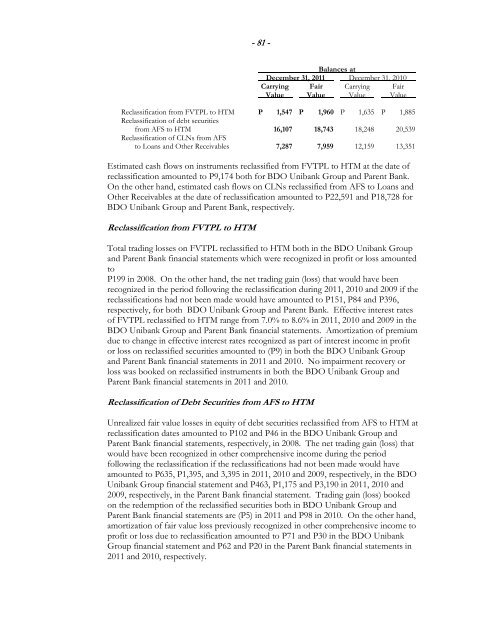

- 81 -Balances atDecember 31, 2011 December 31, 2010Carrying Fair Carrying FairValue Value Value ValueReclassification from FVTPL to HTM P 1,547 P 1,960 P 1,635 P 1,885Reclassification of debt securitiesfrom AFS to HTM 16,107 18,743 18,248 20,539Reclassification of CLNs from AFSto Loans and Other Receivables 7,287 7,959 12,159 13,351Estimated cash flows on instruments reclassified from FVTPL to HTM at the date ofreclassification amounted to P9,174 both for <strong>BDO</strong> Unibank Group and Parent Bank.On the other hand, estimated cash flows on CLNs reclassified from AFS to Loans andOther Receivables at the date of reclassification amounted to P<strong>22</strong>,591 and P18,728 for<strong>BDO</strong> Unibank Group and Parent Bank, respectively.Reclassification from FVTPL to HTMTotal trading losses on FVTPL reclassified to HTM both in the <strong>BDO</strong> Unibank Groupand Parent Bank financial statements which were recognized in profit or loss amountedtoP199 in 2008. On the other hand, the net trading gain (loss) that would have beenrecognized in the period following the reclassification during 2011, 2010 and 2009 if thereclassifications had not been made would have amounted to P151, P84 and P396,respectively, for both <strong>BDO</strong> Unibank Group and Parent Bank. Effective interest ratesof FVTPL reclassified to HTM range from 7.0% to 8.6% in 2011, 2010 and 2009 in the<strong>BDO</strong> Unibank Group and Parent Bank financial statements. Amortization of premiumdue to change in effective interest rates recognized as part of interest income in profitor loss on reclassified securities amounted to (P9) in both the <strong>BDO</strong> Unibank Groupand Parent Bank financial statements in 2011 and 2010. No impairment recovery orloss was booked on reclassified instruments in both the <strong>BDO</strong> Unibank Group andParent Bank financial statements in 2011 and 2010.Reclassification of Debt Securities from AFS to HTMUnrealized fair value losses in equity of debt securities reclassified from AFS to HTM atreclassification dates amounted to P102 and P46 in the <strong>BDO</strong> Unibank Group andParent Bank financial statements, respectively, in 2008. The net trading gain (loss) thatwould have been recognized in other comprehensive income during the periodfollowing the reclassification if the reclassifications had not been made would haveamounted to P635, P1,395, and 3,395 in 2011, 2010 and 2009, respectively, in the <strong>BDO</strong>Unibank Group financial statement and P463, P1,175 and P3,190 in 2011, 2010 and2009, respectively, in the Parent Bank financial statement. Trading gain (loss) bookedon the redemption of the reclassified securities both in <strong>BDO</strong> Unibank Group andParent Bank financial statements are (P5) in 2011 and P98 in 2010. On the other hand,amortization of fair value loss previously recognized in other comprehensive income toprofit or loss due to reclassification amounted to P71 and P30 in the <strong>BDO</strong> UnibankGroup financial statement and P62 and P20 in the Parent Bank financial statements in2011 and 2010, respectively.

- 82 -Reclassification of CLNs from AFS to Loans and Other ReceivablesUnrealized fair value losses in equity of CLNs linked to ROP bonds reclassified fromAFS to Loans and Other Receivables at reclassification dates amounted to P627 andP624 in the <strong>BDO</strong> Unibank Group and Parent Bank financial statements, respectively, in2008. The effective interest rates on reclassified investments range from 5.44% to12.54%, 1.64% to 12.55%, and 4.3% to 12.55% in the <strong>BDO</strong> Unibank Group financialstatements, in 2011, 2010 and 2009, respectively, and 5.44% to 12.54% in 2011 and2.78% to 12.55% in 2010 and 1.1% to 12.55% in 2009 in the Parent Bank financialstatements. Interest income recognized in profit or loss on reclassified securitiesamounted to P178 and P254 in 2011 and 2010, respectively, in the <strong>BDO</strong> UnibankGroup financial statements and P167 and P125 in 2011 and 2010, respectively, in theParent Bank financial statements.Additional unrealized fair value gain (losses) recognized in other comprehensive incomein the period following the reclassification had the CLNs not been reclassified to Loansand Other Receivables would have amounted to (P371), P444 and P643 in 2011, 2010and 2009, respectively, in the <strong>BDO</strong> Unibank Group financial statements and (P371),P469 and P623 in 2011, 2010 and 2009, respectively, in the Parent Bank financialstatements. Additional trading gain (loss) to be recognized in profit or loss had theembedded derivatives not been reclassified totaled to (P208), P152 and P1,597 in 2011,2010 and 2009, respectively, in the <strong>BDO</strong> Unibank Group financial statements and(P202), P148 and P1,274 in 2011, 2010 and 2009, respectively, in the Parent Bankfinancial statements.In 2011, the <strong>BDO</strong> Unibank Group unwound the outstanding CLDs and CLNs withcertain financial institutions amounting to P437 and P5,454, respectively. On the otherhand, the Parent Bank unwound the outstanding CLNs with certain financialinstitutions amounting to P5,009. The <strong>BDO</strong> Unibank Group and Parent Bankrecognized loss amounting to P13 and P7, respectively, in the unwinding of CLNs andis presented as part of the Trading gain – net under Other Operating Income in the2011 statement of income. Also, the unwinding of CLN by the Parent Bank resulted toreversal of net unrealized loss amounting to (P25) and is presented as part of Tradingnet under Other Operating Income in the 2011 statement of income.After the reclassification, amortization of unrealized fair value losses on outstandingCLDs and CLNs previously recognized directly in the statements of comprehensiveincome amounted to P157 and P82 in 2011 and 2010, respectively, for the <strong>BDO</strong>Unibank Group and P157 and P98 in 2011 and 2010, respectively, for the Parent Bank.

- Page 1 and 2:

Via ODiSyMarch 22, 2012PHILIPPINE S

- Page 3:

SEC FORM 17-A

- Page 6 and 7:

TABLE OF CONTENTSPage No.PART I- BU

- Page 8 and 9:

Philippine Subsidiaries% Interest H

- Page 10 and 11:

sophisticated investors. The Bank

- Page 12:

(v)Transactions with and/or Depende

- Page 16 and 17:

BDO BANK-OWNED PROPERTIES UTILIZED

- Page 18 and 19:

BDO BANK-OWNED PROPERTIES UTILIZED

- Page 20 and 21:

2) Leased PropertiesThe Group lease

- Page 22 and 23:

Branch Address Lease Lease ExpiryEf

- Page 24 and 25:

Branch Address Lease Lease ExpiryEf

- Page 26 and 27:

Branch Address Lease Lease ExpiryEf

- Page 28 and 29:

Branch Address Lease Lease ExpiryEf

- Page 30 and 31:

Branch Address Lease Lease ExpiryEf

- Page 32 and 33:

Branch Address Lease Lease ExpiryEf

- Page 34 and 35:

Branch Address Lease Lease ExpiryEf

- Page 36 and 37:

Branch Address Lease Lease ExpiryEf

- Page 38 and 39:

Branch Address Lease Lease ExpiryEf

- Page 40 and 41:

Branch Address Lease Lease ExpiryEf

- Page 42 and 43:

Item 4. Submission of Matters to a

- Page 44 and 45:

On 29 January 2011, the Board of th

- Page 46 and 47:

Total Equity grew by 9% to P97.0 bi

- Page 48 and 49:

Balance Sheet - 2010 vs. 2009Total

- Page 50 and 51:

Comprehensive Income - For the year

- Page 52 and 53:

Item 7. Financial StatementsThe con

- Page 54 and 55:

UOB Singapore. He was formerly the

- Page 56 and 57:

Director of the Philippine Global C

- Page 58 and 59:

Name Age PositionInvestments GroupG

- Page 60 and 61:

Antonio N. Cotoco, 63, is Senior Ex

- Page 62 and 63:

Bienvenido M. Juat, Jr., 58, is Exe

- Page 64 and 65:

Ma. Ophelia Ll. Camiña, 58, is Sen

- Page 66 and 67:

Corporation; a Trustee of PCI Bank

- Page 68 and 69:

Dalmacio D. Martin, 50, is Senior V

- Page 70 and 71:

Luis S. Reyes, Jr., 54, is Senior V

- Page 72 and 73:

Equitable Banking Corporation in Ju

- Page 74 and 75:

The above compensation includes the

- Page 76 and 77:

Title ofClassName of BeneficialOwne

- Page 78 and 79:

esponsible for the setting up of th

- Page 80 and 81:

2 May 2011 Retirement of Ms. Nenita

- Page 82:

Setting the annual shareholders’

- Page 87:

AUDITED FINANCIAL STATEMENTSDECEMBE

- Page 93 and 94:

BDO UNIBANK, INC. AND SUBSIDIARIES(

- Page 95 and 96:

- 2 -Net UnrealizedFair ValueGains

- Page 97 and 98:

- 2 -BDO Unibank GroupParent BankNo

- Page 99 and 100:

1.02 Approval of Financial Statemen

- Page 101 and 102:

- 4 -Parent BankFRSP Difference PFR

- Page 103 and 104:

- 6 -(ii) Philippine Interpretation

- Page 105 and 106:

- 8 -• PFRS 7 (Amendment), Financ

- Page 107 and 108:

- 10 -(v) PFRS 9, Financial Instrum

- Page 109 and 110:

- 12 -The financial statements of s

- Page 111 and 112:

- 14 -2.06 Financial AssetsFinancia

- Page 113 and 114:

- 16 -HTM investments consist of go

- Page 115 and 116:

- 18 -The value produced by a model

- Page 117 and 118:

- 20 -2.12 Premises, Furniture, Fix

- Page 119 and 120:

- 22 -Deposit liabilities and other

- Page 121 and 122:

- 24 -2.20 Revenue and Expense Reco

- Page 123 and 124:

- 26 -Provisions are measured at th

- Page 125 and 126:

- 28 -Future cash flows in a group

- Page 127 and 128: - 30 -Foreign exchange gains and lo

- Page 129 and 130: - 32 -(e)Executive Stock Option Pla

- Page 131 and 132: - 34 -3.01 Critical Management Judg

- Page 133 and 134: - 36 -3.02 Key Sources of Estimatio

- Page 135 and 136: - 38 -(iv) Loans and Other Receivab

- Page 137 and 138: - 40 -Parent BankNotes Level 1 Leve

- Page 139 and 140: - 42 -The retirement benefit asset

- Page 141 and 142: - 44 -• It then disseminates the

- Page 143 and 144: - 46 -2010MoreOne to than three Mor

- Page 145 and 146: - 48 -2010MoreOne to than three Mor

- Page 147 and 148: - 50 -Parent Bank2011 2010ForeignFo

- Page 149 and 150: - 52 -BDO Unibank Group2010More Mor

- Page 151 and 152: - 54 -Parent Bank2010More MoreOne t

- Page 153 and 154: - 56 -A summary of the VaR position

- Page 155 and 156: - 58 -Parent BankImpact onImpact on

- Page 157 and 158: - 60 -b. SubstandardAccounts classi

- Page 159 and 160: - 62 -BDO Unibank Group2010Loans an

- Page 161 and 162: - 64 -Parent Bank2010Loans andTradi

- Page 163 and 164: - 66 -4.02.04.03 Concentrations of

- Page 165 and 166: - 68 -5. SEGMENT REPORTINGThe BDO U

- Page 167 and 168: - 70 -Commercial Investment Private

- Page 169 and 170: - 72 -At Amortized Carrying FairCos

- Page 171 and 172: - 74 -8. DUE FROM OTHER BANKSThe ba

- Page 173 and 174: - 76 -The aggregate contractual or

- Page 175 and 176: - 78 -The fair values of government

- Page 177: - 80 -The fair values are determine

- Page 181 and 182: - 84 -Per MORB, non-performing loan

- Page 183 and 184: - 86 -Leasehold Furniture,Rights an

- Page 185 and 186: - 88 -Land Buildings TotalJanuary 1

- Page 187 and 188: - 90 -Real and other properties acq

- Page 189 and 190: - 92 -The BDO Unibank Group’s sub

- Page 191 and 192: - 94 -Full allowance for impairment

- Page 193 and 194: - 96 -This account is composed of t

- Page 195 and 196: - 98 -The breakdown of this account

- Page 197 and 198: - 100 -On October 19, 2009, the pre

- Page 199 and 200: - 102 -On December 29, 2009, BSP is

- Page 201 and 202: - 104 -19.02 Capital AllocationThe

- Page 203 and 204: - 106 -annum of the par value. Subs

- Page 205 and 206: - 108 -20. INTEREST INCOMEInterest

- Page 207 and 208: - 110 -Other operating expenses con

- Page 209 and 210: - 112 -The movements in the present

- Page 211 and 212: - 114 -Parent Bank2011 2010 2009 20

- Page 213 and 214: - 116 -(c) Other Transactions with

- Page 215 and 216: - 118 -ii. On January 31, 2008, BDO

- Page 217 and 218: - 120 -27. TAXES27.01 Current and D

- Page 219 and 220: - 122 -Movements in net deferred ta

- Page 221 and 222: - 124 -27.04 Gross Receipts Tax (GR

- Page 223 and 224: - 126 -28. EARNINGS PER SHAREBasic

- Page 225 and 226: - 128 -29. SELECTED FINANCIAL PERFO

- Page 227 and 228: - 130 -Sale of BankardBDO (as succe

- Page 229 and 230:

- 132 -PEACe bondsOn October 18, 20

- Page 231:

- 134 -Following is a summary of BD