Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

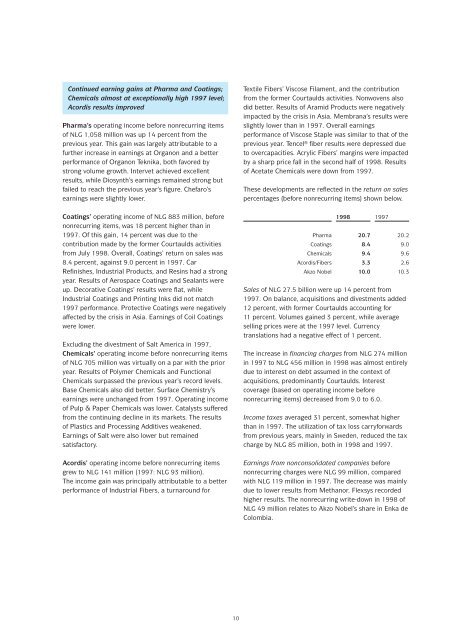

Continued earning gains at Pharma and <strong>Coatings</strong>;<br />

Chemicals almost at exceptionally high 1997 level;<br />

Acordis results improved<br />

Pharma’s operating income before nonrecurring items<br />

of NLG 1,058 million was up 14 percent from the<br />

previous year. This gain was largely attributable to a<br />

further increase in earnings at Organon and a better<br />

performance of Organon Teknika, both favored by<br />

strong volume growth. Intervet achieved excellent<br />

results, while Diosynth’s earnings remained strong but<br />

failed to reach the previous year’s figure. Chefaro’s<br />

earnings were slightly lower.<br />

<strong>Coatings</strong>’ operating income of NLG 883 million, before<br />

nonrecurring items, was 18 percent higher than in<br />

1997. Of this gain, 14 percent was due to the<br />

contribution made by the former Courtaulds activities<br />

from July 1998. Overall, <strong>Coatings</strong>’ return on sales was<br />

8.4 percent, against 9.0 percent in 1997. Car<br />

Refinishes, Industrial Products, and Resins had a strong<br />

year. Results of Aerospace <strong>Coatings</strong> and Sealants were<br />

up. Decorative <strong>Coatings</strong>’ results were flat, while<br />

Industrial <strong>Coatings</strong> and Printing Inks did not match<br />

1997 performance. Protective <strong>Coatings</strong> were negatively<br />

affected by the crisis in Asia. Earnings of Coil <strong>Coatings</strong><br />

were lower.<br />

Excluding the divestment of Salt America in 1997,<br />

Chemicals’ operating income before nonrecurring items<br />

of NLG 705 million was virtually on a par with the prior<br />

year. Results of Polymer Chemicals and Functional<br />

Chemicals surpassed the previous year’s record levels.<br />

Base Chemicals also did better. Surface Chemistry’s<br />

earnings were unchanged from 1997. Operating income<br />

of Pulp & Paper Chemicals was lower. Catalysts suffered<br />

from the continuing decline in its markets. The results<br />

of Plastics and Processing Additives weakened.<br />

Earnings of Salt were also lower but remained<br />

satisfactory.<br />

Acordis’ operating income before nonrecurring items<br />

grew to NLG 141 million (1997: NLG 93 million).<br />

The income gain was principally attributable to a better<br />

performance of Industrial Fibers, a turnaround for<br />

10<br />

Textile Fibers’ Viscose Filament, and the contribution<br />

from the former Courtaulds activities. Nonwovens also<br />

did better. Results of Aramid Products were negatively<br />

impacted by the crisis in Asia. Membrana’s results were<br />

slightly lower than in 1997. Overall earnings<br />

performance of Viscose Staple was similar to that of the<br />

previous year. Tencel® fiber results were depressed due<br />

to overcapacities. Acrylic Fibers’ margins were impacted<br />

by a sharp price fall in the second half of 1998. Results<br />

of Acetate Chemicals were down from 1997.<br />

These developments are reflected in the return on sales<br />

percentages (before nonrecurring items) shown below.<br />

1998 1997<br />

Pharma 20.7 20.2<br />

<strong>Coatings</strong> 8.4 9.0<br />

Chemicals 9.4 9.6<br />

Acordis/Fibers 3.3 2.6<br />

Akzo Nobel 10.0 10.3<br />

Sales of NLG 27.5 billion were up 14 percent from<br />

1997. On balance, acquisitions and divestments added<br />

12 percent, with former Courtaulds accounting for<br />

11 percent. Volumes gained 3 percent, while average<br />

selling prices were at the 1997 level. Currency<br />

translations had a negative effect of 1 percent.<br />

The increase in financing charges from NLG 274 million<br />

in 1997 to NLG 456 million in 1998 was almost entirely<br />

due to interest on debt assumed in the context of<br />

acquisitions, predominantly Courtaulds. Interest<br />

coverage (based on operating income before<br />

nonrecurring items) decreased from 9.0 to 6.0.<br />

Income taxes averaged 31 percent, somewhat higher<br />

than in 1997. The utilization of tax loss carryforwards<br />

from previous years, mainly in Sweden, reduced the tax<br />

charge by NLG 85 million, both in 1998 and 1997.<br />

Earnings from nonconsolidated companies before<br />

nonrecurring charges were NLG 99 million, compared<br />

with NLG 119 million in 1997. The decrease was mainly<br />

due to lower results from Methanor. Flexsys recorded<br />

higher results. The nonrecurring write-down in 1998 of<br />

NLG 49 million relates to Akzo Nobel’s share in Enka de<br />

Colombia.