You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REPORT OF THE BOARD OF MANAGEMENT<br />

GENERAL<br />

STRATEGY<br />

Our strategy is well understood inside the Company, in<br />

the investment community, and in the business<br />

environment in which we operate. Our actions in 1998,<br />

in particular our acquisitions, investments, and<br />

divestments as discussed in this report, should be<br />

viewed in the light of that strategy.<br />

We aspire to leadership positions with structural<br />

profitability in world markets in the areas of healthcare,<br />

coatings, specialty chemicals, and fibers. Our activities<br />

should have the critical mass needed to play an active<br />

role in the restructuring of the industries in which we<br />

operate. We give priority to growth of our Pharma and<br />

<strong>Coatings</strong> operations, while Chemicals first focuses on<br />

improving returns and portfolio composition. We intend<br />

to create an independent fibers company, thus<br />

participating in the restructuring of that industry<br />

in Europe.<br />

Specific financial targets have been set in terms of<br />

return on sales (ROS) and return on invested capital<br />

(ROI), which will be stated in the appropriate sections of<br />

this report.<br />

The acquisition of Courtaulds—1998’s main event<br />

In April 1998, Akzo Nobel made a public offer for<br />

Courtaulds plc of GBP 4.50 per ordinary share. Early in<br />

July, the offer was declared unconditional and by the<br />

end of September the buyout procedure was<br />

completed. The total acquisition price for all ordinary<br />

shares was NLG 6.1 billion. The related goodwill of<br />

NLG 4.8 billion was written off against equity.<br />

The former Courtaulds accounts have been<br />

consolidated since the beginning of July 1998.<br />

The acquisition of Courtaulds enables us to realize two<br />

important strategic objectives:<br />

• to become the world’s number one in coatings;<br />

• to form a stand-alone fibers company to be prepared<br />

for demerger.<br />

The integration of the former Courtaulds activities is<br />

progressing well. We are confident that we will realize<br />

the strategic objectives as planned in the acquisition<br />

process.<br />

AKZO NOBEL ANNUAL REPORT 1998<br />

9<br />

FINANCIAL PERFORMANCE<br />

Earnings slightly higher<br />

Net income excluding nonrecurring items of NLG 1,630<br />

million slightly exceeded the previous year’s record of<br />

NLG 1,613 million. This translated into per share<br />

amounts of NLG 5.71 and NLG 5.66, respectively.<br />

Nonrecurring charges of NLG 287 million (after taxes),<br />

mainly relating to various restructurings and asset<br />

write-downs, reduced net income to NLG 1,343 million<br />

(1997: NLG 1,615 million).<br />

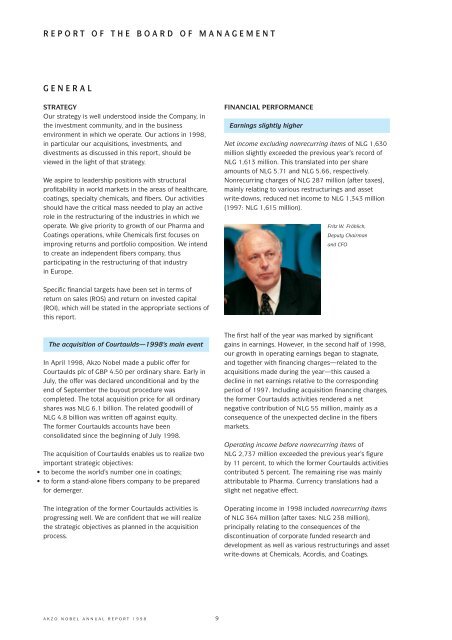

Fritz W. Fröhlich,<br />

Deputy Chairman<br />

and CFO<br />

The first half of the year was marked by significant<br />

gains in earnings. However, in the second half of 1998,<br />

our growth in operating earnings began to stagnate,<br />

and together with financing charges—related to the<br />

acquisitions made during the year—this caused a<br />

decline in net earnings relative to the corresponding<br />

period of 1997. Including acquisition financing charges,<br />

the former Courtaulds activities rendered a net<br />

negative contribution of NLG 55 million, mainly as a<br />

consequence of the unexpected decline in the fibers<br />

markets.<br />

Operating income before nonrecurring items of<br />

NLG 2,737 million exceeded the previous year’s figure<br />

by 11 percent, to which the former Courtaulds activities<br />

contributed 5 percent. The remaining rise was mainly<br />

attributable to Pharma. Currency translations had a<br />

slight net negative effect.<br />

Operating income in 1998 included nonrecurring items<br />

of NLG 364 million (after taxes: NLG 238 million),<br />

principally relating to the consequences of the<br />

discontinuation of corporate funded research and<br />

development as well as various restructurings and asset<br />

write-downs at Chemicals, Acordis, and <strong>Coatings</strong>.