures and <strong>2006</strong>/<strong>07</strong> ResultsCorporatePlanObjectiveIndicatorMeasureActual Target Target YTD2005/06 <strong>2006</strong>/<strong>07</strong> 20<strong>07</strong>/08 <strong>2006</strong>/<strong>07</strong>ResultAgainstTarget1.5 Workforce PlanningImplementation <strong>of</strong> framework forWorkforce Planning30%Phase 1 & 260%Phase 3100%Phase 430% x1.7 Retention3.1 <strong>Gov</strong>ernance4.1 Resource Allocation4.2 FinancialEmployee Turnover - No. <strong>of</strong>employees that leave during theperiod (exempt casual staff andstaff who terminate due to end <strong>of</strong>their funded contract)Percentage <strong>of</strong> <strong>Playford</strong> policiesthat are currentAgreement to a resourceallocation methodologyOperating Surplus/ OperatingRevenue5.7%

Organisational ExcellenceCommunity Engagement<strong>City</strong> <strong>of</strong> <strong>Playford</strong> is committed to engaging with the community in setting priorities for action and contributing todecision making that affects the community. Council is an organisation that listens to the community and workstogether toward achieving the community vision and goals. While various teams have historically andconsistently engaged with their communities <strong>of</strong> interest and place, in <strong>2006</strong>/<strong>07</strong> at an organisational level, Councilformed a Community Engagement Team to support engagement practice across the organisation. We arelooking forward to developing a community engagement framework and other initiatives to support us in activelyengaging our community in the years to come.Awards Received By CouncilThe following awards were received during <strong>2006</strong>/<strong>07</strong>:October <strong>2006</strong>• Australian Business Arts Foundation – KPMG adviceBank AwardThis was received by the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> in partnership with Out <strong>of</strong> the Square Network and thecorporate sector.November <strong>2006</strong>• National Award for Local <strong>Gov</strong>ernment <strong>2006</strong> - Outstanding Achievement Award – StrengtheningIndigenous Communities CategoryThis was received by the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> for its Marni Waeindi – Indigenous Transition Pathway CentreProject.• NIFTeY Award (National Investment for the Early Years <strong>SA</strong>) - Award for ExcellenceThis was received by the Cities <strong>of</strong> <strong>Playford</strong> and Salisbury for Early Childhood Lapsit Outreach LiteracyProgram.May 20<strong>07</strong>• National Volunteering Week AwardsReceived by the Grenville Community Connections Hub for: “After Hours” Programs <strong>2006</strong> and Servicesto the Elderly 20<strong>07</strong>.30

Organisational Accountability<strong>Annual</strong> Auditors FeesThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong> paid $13,000 in remuneration for the annual <strong>au</strong>dit <strong>of</strong> the <strong>2006</strong>/<strong>07</strong> financial statements.There was no other remuneration payable.Workforce Pr<strong>of</strong>ileEqual Employment Opportunity (EEO)The <strong>City</strong> <strong>of</strong> <strong>Playford</strong> has made significant progress in the overall gender balance across the organisation as anentity. However, as is the case at other local governments and organisations, it is challenging to attract femalestaff into the traditionally male dominated areas <strong>of</strong> engineering and outside services such as civil and parks. Itmust be taken into account that in these disciplines the potential pool <strong>of</strong> applicants in the labour market(including internationally) and particularly at the senior levels, is limited.External recruitment and internal merit-based appointment <strong>of</strong> women to senior positions has been successful atsenior levels with women now representing 35% <strong>of</strong> the Team/Group Manager membership. The <strong>City</strong> <strong>of</strong> <strong>Playford</strong>seeks to ensure that all relevant policies, guidelines and procedures are in accordance with State and Federalequal opportunity legislation. The <strong>City</strong> <strong>of</strong> <strong>Playford</strong> supports and fulfils its EEO legal obligations by undertakingthe following actions:Selection ProcessThe selection process is based solely on the principle <strong>of</strong> merit; that is, the extent to which an applicant hasabilities, aptitude, skills, qualifications, knowledge, experience and achievement (including community service),characteristics and personal qualities relevant to carrying out duties in question. This includes, where relevant,the manner in which an applicant carried out the duties or functions <strong>of</strong> any position, employment or occupationpreviously held or engaged in (paid or unpaid) and the extent to which an applicant has potential fordevelopment necessary to fulfil the position within reasonable time and resources.Training and DevelopmentThese activities are provided to staff on an equal opportunity basis.Conditions <strong>of</strong> EmploymentOur policies, guidelines and procedures, South Australian and Commonwealth Equal Employment Opportunityand anti-discrimination legislation protect our staff from discrimination on the grounds <strong>of</strong> their sex; genderidentity; sexual orientation; lawful sexual activity; marital, parental or carer status; pregnancy; breastfeeding;age; physical features; impairment; race; political or religious belief or activity; and industrial activity.31

Work-Life Balance InitiativesThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong>’s commitment to work/life balance is supported by the provisions in the EnterpriseAgreement. New and updated cl<strong>au</strong>ses exist to increase Council’s already excellent family friendly provisions.These include:• Flexible work arrangements• Overtime• Family responsibility leave• Access to sick leave for family responsibilities• Recreation Leave• Maternity/adoption leave• Salary Sacrifice provisions• Equal opportunity policies• Employee Assistance Program.Council is committed to ensuring that staff, regardless <strong>of</strong> their gender, feels comfortable in accessing the familyfriendly provisions described above to improve their work/life balance.Code <strong>of</strong> ConductEmployee Code <strong>of</strong> Conduct AllegationsDuring <strong>2006</strong>/<strong>07</strong> there were six allegations made in regards to the Code <strong>of</strong> Conduct:• Two where it has been determined that no further action is warranted• Four which resulted in investigations and appropriate action taken.32

Workforce SalariesSalary Bracket Male Female TotalPercentage0 to 10,000 4 10 14 3.85%10,000 to 20,000 3 12 15 4.12%20,000 to 30,000 5 24 29 7.97%30,000 to 40,000 2 20 22 6.04%40,000 to 50,000 94 33 127 34.89%50,000 to 60,000 21 48 69 18.96%60,000 to 70,000 23 14 37 10.16%70,000 to 80,000 10 7 17 4.67%80,000 to 90,000 2 1 3 0.82%90,000 to 100,0000 6 5 11 3.02%100,000 to 110,000 7 1 8 2.20%110,000 to 120,000 1 1 2 0.55%120,000 to 130,000 6 0 6 1.65%130,000 to 140,000 1 0 1 0.27%140,000 to 150,000 0 0 0 0.00%150,000 to 160,000 0 0 0 0.00%160,000 to 170,000 0 1 1 0.27%170,000 to 180,000 1 0 1 0.27%180,000 to 190,000 0 0 0 0.00%190,000 to 200,000 0 0 0 0.00%200,000 to 210,000 0 0 0 0.00%210,000 to 220,000 1 0 1 0.27%Total 187 177 364 100%The total remuneration package <strong>of</strong> managers is reported in the above table. The remuneration packageconsists <strong>of</strong> the employer superannuation contribution, cost <strong>of</strong> Council supplied vehicle and salary. Salaries <strong>of</strong>general staff are reported in the above table, excluding employer super contribution. No bonuses are paid.33

Workforce SizeThere is 13 Indigenous staff employed by Council, totalling 3.6% <strong>of</strong> the entire workforce.Employee Status No. PercentageCasual 30 8.24%Ongoing Full Time 209 57.42%Ongoing Part Time 57 15.66%Contract Leadership 1 0.27%Fixed Term Contract 40 10.99%Secondment 3 0.82%Contract Part Time 24 6.59%Total 364 100%Management RemunerationThe remuneration practices <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> should ensure that the organisation is competitive inattracting and retaining staff capable <strong>of</strong> delivering the communities and organisational desired outcomes. It isessential that the remuneration be perceived as equitable in terms <strong>of</strong> the market place and the complexity <strong>of</strong> therole. <strong>City</strong> <strong>of</strong> <strong>Playford</strong>’s continuing success in a competitive environment depends on the quality and motivation<strong>of</strong> its employees, which requires at a minimum that employees should receive appropriate remuneration for thework they undertake.Mercer Human Resource Consulting, experts in remuneration, was engaged in 2004 to review the managementremuneration practices <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Playford</strong>. A new remuneration model has been developed since theconclusion <strong>of</strong> the review. The new model aligns manager’s remuneration to a percentage <strong>of</strong> the CEOsremuneration, and is based on the individual’s competencies, experience and market value <strong>of</strong> the position. Thenew system was introduced in July <strong>2006</strong> and required the alignment <strong>of</strong> current remuneration to the new system.The alignment to the new system resulted in approximately an $83,000 (2%) variance above that budgetedfigure for the remuneration <strong>of</strong> management.The employment and contractual arrangements <strong>of</strong> the management group has also been reviewed tostandardise employment arrangements. The management contracts have been revised and six managers,previously employed under the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> Enterprise Agreement have been employed under the newmanagement contracts. The six manager’s salaries were increased to compensate for loss <strong>of</strong> flexi time,overtime and employment under contractual arrangements. Two managers remain employed under the <strong>City</strong> <strong>of</strong><strong>Playford</strong> Enterprise Agreement.34

Freedom <strong>of</strong> InformationRequests for information that is not already public (and is not listed as a public document under “DocumentsHeld by Council”) will be considered under the Freedom <strong>of</strong> Information Act 1991. This does not guaranteeaccess.Requests are required to be in writing and addressed to the Freedom <strong>of</strong> Information Officer, <strong>City</strong> <strong>of</strong> <strong>Playford</strong>, 12Bishopstone Road, Davoren Park, 5113 (Request for Access forms are available from the following locations,and can be lodged together with the prescribed fee determined by Regulation (currently $25.75):• <strong>Playford</strong> Civic Centre, Customer Service Counter,10 <strong>Playford</strong> Boulevard, Elizabeth <strong>City</strong> Centre• <strong>Playford</strong> Library Service, Customer Service Counter, Munno Para Shopping <strong>City</strong>, Shop 51, 600 MainNorth Road, Smithfield; or• State Records <strong>of</strong> <strong>SA</strong> website (www.archives.sa.gov.<strong>au</strong>/foi/forms.html).Although the Freedom <strong>of</strong> Information Act 1991 allows 30 days to deal with applications, Council endeavours toprocess them as quickly as possible.Your RightsThe right exists to amend personal information <strong>of</strong> a document held by Council to ensure that personalinformation which may be used by the Council does not unfairly harm or misrepresent the person referred to.A person can apply for the amendment <strong>of</strong> a Council document which they have already obtained, provided that:• The document containing the personal information relates to the applicant only• The information is available for use by Council in connection with its administrative functions• The information is, in the person’s opinion, incomplete, incorrect, out <strong>of</strong> date or misleading.Access to documents may be available under other arrangements in some circumstances, without the need torefer to provisions contained in the Local <strong>Gov</strong>ernment Act.Who to ContactApplications and enquiries relating to Freedom <strong>of</strong> Information matters may be directed to the Freedom <strong>of</strong>Information Officer between 9.00 am and 5.00 pm, Monday to Friday by telephone 8256 0288.35

Freedom <strong>of</strong> Information continued …Requests during <strong>2006</strong>/<strong>07</strong>During <strong>2006</strong>/<strong>07</strong>, 13 requests for information under the Freedom <strong>of</strong> Information Act were received. Thiscompares with three requests for the 2005/06 financial year. Of these 13 requests, nine were processed andgranted in full. Of the remaining four: one involved documents that the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> did not hold, oneinvolved documents that the applicant already had and two are yet to be completed (carried over to 20<strong>07</strong>/08).Three requests involved an extension <strong>of</strong> time limit under section 14a as the requests required consultation witha third party. The other remaining six requests were processed within the required timeframe.Ombudsman <strong>Report</strong>The State Ombudsman provides free, impartial, informal and timely resolution <strong>of</strong> complaints to promote fairness,openness and good public administration in South Australia.The South Australian Ombudsman assists with complaints about the administrative actions <strong>of</strong> a localgovernment council and reviews decisions about Freedom <strong>of</strong> Information.The following information details the number <strong>of</strong> complaints received for each financial year and the number <strong>of</strong>complaints which have been finalised. A number <strong>of</strong> the complaints are carried forward to the next financial yearfor completion.2003/04 2004/05 2005/06 <strong>2006</strong>/<strong>07</strong>No. <strong>of</strong> Complaints Received 37 26 20 24No. <strong>of</strong> Complaints Completed 29 33 22 20Summary <strong>of</strong> Complaints Completed – Outcome 1/7/06 – 30/6/<strong>07</strong>OutcomeNo.Advice Given 7Advice Given - Referred to Agency 5Advice Given - Other/General 1Preliminary Investigation - Reasonable Resolution 4Preliminary Investigation - Not Sustained 1Preliminary Investigation - Partly Resolved in Favour <strong>of</strong>Complainant1Preliminary Investigation - Not Sustained - Explanation Given 1Total 2036

Description <strong>of</strong> outcomesAdvice givenInformation or advice was provided to the public without contacting the agency complained against.Preliminary InvestigationA Preliminary Investigation pursuant to section 18(1) <strong>of</strong> the Ombudsman Act is conducted to obtain preliminaryinformation to determine whether the matter should proceed to a full investigation. Often such an investigationcan involve a considerable amount <strong>of</strong> effort on the part <strong>of</strong> the investigator, without reaching the point whereformal advice <strong>of</strong> a full investigation is necessary. Many complaints are resolved during this phase.Not SustainedA matter is classed as Not Sustained if the complaint has been investigated and sufficient information has beendiscovered to conclude that there is no basis to form an opinion pursuant to section 25(1).Not Sustained - Explanation GivenA matter is classed as Not Sustained - Explanation Given if the complaint has been investigated and sufficientinformation has been discovered to conclude that there is no basis to form an opinion pursuant to section 25(1),but as a consequence <strong>of</strong> the information obtained the complainant is able to receive an explanation <strong>of</strong> thereasons for the agency’s actions, and that explanation is in advance <strong>of</strong> the explanation or information which thecomplainant previously had from the agency.Partly Resolved in Favour <strong>of</strong> ComplainantA matter is Partly Resolved in Favour <strong>of</strong> Complainant if there is some benefit to the complainant or some actionby the agency such that the substance <strong>of</strong> the complaint is partly addressed and resolved. This descriptionwould <strong>of</strong>ten apply where there would not have been sufficient information to sustain the complaint, butnotwithstanding this the agency acts to partly remove the difficulty which was the basis <strong>of</strong> the complaint.Reasonable ResolutionA matter is classed as having a Reasonable Resolution if, before an opinion is formed pursuant to section 25(1)<strong>of</strong> the Ombudsman Act, some action is taken by the agency to remedy (in the opinion <strong>of</strong> the Ombudsman) thec<strong>au</strong>se <strong>of</strong> the complaint, or provision is made whereby the complaint can be properly addressed by the agency.37

Corporate <strong>Gov</strong>ernance Documents and PoliciesThe <strong>City</strong> <strong>of</strong> <strong>Playford</strong> has a range <strong>of</strong> corporate governance documents and policies to assist with decisionmakingand to ensure Council’s activities are undertaken in an accountable, efficient, open and transparentmanner.The following list outlines the current corporate governance documents and policies <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Playford</strong> atthe end <strong>of</strong> the <strong>2006</strong>/<strong>07</strong> financial year:• Access to Meetings and Documents Code <strong>of</strong>Practice• Accident <strong>Report</strong>ing, Investigation and First AidPolicy• After Hours Response Policy• Alcohol and Drugs in the Workplace Policy• <strong>Annual</strong> Financial Statements• Asbestos Policy• Assessment Book• Capitalisation Policy• Circus Policy• <strong>City</strong> <strong>of</strong> <strong>Playford</strong> <strong>Annual</strong> <strong>Report</strong>• <strong>City</strong> Plan• Club Indebtedness Policy• Code <strong>of</strong> Conduct - Elected Members and Staff• Code <strong>of</strong> Practice - Procedures at Council,Special Council, and Committee Meetings• Code <strong>of</strong> Practice - Public Access to Council,Special Council and Committee Meetings &Documents• Collection <strong>of</strong> Long Term Debts Policy• Committee and Development AssessmentPanel <strong>Annual</strong> <strong>Report</strong>s• Committee Terms <strong>of</strong> Reference and RulesPolicy• Community Involvement Policy• Community Wellbeing Goal Plan• Competency and Training Policy• Complaints and Grievance Handling Policy• Confined Spaces Policy• Consultation Policy• Corporate Management Plan• Corporate Uniform Policy and Dress Image• Council Agendas, <strong>Report</strong>s, Minutes andCharters <strong>of</strong> Committees and Council• Council and Committee Code <strong>of</strong> Practice• Council By-laws• Credit Card Policy• Creditor Payment Terms Policy• Criminal Record Check for Volunteers Policy• Damage to Clothing/Personal Property Policy• Debt Policy• Delegations Register• Development Assessment Panel Code <strong>of</strong>Practice• Development <strong>of</strong> Standard OperatingProcedures• Discipline Policy• Disease Prevention Policy• Donations to Communities Affected by NaturalDisasters Policy• Economic Prosperity Goal Plan• Elected Members Access and Use <strong>of</strong> CouncilInformation Policy• Elected Members Recognition <strong>of</strong> ServicePolicy• Elected Members Support Policy• Elected Members Training and DevelopmentPolicy• Election Campaign Donation Returns• Election <strong>of</strong> Health and Safety RepresentativesPolicy• Electrical Safety Policy• Elizabeth Regional Centre Car Parking FundPolicy• Emergency Procedures Policy• Employee Assistance Program Policy• Employee Representative Support Policy• Environmental Care Goal Plan38

• Equal Opportunity and Affirmative ActionPolicy• Exit Interviews Policy• Fees and Charges Policy• Fees and Charges Schedule• First Aid Allowance Policy• Flying <strong>of</strong> Flags on Council Property Policy• <strong>Gov</strong>ernance Architecture• Graffiti Maintenance and Prevention Policy• Hazard Management Policy• Higher Duties - Secondment and MixedFunctions Policy• Induction and Probation Policy• Information Technology Policy• Injury Management Policy and Procedures• Internal Control Policy• Isolated / Remote Work Policy• Leave and Absences Policy• Limits <strong>of</strong> Authority Policy• Management <strong>of</strong> Change Policy• Management <strong>of</strong> Excessive Leave Policy• Management <strong>of</strong> Working Outdoors Policy• Management <strong>of</strong> Workplace Substances Policy• Manual Handling Policy• Mobile Phone - Allocation and AdministrationPolicy• Motor Vehicle Purchase and Usage Policy• Naming <strong>of</strong> Assets Policy• Oil Spill Response Policy• Order Making Policy• Performance Appraisals Policy andGuidelines• Performance Appraisal Policy and Form -Childcare• Personal Protective Equipment and ClothingPolicy• Personnel Files Policy• Petty Cash Policy• Plant and Equipment Policy• <strong>Playford</strong> Plan• Private Motor Vehicle Allowance Policy• Purchasing Policy• Purchasing, Contracts Policy• Purchasing, Tendering and Contracts Policy• Rates Rebate Policy• Rating Policy Statement• Reclassification Policy• Recognition <strong>of</strong> Staff Policy• Records Management Policy• Recruitment and Selection Policy• Register <strong>of</strong> Community Land• Register <strong>of</strong> Elected Members Expenses andAllowances• Register <strong>of</strong> Interests – Primary and OrdinaryReturns• Register <strong>of</strong> Public Roads• Register <strong>of</strong> Staff Salaries and Benefits• Risk Management Policy• Salary Sacrifice for Super Contribution Policy• Sale or Disposal <strong>of</strong> Land and Other AssetsPolicy• Screened Based Equipment Policy• Serious Medical Condition or Injury Policy• Smoke Free Work Environment Policy• Special Occasion Temporary Road ClosurePolicy• Staff Member Expenses Policy• Sub - Delegation Register• Telephone Standards and Procedures Policy• Unsanctioned Events Policy• Use <strong>of</strong> Council Emblem Policy• Use <strong>of</strong> Mobile Communication Devices Policy• Use <strong>of</strong> Public Roads for Business PurposesPolicy• Vegetation Management Policy• Volunteer Policy• Walkway Closure Policy• Work Experience Policy• Zero Tolerance to Bullying Policy39