Sustaining Generic Medicines Markets in Europe

Sustaining Generic Medicines Markets in Europe

Sustaining Generic Medicines Markets in Europe

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es marketsiiThe authorsResearch Centre for Pharmaceutical Care and Pharmaco-economicsS<strong>in</strong>ce the early 1990s, the Research Centre for Pharmaceutical Care and Pharmaco-economicsat the Katholieke Universiteit Leuven has made a scientific contribution to the efficient, effectiveand safe use of medic<strong>in</strong>es, medical devices and related products. In addition to research <strong>in</strong>tothe key areas of pharmaco-economics, pharmaco-therapeutics and pharmaceutical care, theCentre is committed to transferr<strong>in</strong>g scientific knowledge <strong>in</strong> these areas to health careprofessionals, policy makers, pharmaceutical <strong>in</strong>dustry, and patients.Steven SimoensSteven is a Professor at the Research Centre for Pharmaceutical Care and Pharmacoeconomics.He is a health economist and leads the Centre’s research <strong>in</strong>to the economics ofmedic<strong>in</strong>es, medical devices and related products. His research <strong>in</strong>terests focus on issuessurround<strong>in</strong>g competition and regulation of the pharmaceutical <strong>in</strong>dustry, and economicevaluation of medic<strong>in</strong>es and medical devices. Previously, Steven worked at the Organization forEconomic Co-operation and Development and at the University of Aberdeen. He holds a degree<strong>in</strong> commercial eng<strong>in</strong>eer<strong>in</strong>g from the Katholieke Universiteit Leuven, a MSc <strong>in</strong> Health Economicsfrom the University of York and a PhD <strong>in</strong> Economics from the University of Aberdeen.Sandra De CosterSandra graduated from the Katholieke Universiteit Leuven as a pharmacist. She spent twoyears <strong>in</strong> the pharmaceutical <strong>in</strong>dustry, where she participated <strong>in</strong> the regulatory affairs of herbalmedic<strong>in</strong>es. She then jo<strong>in</strong>ed the Research Centre for Pharmaceutical Care and Pharmacoeconomicsas a research fellow. Her research <strong>in</strong>terests focus on pharmacotherapy. In additionto this, she works part-time as a community pharmacist.

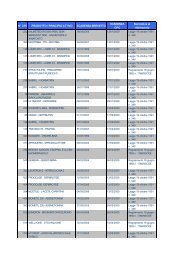

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es marketsviiiFigure 25. Potential sav<strong>in</strong>gs from <strong>in</strong>creased generic substitution <strong>in</strong> Italy, 2004 87Figure 26. Potential sav<strong>in</strong>gs from <strong>in</strong>creased generic substitution <strong>in</strong> the Netherlands,200488Figure 27. Potential sav<strong>in</strong>gs from <strong>in</strong>creased generic substitution <strong>in</strong> Poland, 2004 88Figure 28. Potential sav<strong>in</strong>gs from <strong>in</strong>creased generic substitution <strong>in</strong> Portugal, 2004 89Figure 29. Potential sav<strong>in</strong>gs from <strong>in</strong>creased generic substitution <strong>in</strong> Spa<strong>in</strong>, 2004 89Figure 30. Potential sav<strong>in</strong>gs from <strong>in</strong>creased generic substitution <strong>in</strong> United K<strong>in</strong>gdom,200490

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 11Demand-side policiesPhysician budgets created a stimulus to prescribe generic medic<strong>in</strong>es <strong>in</strong> Germany and the UnitedK<strong>in</strong>gdom, but rewards and sanctions for budget surpluses and deficits, respectively, are anecessary condition for mak<strong>in</strong>g budgets effective. Initiatives to promote INN prescrib<strong>in</strong>g provideimpetus for generic medic<strong>in</strong>es use only if regulation specify<strong>in</strong>g which medic<strong>in</strong>e pharmacists needto dispense and the system of pharmacist remuneration favour the delivery of generic medic<strong>in</strong>es.<strong>Generic</strong> substitution aids generic medic<strong>in</strong>es use if it is f<strong>in</strong>ancially attractive to pharmacists tosubstitute generic for orig<strong>in</strong>ator medic<strong>in</strong>es. However, the remuneration system of pharmacists <strong>in</strong>the majority of selected countries provides a f<strong>in</strong>ancial dis<strong>in</strong>centive to dispense generic medic<strong>in</strong>es.Belgian and French remuneration systems that guarantee the same absolute marg<strong>in</strong> on orig<strong>in</strong>atorand generic medic<strong>in</strong>es provide a neutral f<strong>in</strong>ancial <strong>in</strong>centive to pharmacists, but <strong>in</strong>crease the priceof generic medic<strong>in</strong>es relative to orig<strong>in</strong>ator medic<strong>in</strong>es. Few countries have <strong>in</strong> place systems thatf<strong>in</strong>ancially reward pharmacists for substitut<strong>in</strong>g generic for orig<strong>in</strong>ator medic<strong>in</strong>es. In countries wherecompanies compete by offer<strong>in</strong>g discounts to pharmacists, health care payers and patients do notcapture the potential sav<strong>in</strong>gs from generic medic<strong>in</strong>es use.Patient co-payment seems to play a role <strong>in</strong> stimulat<strong>in</strong>g demand for generic medic<strong>in</strong>es <strong>in</strong> Polandand Portugal. This <strong>in</strong>centive does not exist <strong>in</strong> France where co-payments tend to be covered byprivate <strong>in</strong>surance. Many countries have launched advertis<strong>in</strong>g campaigns to <strong>in</strong>form patients ofgeneric medic<strong>in</strong>es, but the effectiveness of such campaigns has not been evaluated.Sav<strong>in</strong>gs from generic medic<strong>in</strong>es useAn illustrative exercise showed that <strong>in</strong>creased substitution of generic for orig<strong>in</strong>ator medic<strong>in</strong>es canyield substantial sav<strong>in</strong>gs. For the top 10 active substances by expenditure of orig<strong>in</strong>atormedic<strong>in</strong>es, generic substitution would reduce public expenditure on the orig<strong>in</strong>ator medic<strong>in</strong>esconta<strong>in</strong><strong>in</strong>g these active substances by 21%-48% <strong>in</strong> selected countries, with a proportionalreduction of 27% <strong>in</strong> Austria, 42% <strong>in</strong> Belgium, 48% <strong>in</strong> Denmark, 35% <strong>in</strong> France, 47% <strong>in</strong> Germany,31% <strong>in</strong> Italy, 41% <strong>in</strong> the Netherlands, 21% <strong>in</strong> Poland, 42% <strong>in</strong> Portugal, 33% <strong>in</strong> Spa<strong>in</strong>, and 33% <strong>in</strong>the United K<strong>in</strong>gdom.Recommendations to susta<strong>in</strong> <strong>Europe</strong>an generic medic<strong>in</strong>es marketsTo susta<strong>in</strong> the development of a competitive generic medic<strong>in</strong>es market, the follow<strong>in</strong>grecommendations are proposed:

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 13Proprietary Name dur<strong>in</strong>g their undergraduate education; by demonstrat<strong>in</strong>g to physicians theamount of sav<strong>in</strong>gs that can be made from generic medic<strong>in</strong>es use; by support<strong>in</strong>g physicianprescrib<strong>in</strong>g with electronic prescrib<strong>in</strong>g systems, medic<strong>in</strong>e databases, audit of and feedback onprescrib<strong>in</strong>g data, prescrib<strong>in</strong>g guidel<strong>in</strong>es and formularies, substitution lists, and local pharmacotherapeuticdiscussions between physicians and pharmacists. These policy tools need to beaccompanied by rewards/sanctions for physicians who do/do not adhere to them, respectively.6. Remove f<strong>in</strong>ancial dis<strong>in</strong>centives for pharmacists to dispense generic medic<strong>in</strong>esPharmacists need to receive a remuneration that does not f<strong>in</strong>ancially penalise them fordispens<strong>in</strong>g generic medic<strong>in</strong>es. Countries need to move away from distribution marg<strong>in</strong>s that areset as a fixed percentage of the public price of medic<strong>in</strong>es or marg<strong>in</strong>s that, even though they areregressive, still favour the delivery of orig<strong>in</strong>ator medic<strong>in</strong>es. Instead, countries need to consider<strong>in</strong>troduc<strong>in</strong>g pharmacist remuneration systems that are neutral or favour the delivery of genericmedic<strong>in</strong>es from a f<strong>in</strong>ancial perspective.7. Provide <strong>in</strong>centives for patients to demand generic medic<strong>in</strong>esCountries need to <strong>in</strong>cite patients to demand generic medic<strong>in</strong>es. This may take the form off<strong>in</strong>ancial <strong>in</strong>centives that reduce co-payment on generic medic<strong>in</strong>es or impose higher co-paymenton orig<strong>in</strong>ator medic<strong>in</strong>es.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 141 IntroductionOver the past decades, medic<strong>in</strong>es have made a major contribution to improv<strong>in</strong>g the health statusof patients. At the same time, pharmaceutical expenditure has <strong>in</strong>creased rapidly, with spend<strong>in</strong>gon medic<strong>in</strong>es outpac<strong>in</strong>g economic growth <strong>in</strong> many <strong>Europe</strong>an countries (OECD, 2005). As aresult, Governments seek to implement effective pharmaceutical policies that support furtherhealth improvements by accommodat<strong>in</strong>g the <strong>in</strong>troduction of new and more effective medic<strong>in</strong>es,whilst conta<strong>in</strong><strong>in</strong>g pharmaceutical expenditure.In the face of these pressures, a grow<strong>in</strong>g number of <strong>Europe</strong>an countries pursue the developmentof their domestic generic medic<strong>in</strong>es market. A generic medic<strong>in</strong>e is a medic<strong>in</strong>al product which hasthe same qualitative and quantitative composition <strong>in</strong> active substances and the samepharmaceutical form as the reference medic<strong>in</strong>al product, and whose bio-equivalence with thereference medic<strong>in</strong>al product has been demonstrated by appropriate bio-availability studies(Directive 2004/27/EC).A favourable environment for generic medic<strong>in</strong>es is likely to aid Governments <strong>in</strong> susta<strong>in</strong><strong>in</strong>g healthcare provision and controll<strong>in</strong>g pharmaceutical expenditure because generic medic<strong>in</strong>es have thesame quality, safety and therapeutic efficacy as the orig<strong>in</strong>ator medic<strong>in</strong>e, but are less expensivethan orig<strong>in</strong>ator medic<strong>in</strong>es. Their lower cost derives from the fact that companies of genericmedic<strong>in</strong>es do not <strong>in</strong>cur the development costs of <strong>in</strong>novative medic<strong>in</strong>es. Competition from genericmedic<strong>in</strong>es also <strong>in</strong>cites orig<strong>in</strong>ator companies to develop <strong>in</strong>novative medic<strong>in</strong>es and to reduce priceson off-patent orig<strong>in</strong>ator medic<strong>in</strong>es, thus generat<strong>in</strong>g additional sav<strong>in</strong>gs to patients (<strong>Europe</strong>anCommission, 2004). Sav<strong>in</strong>gs on the pharmaceutical budget, <strong>in</strong> turn, enable Governments toreimburse newer, more expensive medic<strong>in</strong>es.The size of generic medic<strong>in</strong>es retail markets varies widely between <strong>Europe</strong>an countries. Twogroups of countries can be dist<strong>in</strong>guished <strong>in</strong> terms of the market share of generic medic<strong>in</strong>es byvolume <strong>in</strong> 2004 (IMS Health, 2004). Countries with a mature generic medic<strong>in</strong>es market exhibiteda generic market share exceed<strong>in</strong>g 40% (e.g. Denmark, Germany, Netherlands, Poland, UnitedK<strong>in</strong>gdom). In countries with develop<strong>in</strong>g generic medic<strong>in</strong>es markets, market share of genericmedic<strong>in</strong>es did not surpass 20% (e.g. Austria, Belgium, France, Italy, Portugal, Spa<strong>in</strong>). Variation <strong>in</strong>the development of national generic medic<strong>in</strong>es retail markets owes, amongst other th<strong>in</strong>gs, todifferences <strong>in</strong> the policy and regulatory environment surround<strong>in</strong>g generic medic<strong>in</strong>es.This study aims to analyse the policy environment surround<strong>in</strong>g the generic medic<strong>in</strong>es retailmarket <strong>in</strong> selected <strong>Europe</strong>an countries s<strong>in</strong>ce 1990. A sample of countries with mature generic

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 15medic<strong>in</strong>es markets as well as countries with develop<strong>in</strong>g markets was <strong>in</strong>cluded. Analysis of thepolicy environment focuses on pric<strong>in</strong>g and reimbursement systems, and other <strong>in</strong>centives forphysicians to prescribe, for pharmacists to dispense and for patients to use generic medic<strong>in</strong>es. Inlight of Directive 2004/27/EC which harmonizes data exclusivity provisions and market<strong>in</strong>gauthorisation procedures across EU countries, such issues are not discussed <strong>in</strong> this report,except for when they had a clear impact on the development of a domestic generic medic<strong>in</strong>esmarket over the last 15 years.The material presented <strong>in</strong> this report was derived from a review of the <strong>in</strong>ternational peer-reviewedliterature and relevant legal texts. This was supplemented by <strong>in</strong>formation collected by the 2005and 2006 EGA surveys of pric<strong>in</strong>g and reimbursement systems govern<strong>in</strong>g generic medic<strong>in</strong>esmarkets (EGA, 2005 and 2006). Information derived from these sources was validated byrepresentatives of the EGA Healthcare Economics Committee, national generic medic<strong>in</strong>esassociations, M<strong>in</strong>istries of Health and National <strong>Medic<strong>in</strong>es</strong> Agencies.The study is structured as follows. For each of the selected countries, an overview is presented ofgeneric medic<strong>in</strong>es policy dur<strong>in</strong>g the last 15 years. Incentives created by policy measures areanalysed and key factors aid<strong>in</strong>g and h<strong>in</strong>der<strong>in</strong>g the development of the domestic genericmedic<strong>in</strong>es market are identified. This is followed by a comparative analysis of the policy tools thatcountries have used to strengthen their generic medic<strong>in</strong>es market and of their experience withthem. A set of general and country-specific recommendations is developed that can aid policymakers <strong>in</strong> susta<strong>in</strong><strong>in</strong>g their domestic generic medic<strong>in</strong>es market. F<strong>in</strong>ally, the potential sav<strong>in</strong>gs thatcould be realized from <strong>in</strong>creased substitution of generic for orig<strong>in</strong>ator medic<strong>in</strong>es are illustrated.The analysis is exemplified by data from IMS Health. Differences were noted between the IMSHealth classification of orig<strong>in</strong>ator and generic medic<strong>in</strong>es, and EGA def<strong>in</strong>itions. Therefore, datawere presented only for those countries where a close match could be obta<strong>in</strong>ed between IMSHealth and EGA def<strong>in</strong>itions. Further work is undertaken by IMS Health and EGA to resolverema<strong>in</strong><strong>in</strong>g data issues.The report hopes to aid policy makers <strong>in</strong> ga<strong>in</strong><strong>in</strong>g a better understand<strong>in</strong>g of how pharmaceuticalcompanies, physicians, pharmacists and patients react to <strong>in</strong>centives created by genericmedic<strong>in</strong>es policy, and to propose tools that policy makers can use to cont<strong>in</strong>ue develop<strong>in</strong>gdomestic generic medic<strong>in</strong>es retail markets.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 16PART IGENERIC MEDICINES POLICYIN COUNTRIES WITH MATURE MARKETS

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 172 Denmark2.1 <strong>Generic</strong> medic<strong>in</strong>es marketDanish generic medic<strong>in</strong>es policy has created conditions foster<strong>in</strong>g a low-price, high-volumegeneric medic<strong>in</strong>es market. Market shares of generic medic<strong>in</strong>es <strong>in</strong> terms of value of consumptionhave decreased from 39.3% <strong>in</strong> 1994 to 29.7% <strong>in</strong> 2004 as a result of fall<strong>in</strong>g prices of genericmedic<strong>in</strong>es. This has been accompanied by <strong>in</strong>creased volume of consumption of genericmedic<strong>in</strong>es, with market shares ris<strong>in</strong>g from 61.3% <strong>in</strong> 1994 to 69.7% <strong>in</strong> 2004.Figure 1. Market share of generic medic<strong>in</strong>es by value <strong>in</strong> Denmark, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%39,3%36,2%34,2%32,9%31,8%30,3%30,1%29,3%29,0% 28,3%29,7%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004YearNote: Data relate to both hospital and retail pharmacy.Figure 2. Market share of generic medic<strong>in</strong>es by volume <strong>in</strong> Denmark, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%61,3%58,5%58,1%58,4%58,3%59,0%63,3%59,8%72,8% 69,7%66,0%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004YearNote: Data relate to both hospital and retail pharmacy.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 182.2 <strong>Generic</strong> medic<strong>in</strong>es policy2.2.1 Pric<strong>in</strong>gIn Denmark, pharmaceutical companies are essentially free to set medic<strong>in</strong>e prices. Forreimbursement purposes, generic medic<strong>in</strong>es generally need to be priced below the price level oforig<strong>in</strong>ator medic<strong>in</strong>es.2.2.2 Reference pric<strong>in</strong>gA RPS by active substance was launched <strong>in</strong> 1993. Physicians can exempt patients from the RPSon specific medical grounds. Orig<strong>in</strong>ally, the RP was set at the average price per dosage unit ofthe two lowest-priced medic<strong>in</strong>es <strong>in</strong> the homogeneous group. S<strong>in</strong>ce 2001, the price of thecheapest medic<strong>in</strong>e <strong>in</strong> the group has been used to determ<strong>in</strong>e the RP. The level of RPs tends tochange every two weeks.2.2.3 Incentives for physiciansThe Danish <strong>Medic<strong>in</strong>es</strong> Agency has <strong>in</strong>troduced the ‘Medic<strong>in</strong>e Profile’, a database that GPs andpatients can access to check their <strong>in</strong>dividual medic<strong>in</strong>e use and to compare the price of theprescribed medic<strong>in</strong>e with that of equivalent medic<strong>in</strong>es. The Agency also publishes a monthlynewsletter targeted at physicians giv<strong>in</strong>g them advice on cost-effective prescrib<strong>in</strong>g.Decentralised <strong>in</strong>itiatives exist <strong>in</strong> all counties that stimulate generic prescrib<strong>in</strong>g through the use ofdatabases which report only the cheapest medic<strong>in</strong>e, through medical audit and dissem<strong>in</strong>ation ofprescrib<strong>in</strong>g data, and through visits to GPs to discuss their prescrib<strong>in</strong>g behaviour. These<strong>in</strong>itiatives have contributed to reduc<strong>in</strong>g the proportion of prescriptions where physicians forbidgeneric substitution.The Danish College of General Practice and the Medical Colleges of the various specialties havecompiled practice guidel<strong>in</strong>es, but no <strong>in</strong>centives or sanctions have been attached to physician(lack of) adherence to these guidel<strong>in</strong>es. Physicians are neither legally required nor encouraged toprescribe medic<strong>in</strong>es by INN.2.2.4 Incentives for pharmacistsIn 1991, generic substitution by pharmacists was <strong>in</strong>troduced. If the price of the prescribedmedic<strong>in</strong>e is less than 100 DKK, the pharmacist must substitute with the least expensive (generic

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 19or orig<strong>in</strong>ator) medic<strong>in</strong>e that is at least 5 DKK cheaper than the prescribed medic<strong>in</strong>e. Formedic<strong>in</strong>es priced between 100 and 400 DKK, substitution with the cheapest medic<strong>in</strong>e ismandatory if it is at least 5% cheaper than the prescribed medic<strong>in</strong>e. If the price of the prescribedmedic<strong>in</strong>e exceeds 400 DKK, the pharmacist must dispense the cheapest medic<strong>in</strong>e that is at least20 DKK below the price of the prescribed medic<strong>in</strong>e.Physicians can write on the prescription form that generic substitution is forbidden. In the thirdquarter of 2005, generic substitution was not allowed on 6.1% of prescriptions (Danish <strong>Medic<strong>in</strong>es</strong>Agency, 2006). The responsibility of <strong>in</strong>form<strong>in</strong>g patients of the availability of generic medic<strong>in</strong>es lieswith the pharmacist. Patients have the right to refuse substitution, but <strong>in</strong>cur a higher patient copaymentif they do so.<strong>Generic</strong> substitution is re<strong>in</strong>forced by dispens<strong>in</strong>g budgets for pharmacists, which provide an<strong>in</strong>centive to dispense cheap generic medic<strong>in</strong>es. Pharmacists have no personal f<strong>in</strong>ancial <strong>in</strong>terest<strong>in</strong> dispens<strong>in</strong>g generic medic<strong>in</strong>es as their remuneration is made up of a fee per prescription itemand a percentage marg<strong>in</strong>, the regressive nature of which is limited.2.2.5 Incentives for patientsS<strong>in</strong>ce 2005, patients <strong>in</strong>cur the full costs of medic<strong>in</strong>es up to 520 DKK per year. Once expendituresurpasses that level, patient co-payment as a percentage of medic<strong>in</strong>e costs decreases asexpenditure crosses specific thresholds: 50% co-payment from 520 to 1,260 DKK; 25% from1,260 to 2,950 DKK; and 15% from 2,950 DKK onwards. Reimbursement is calculated on thebasis of the price of the cheapest medic<strong>in</strong>e among the different products with the same activesubstance and effect. No campaigns to raise patient awareness of generic medic<strong>in</strong>es have beenconducted.2.3 Policy analysisThe Danish generic medic<strong>in</strong>es market is a low-price, high-volume market. This is because theRPS and generic substitution by pharmacists create a set of conditions that reward genericmedic<strong>in</strong>es companies that have competitive prices for an active substance with high sales. Formost active substances, the market consists of around ten companies that compete on price. Lowprices also stimulate patient demand for generic medic<strong>in</strong>es. This approach ensures the economicviability of the generic medic<strong>in</strong>es market.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 20Demand for generic medic<strong>in</strong>es is supported by generic substitution by pharmacists. <strong>Generic</strong>substitution rules require pharmacists to dispense the cheapest medic<strong>in</strong>e. Also, genericsubstitution by pharmacists is not <strong>in</strong>hibited by physician opposition. F<strong>in</strong>ancial <strong>in</strong>centives forpharmacists tend to be neutral or <strong>in</strong> favour of dispens<strong>in</strong>g generic medic<strong>in</strong>es. F<strong>in</strong>ally, genericprescrib<strong>in</strong>g is promoted by non-f<strong>in</strong>ancial <strong>in</strong>centives fac<strong>in</strong>g physicians.The Danish generic medic<strong>in</strong>es market is a competitive market where RPs change regularly andsome companies specialise <strong>in</strong> offer<strong>in</strong>g a limited number of generic medic<strong>in</strong>es at the lowest cost.Price competition and low prices could endanger the long-term susta<strong>in</strong>ability of the genericmedic<strong>in</strong>es <strong>in</strong>dustry, particularly those companies that offer a broad range of medic<strong>in</strong>es.Key factors aid<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• The RPS and generic substitution by pharmacists reward generic medic<strong>in</strong>es companies thatset competitive prices for an active substance with high sales• Physicians tend to have a favourable attitude towards generic substitution by pharmacistsand face non-f<strong>in</strong>ancial <strong>in</strong>centives to prescribe generic medic<strong>in</strong>esKey factors h<strong>in</strong>der<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• Strong price competition and low prices could endanger the long-term susta<strong>in</strong>ability of thegeneric medic<strong>in</strong>es <strong>in</strong>dustry

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 213 Germany3.1 <strong>Generic</strong> medic<strong>in</strong>es marketData on the market share of generic medic<strong>in</strong>es are not reported due to <strong>in</strong>compatibility of IMSHealth and EGA def<strong>in</strong>itions of generic medic<strong>in</strong>es.3.2 <strong>Generic</strong> medic<strong>in</strong>es policy3.2.1 Pric<strong>in</strong>gIn Germany, free medic<strong>in</strong>e pric<strong>in</strong>g prevails <strong>in</strong> that ex-factory prices of medic<strong>in</strong>es are set<strong>in</strong>dependently by pharmaceutical companies. Medic<strong>in</strong>e prices <strong>in</strong> Germany tend to be higher thanthose <strong>in</strong> other EU countries (Mrazek, 2002).An illustrative analysis focus<strong>in</strong>g on five active substances revealed that generic medic<strong>in</strong>es <strong>in</strong>Germany were priced at an average level as compared with prices <strong>in</strong> France, Italy, Spa<strong>in</strong> and theUnited K<strong>in</strong>gdom <strong>in</strong> 2005 (Accenture, 2005).3.2.2 Reference pric<strong>in</strong>gA RPS was launched <strong>in</strong> 1989 and gradually <strong>in</strong>troduced <strong>in</strong> the early 1990s. Physicians have thelegal obligation to <strong>in</strong>form patients of the surcharge when prescrib<strong>in</strong>g a medic<strong>in</strong>e priced above theRP. RPs were set for homogeneous groups of medic<strong>in</strong>es, which were def<strong>in</strong>ed at three levels.Level 1, implemented <strong>in</strong> 1989, related to off-patent medic<strong>in</strong>es with the same active substance. Asof 1991, level 2 applied to medic<strong>in</strong>es with pharmacologically and therapeutically comparableactive substances. Level 3 was <strong>in</strong>troduced <strong>in</strong> 1992 and grouped medic<strong>in</strong>es with a comparabletherapeutic effect without restrictions on chemical similarity. Initially, levels 2 and 3 of the RPScovered patented medic<strong>in</strong>es from the moment that the first patent for an active substance <strong>in</strong> thegroup had expired. Subsequently, newly-patented medic<strong>in</strong>es were exempted from the RPS after1996. The RP is calculated as a function of ex-factory prices, medic<strong>in</strong>e dosage and package size,and the number of generic competitors. In 1998, an additional condition was imposed, specify<strong>in</strong>gthat the RP could not surpass the highest price <strong>in</strong> the bottom third of the price range for thehomogeneous group.3.2.3 Incentives for physiciansDur<strong>in</strong>g the 1990s, Germany has experimented with different models of budgets at regional leveland budgets at physician level. In 1993, regional budgets were <strong>in</strong>troduced, the level of which was

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 22determ<strong>in</strong>ed by law from 1993 to 1995 and negotiated between regional sickness funds andphysician associations thereafter. Although legislation called for any deficit on medic<strong>in</strong>e budgetsto be paid by physician associations, such collective sanctions were never executed. Despite an<strong>in</strong>itial drop <strong>in</strong> medic<strong>in</strong>e prescriptions <strong>in</strong> 1993, costs started to rise <strong>in</strong> 1994 and exceeded themedic<strong>in</strong>e budget <strong>in</strong> a number of regions from 1995 onwards (Ess et al., 2003). There is alsosome evidence po<strong>in</strong>t<strong>in</strong>g to physicians <strong>in</strong>creas<strong>in</strong>g the number of referrals and hospital admissionsfollow<strong>in</strong>g the <strong>in</strong>troduction of budgets (Schoffski, 1996; von der Schulenburg, 1997).In the late 1990s, regional budgets met with legal challenges. They were abolished <strong>in</strong> 1998, re<strong>in</strong>troduced<strong>in</strong> 1999 and discont<strong>in</strong>ued aga<strong>in</strong> <strong>in</strong> 2001. From 1998 onwards, <strong>in</strong> practice, regionalbudgets were replaced by physician budgets based on practice-specific prescription targets.Physicians surpass<strong>in</strong>g their <strong>in</strong>dividual target by more than 15% received written notice <strong>in</strong>form<strong>in</strong>gthem to reconsider their prescrib<strong>in</strong>g practices. Physicians exceed<strong>in</strong>g 125% of the medic<strong>in</strong>ebudget were required to refund the difference between the actual budget and 115% of the targetbudget <strong>in</strong> the absence of a justification for the budget deficit. Although this recourse proceduregenerally took years, it was successfully carried out <strong>in</strong> a number of regions (Schreyogg et al.,2004).Physician budgets based on prescription targets were supported by feedback on prescrib<strong>in</strong>gbehaviour. From 2000 onwards, data on regional prescrib<strong>in</strong>g practices were sent to eachphysician. Additionally, physicians received <strong>in</strong>formation about a three-monthly volume ofprescriptions of their specialty group <strong>in</strong> the region and their <strong>in</strong>dividual prescription volume s<strong>in</strong>ce2003. Physicians can also draw on computerised prescrib<strong>in</strong>g to <strong>in</strong>form their prescrib<strong>in</strong>gbehaviour. However, physicians are neither legally required nor stimulated to issue prescriptionsby INN.Both the RPS and physician budgets appear to have boosted the German generic medic<strong>in</strong>esmarket dur<strong>in</strong>g the 1990s: actual generic prescriptions as a percentage of potential genericprescriptions <strong>in</strong>creased from 60% <strong>in</strong> 1992 to 75% <strong>in</strong> 2003 (Busse and Riesberg, 2004). However,no studies have been able to assess the separate effect of RPS and physician budgets ongeneric medic<strong>in</strong>es prescription rates as these policy measures were <strong>in</strong>troduced concomitantly.Additionally, physicians and their patients accept and have confidence <strong>in</strong> generic medic<strong>in</strong>es dueto well-known company brand<strong>in</strong>g of generic medic<strong>in</strong>es.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 233.2.4 Incentives for pharmacistsRules govern<strong>in</strong>g generic substitution by pharmacists have changed over time. Until 2001,physicians had to <strong>in</strong>dicate on the prescription form that they allowed substitution. S<strong>in</strong>ce 2002,pharmacists were required to substitute and dispense lower-cost, equivalent medic<strong>in</strong>es, unlessthe physician forbids it. In the case of a prescription by INN, the pharmacist must dispense one ofthe three cheapest medic<strong>in</strong>es. If the physician issues a prescription for a specific medic<strong>in</strong>ewithout exclud<strong>in</strong>g substitution, the pharmacist must dispense the prescribed medic<strong>in</strong>e or one ofthe three cheapest alternatives provided that they have an identical dosage and package size, an<strong>in</strong>terchangeable pharmaceutical form and same range of <strong>in</strong>dications.From 1980 to 2003, pharmacists were paid by regressive marg<strong>in</strong>s. However, as the regressiveeffect was restricted and the absolute size of the marg<strong>in</strong> still <strong>in</strong>creased with medic<strong>in</strong>e prices, thedelivery of generic medic<strong>in</strong>es was penalised. Marg<strong>in</strong>s of pharmacists were reduced <strong>in</strong> 2002. From2004 onwards, pharmacists are paid a fixed marg<strong>in</strong> of 3% <strong>in</strong> addition to a flat-rate payment of8.10 €. This remuneration system implies that pharmacists f<strong>in</strong>ancially benefit from dispens<strong>in</strong>g anorig<strong>in</strong>ator medic<strong>in</strong>e.3.2.5 Incentives for patientsPatient co-payments are currently set as a percentage of the public price of medic<strong>in</strong>es. NoGovernment <strong>in</strong>itiatives have been undertaken to <strong>in</strong>form patients of generic medic<strong>in</strong>es.3.3 Policy analysisHigh medic<strong>in</strong>e prices assist market entry of generic medic<strong>in</strong>es. Regulation govern<strong>in</strong>g theestablishment of RPs stimulates the German generic medic<strong>in</strong>es market by facilitat<strong>in</strong>g marketentry of generic medic<strong>in</strong>es (higher prices are awarded <strong>in</strong> groups with fewer generic competitors).Furthermore, price competition is stimulated <strong>in</strong> established markets, but not to the extent that itbecomes economically unviable for generic medic<strong>in</strong>es companies to rema<strong>in</strong> on the market.Germany has <strong>in</strong>centives for physicians (physician budgets <strong>in</strong> comb<strong>in</strong>ation with prescriptiontargets and feedback on prescrib<strong>in</strong>g behaviour) that, as they are primarily geared towardsconta<strong>in</strong><strong>in</strong>g costs, promote generic prescrib<strong>in</strong>g by physicians. The experience with regionalbudgets seems to suggest that rewards or sanctions are a necessary condition for mak<strong>in</strong>gbudgets effective. It also <strong>in</strong>dicates that budgets may have un<strong>in</strong>tended side effects. Budgets mayprovide an <strong>in</strong>centive for physicians to refer costly patients to hospital or may encourage the

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 24selection of less risky patients if they do not take <strong>in</strong>to account patient profiles or do not cover acomprehensive range of health care services. Significantly, there is a high rate of confidence andacceptance of generic medic<strong>in</strong>es among both physicians and patients ma<strong>in</strong>ly due to well-knowncompany brand<strong>in</strong>g of generic medic<strong>in</strong>es.Demand for generic medic<strong>in</strong>es is supported by generic substitution by pharmacists. Furthermore,conditions govern<strong>in</strong>g substitution have been losened from physicians hav<strong>in</strong>g to allow substitutionto physicians opposed to substitution hav<strong>in</strong>g to forbid it. The former <strong>in</strong>centive not to substitute hasthereby been removed. However, pharmacists are f<strong>in</strong>ancially penalised for dispens<strong>in</strong>g genericmedic<strong>in</strong>es.Key factors aid<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• Market entry of generic medic<strong>in</strong>es benefits from a RPS that sets higher RPs <strong>in</strong> medic<strong>in</strong>egroups with fewer generic competitors and that stimulates price competition, but still makes itpossible for generic medic<strong>in</strong>es companies to earn profits• Demand for generic medic<strong>in</strong>es is driven by generic substitution by pharmacists and byphysician budgets <strong>in</strong> comb<strong>in</strong>ation with prescription targets and feedback on prescrib<strong>in</strong>gbehaviourKey factors h<strong>in</strong>der<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• Pharmacists are f<strong>in</strong>ancially penalised for dispens<strong>in</strong>g generic medic<strong>in</strong>es

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 254 Netherlands4.1 <strong>Generic</strong> medic<strong>in</strong>es marketThe Dutch generic medic<strong>in</strong>es market has grown rapidly over time, with public expenditure<strong>in</strong>creas<strong>in</strong>g from 185 million € <strong>in</strong> 1994 (market share by value of 8.5%) to 830 million € <strong>in</strong> 2004(market share of 17.7%). The fall <strong>in</strong> market share of generic medic<strong>in</strong>es by value between 2003and 2004 is likely to orig<strong>in</strong>ate from a 2004 policy that substantially reduced prices of genericmedic<strong>in</strong>es. Market share of generic medic<strong>in</strong>es by volume has more than doubled from 19.9% <strong>in</strong>1994 to 44.3% <strong>in</strong> 2004.Figure 3. Market share of generic medic<strong>in</strong>es by value <strong>in</strong> the Netherlands, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%8,5%8,9%8,9%9,8%10,8%12,0%13,5%14,2%17,9%21,9%17,7%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004YearFigure 4. Market share of generic medic<strong>in</strong>es by volume <strong>in</strong> the Netherlands, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%43,1%39,6%44,3%34,7% 35,9%28,9%33,0%25,3% 27,1%19,9% 22,6%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004Year

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 264.2 <strong>Generic</strong> medic<strong>in</strong>es policy4.2.1 Pric<strong>in</strong>gThe Netherlands enforced pric<strong>in</strong>g regulation sett<strong>in</strong>g maximum prices of medic<strong>in</strong>es <strong>in</strong> 1996.Companies that set prices above the maximum level are liable for crim<strong>in</strong>al <strong>in</strong>junction. Themaximum price is based on the average price of both orig<strong>in</strong>ator and generic medic<strong>in</strong>es hav<strong>in</strong>g thesame active substance, strength and dosage form <strong>in</strong> Belgium, France, Germany and the UnitedK<strong>in</strong>gdom. In general, this led to a 15% fall <strong>in</strong> medic<strong>in</strong>e prices (Danzon and Ketcham, 2003).However, the level of medic<strong>in</strong>e prices still tended to be higher <strong>in</strong> the Netherlands as compared toother EU countries <strong>in</strong> the early 2000s (Koopmanschap and Rutten, 2003). Health <strong>in</strong>surancefunds, pharmacists, generic medic<strong>in</strong>es companies, and the Government agreed to reduce pricesof generic medic<strong>in</strong>es by 40% (<strong>in</strong>clud<strong>in</strong>g claw-back) on average <strong>in</strong> 2004. Medic<strong>in</strong>e prices were atthe average level of EU prices <strong>in</strong> 2005.4.2.2 Reference pric<strong>in</strong>gIn 1991, a RPS by therapeutic class was <strong>in</strong>troduced. Irrespective of patent status, medic<strong>in</strong>es witha comparable therapeutic effect were grouped if they had the same mechanism of action, asimilar route of adm<strong>in</strong>istration for treat<strong>in</strong>g the same <strong>in</strong>dication <strong>in</strong> the same age group and acomparable cl<strong>in</strong>ical effect. For each active substance <strong>in</strong> a homogeneous group, the average priceper def<strong>in</strong>ed daily dose of all orig<strong>in</strong>ator and generic medic<strong>in</strong>es with that active substance iscalculated. The RP is then set as the median of the distribution across all active substances <strong>in</strong> thegroup.The 1996 pric<strong>in</strong>g regulation <strong>in</strong>troduced maximum prices for many medic<strong>in</strong>es below the level ofRPs (Danzon and Ketcham, 2003). In 1999, RP levels were recalculated tak<strong>in</strong>g <strong>in</strong>to accountactual prices.4.2.3 Incentives for physiciansS<strong>in</strong>ce 1995, the Dutch Government has stimulated physicians to prescribe by INN. This has beensupported by the <strong>in</strong>troduction of an electronic prescription system, although this system is not yetwidely used.The Netherlands has a tradition of develop<strong>in</strong>g and implement<strong>in</strong>g prescrib<strong>in</strong>g guidel<strong>in</strong>es andtreatment protocols that promote the efficient use of medic<strong>in</strong>es. Local pharmaco-therapeuticdiscussions take place periodically between GPs and community pharmacists to evaluate

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 27medic<strong>in</strong>e prescrib<strong>in</strong>g and dispens<strong>in</strong>g, and formularies have been developed to rationaliseprescrib<strong>in</strong>g practices. Information campaigns have urged physicians to use generic names ratherthan brand names. There are no sanctions for physicians who do not respond to these <strong>in</strong>centives.A recent <strong>in</strong>itiative by one health <strong>in</strong>surance fund is the <strong>in</strong>troduction of a f<strong>in</strong>ancial stimulus for thedoctor if (s)he uses generic medic<strong>in</strong>es more frequently. This <strong>in</strong>itiative has been legally challengedby the orig<strong>in</strong>ator medic<strong>in</strong>e <strong>in</strong>dustry.4.2.4 Incentives for pharmacists<strong>Generic</strong> substitution by pharmacists is allowed if physicians and patients agree with it. Physicianscan <strong>in</strong>dicate on the prescription form that generic substitution is not permitted for medicalreasons. When the physician prescribes a branded orig<strong>in</strong>ator medic<strong>in</strong>e that is out of patent andgeneric substitution is allowed, the pharmacist can dispense any generic medic<strong>in</strong>e withoutreference to the physician. If the prescription is issued by INN, the pharmacist may dispense anyorig<strong>in</strong>ator or generic medic<strong>in</strong>e. Health <strong>in</strong>surance funds have also agreed a target rate of genericsubstitution with pharmacists.Pharmacists receive a fixed dispens<strong>in</strong>g fee per prescription. This implies that the delivery of ageneric or orig<strong>in</strong>ator medic<strong>in</strong>e is neutral from a f<strong>in</strong>ancial perspective. As a consequence, it is <strong>in</strong>the <strong>in</strong>terests of pharmacists to dispense the medic<strong>in</strong>e with the highest profit marg<strong>in</strong>. Two policymeasures were <strong>in</strong>troduced <strong>in</strong> the early 1990s that have a f<strong>in</strong>ancial impact on pharmacistdispens<strong>in</strong>g practices. First, if the pharmacist issues a medic<strong>in</strong>e that is priced below the level ofthe RP, the pharmacist can reta<strong>in</strong> one third of the price difference between the price of themedic<strong>in</strong>e and the RP. Second, pharmacists can keep any discounts awarded by pharmaceuticalcompanies s<strong>in</strong>ce 1991. Pharmacists are thus able to reta<strong>in</strong> 100% of discounts offered bywholesalers, but only 33% of the difference between the medic<strong>in</strong>e price and the RP. This led tocompetition between companies through discounts to pharmacists rather than lower medic<strong>in</strong>eprices. In fact, prices of several generic medic<strong>in</strong>es were raised to the level of the RP (Brouwerand Rutten, 2002). Therefore, s<strong>in</strong>ce 1998, a claw-back system imposed a mandatory reduction <strong>in</strong>pharmacists’ reimbursement of 6.82% of medic<strong>in</strong>e acquisition costs. This claw-back mechanismdoes not <strong>in</strong>tend to fully recover discounts as discounts are seen by the Government as an<strong>in</strong>strument to remunerate pharmacists, obviat<strong>in</strong>g the need to <strong>in</strong>crease the fixed dispens<strong>in</strong>g fee.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 284.2.5 Incentives for patientsIn the Netherlands, patients don’t have a f<strong>in</strong>ancial <strong>in</strong>centive to buy generic medic<strong>in</strong>es becausethere are no patient co-payments, except for the difference between the price of the medic<strong>in</strong>e andthe RP if the patient buys a medic<strong>in</strong>e priced above the level of the RP. A specific policy measuretargets three active substances (omeprazole, pravastat<strong>in</strong> and simvastat<strong>in</strong>). For these activesubstances, reimbursement is granted on the basis of the medic<strong>in</strong>e with the lowest pharmacyacquisition cost plus a pharmacist marg<strong>in</strong>. No campaigns to raise patient awareness of genericmedic<strong>in</strong>es have been run.4.3 Policy analysisThe ma<strong>in</strong> driver of generic medic<strong>in</strong>es use <strong>in</strong> the Netherlands is the f<strong>in</strong>ancial attractiveness ofgeneric substitution to pharmacists. A f<strong>in</strong>ancial <strong>in</strong>centive and discounts awarded bypharmaceutical companies has encouraged pharmacists to dispense generic medic<strong>in</strong>es.However, competition <strong>in</strong> the form of discounts to pharmacists rather than by price implies thathealth <strong>in</strong>surance funds do not fully benefit from the cost-sav<strong>in</strong>g potential of generic medic<strong>in</strong>es. Inresponse to this, a claw-back mechanism was <strong>in</strong>troduced. This type of government <strong>in</strong>tervention isunlikely to be as efficient as a market mechanism where pharmaceutical companies compete onthe basis of prices rather than discounts to pharmacists.Additionally, the Dutch generic medic<strong>in</strong>es market is supported by the lower prices of genericmedic<strong>in</strong>es. The Government has provided a range of f<strong>in</strong>ancial and non-f<strong>in</strong>ancial <strong>in</strong>centives forphysicians to prescribe generic medic<strong>in</strong>es, but adherence to these <strong>in</strong>centives is voluntary. Health<strong>in</strong>surance funds have set generic substitution target rates <strong>in</strong> consultation with pharmacists.Key factors aid<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• The f<strong>in</strong>ancial attractiveness of generic substitution by pharmacists susta<strong>in</strong>s genericmedic<strong>in</strong>es use• The generic medic<strong>in</strong>es market is driven by the lower prices of generic medic<strong>in</strong>es• A range of f<strong>in</strong>ancial and non-f<strong>in</strong>ancial <strong>in</strong>centives for physicians support generic prescrib<strong>in</strong>g• Health <strong>in</strong>surance funds have agreed generic substitution target rates <strong>in</strong> consultation withpharmacistsKey factors h<strong>in</strong>der<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• Patients have few <strong>in</strong>centives to buy generic medic<strong>in</strong>es

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 295 Poland5.1 <strong>Generic</strong> medic<strong>in</strong>es marketPoland has a mature generic medic<strong>in</strong>es market. Irrespective of express<strong>in</strong>g shares by value or byvolume, market shares of generic medic<strong>in</strong>es have fallen <strong>in</strong> the 1990s, but stabilized <strong>in</strong> the early2000s. In 2004, market shares of generic medic<strong>in</strong>es atta<strong>in</strong>ed 60% by value and 85% by volume.Figure 5. Market share of generic medic<strong>in</strong>es by value <strong>in</strong> Poland, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%66,4%66,8%65,7%62,1%58,4%59,2%57,6%57,8%57,6%60,5%56,9%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004YearFigure 6. Market share of generic medic<strong>in</strong>es by volume <strong>in</strong> Poland, 1994-2004Market share of generic medic<strong>in</strong>es100,0%80,0%60,0%90,8%89,6%88,5%86,9%85,0%84,3%83,8%83,8%84,0%84,7%83,9%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004Year

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 305.2 <strong>Generic</strong> medic<strong>in</strong>es policy5.2.1 Intellectual property rightsAs <strong>in</strong> many Central and Eastern <strong>Europe</strong>an countries, prescription of generic medic<strong>in</strong>es iscommon practice due to the limited availability of orig<strong>in</strong>ator medic<strong>in</strong>es <strong>in</strong> ambulatory care prior tothe end of communism <strong>in</strong> 1989 and due to the absence of product patents until the early 1990s.The Polish generic medic<strong>in</strong>es market benefited from regulation impos<strong>in</strong>g a three-year dataexclusivity period until EU accession of Poland. Dur<strong>in</strong>g the data exclusivity period, the applicationfor market<strong>in</strong>g authorisation for a generic medic<strong>in</strong>e cannot refer to the pre-cl<strong>in</strong>ical and cl<strong>in</strong>icaldocumentation of the orig<strong>in</strong>ator medic<strong>in</strong>e. As the Polish data exclusivity period was shorter thanthe 6-10 years of data exclusivity granted <strong>in</strong> the EU at that time, this served to speed up entry ofgeneric medic<strong>in</strong>es <strong>in</strong>to the Polish market.In recent years, there has been a significant <strong>in</strong>crease <strong>in</strong> the market share of imported orig<strong>in</strong>atormedic<strong>in</strong>es (Krumschmidt, 2006). Furthermore, the <strong>in</strong>troduction of Supplementary ProtectionCertificates for all patented medic<strong>in</strong>es registered <strong>in</strong> Poland s<strong>in</strong>ce 2000 can be expected to reducegeneric medic<strong>in</strong>es market shares <strong>in</strong> future years.5.2.2 Pric<strong>in</strong>gPolish medic<strong>in</strong>e prices tend to be lower than those <strong>in</strong> other EU countries (Pharmacos, 2005).Poland operates a price-regulated system for medic<strong>in</strong>es that wish to be entered on thereimbursement list.5.2.3 Reference pric<strong>in</strong>gPoland runs two RPS <strong>in</strong> parallel, one by active substance and the other by pharmacologicalclass. The RP is set below or equal to the price of the cheapest generic medic<strong>in</strong>e.5.2.4 Incentives for physiciansPrescrib<strong>in</strong>g of branded and unbranded generic medic<strong>in</strong>es is common because physicians havelong-term, positive experience with generic medic<strong>in</strong>es and because they are conscious of thelimited ability of patients to meet co-payments. Physicians are not encouraged to prescribe byINN and they are not assisted <strong>in</strong> generic prescrib<strong>in</strong>g.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 315.2.5 Incentives for pharmacists<strong>Generic</strong> substitution by pharmacists is allowed. In the case of the prescription of a brandedgeneric medic<strong>in</strong>e, the pharmacist can dispense any generic medic<strong>in</strong>e. If the physician prescribesby INN, the pharmacist may deliver any orig<strong>in</strong>ator or generic medic<strong>in</strong>e. Pharmacists are requiredto <strong>in</strong>form patients of the availability of cheaper generic medic<strong>in</strong>es and of generic substitution.<strong>Generic</strong> substitution by pharmacists is conditional on physicians not forbidd<strong>in</strong>g substitution.Until the mid-1990s, pharmacists earned a marg<strong>in</strong> of 33% on local medic<strong>in</strong>es and 25% onimported medic<strong>in</strong>es irrespective of whether this concerned orig<strong>in</strong>ator or generic medic<strong>in</strong>es. S<strong>in</strong>ce1995, pharmacist marg<strong>in</strong>s are regressive, but this did not completely remove the f<strong>in</strong>ancial<strong>in</strong>centive to dispense orig<strong>in</strong>ator medic<strong>in</strong>es. Discounts awarded by pharmaceutical companiesencourage pharmacists to dispense generic medic<strong>in</strong>es.5.2.6 Incentives for patientsFour rates of patient co-payment apply depend<strong>in</strong>g on therapeutic class and patientcharacteristics. Patient co-payment consists of a fixed amount per prescription for essentialmedic<strong>in</strong>es (list 1). Supplementary medic<strong>in</strong>es are subject to a patient co-payment of 30% (list 2) or50% (list 3). Other prescription medic<strong>in</strong>es that are not <strong>in</strong>cluded <strong>in</strong> the reimbursement lists as wellas over-the-counter medic<strong>in</strong>es are fully paid for by the patient. Initiatives to <strong>in</strong>form patients ofgeneric medic<strong>in</strong>es have not been undertaken.5.3 Policy analysisThe development of the Polish generic medic<strong>in</strong>es market has benefited from the limitedavailability of orig<strong>in</strong>ator medic<strong>in</strong>es and a short data exclusivity period. Sett<strong>in</strong>g the RP at the priceof the cheapest generic medic<strong>in</strong>e <strong>in</strong> comb<strong>in</strong>ation with the low level of medic<strong>in</strong>e prices <strong>in</strong> Polandwould be expected to keep down profitability of generic medic<strong>in</strong>es. However, the economicviability of the Polish generic medic<strong>in</strong>es market derives from the fact that it is a high-volumemarket as a result of the positive attitude of physicians towards generic medic<strong>in</strong>es and the highlevel of patient co-payments.The absence of <strong>in</strong>centives for physicians to prescribe generic medic<strong>in</strong>es <strong>in</strong>hibits the furtherdevelopment of the market. Pharmacists are f<strong>in</strong>ancially penalised for dispens<strong>in</strong>g genericmedic<strong>in</strong>es, except for discounts awarded by pharmaceutical companies.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 32Key factors aid<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• The economic viability of the generic medic<strong>in</strong>es market orig<strong>in</strong>ates from low prices and highvolume of consumption• Sett<strong>in</strong>g the RP at the level of the cheapest generic medic<strong>in</strong>e has led to low prices of genericmedic<strong>in</strong>es• The high volume of consumption derives from the positive experience of physicians withgeneric medic<strong>in</strong>es and the high level of patient co-paymentsKey factors h<strong>in</strong>der<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• Physicians have no <strong>in</strong>centives to prescribe generic medic<strong>in</strong>es• Pharmacists are f<strong>in</strong>ancially penalised for dispens<strong>in</strong>g generic medic<strong>in</strong>es

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 336 United K<strong>in</strong>gdom6.1 <strong>Generic</strong> medic<strong>in</strong>es marketThe market share of generic medic<strong>in</strong>es has more than doubled over a decade <strong>in</strong> the UnitedK<strong>in</strong>gdom. Public expenditure on generic medic<strong>in</strong>es rose from 655 million € <strong>in</strong> 1994 (market shareby value of 8.6%) to 3,625 million € <strong>in</strong> 2004 (market share of 20.1%).Figure 7. Market share of generic medic<strong>in</strong>es by value <strong>in</strong> the United K<strong>in</strong>gdom, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%20,1%17,0%11,8% 13,8% 11,1%13,3%8,6%8,9% 10,3% 10,4%8,3%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004YearData on generic medic<strong>in</strong>es market share by volume are not reported due to <strong>in</strong>compatibility of IMSHealth and EGA def<strong>in</strong>itions of generic medic<strong>in</strong>es.6.2 <strong>Generic</strong> medic<strong>in</strong>es policy6.2.1 Pric<strong>in</strong>gRegulation of orig<strong>in</strong>ator medic<strong>in</strong>e prices is governed by the Pharmaceutical Price RegulationScheme. This voluntary scheme between the British Pharmaceutical Industry and the Departmentof Health does not control prices directly. Instead, pharmaceutical companies strike an agreementenabl<strong>in</strong>g them to ga<strong>in</strong> a specific return on capital which is set equal to profits from sales to theNHS m<strong>in</strong>us allowable costs. Companies are free to set launch prices of new medic<strong>in</strong>es as long asthey do not systematically exceed the target rate of return on capital. This system has led tomedic<strong>in</strong>e prices <strong>in</strong> the United K<strong>in</strong>gdom be<strong>in</strong>g higher than <strong>in</strong> other EU countries (Burstall, 1997).The Pharmaceutical Price Regulation Scheme does not apply to generic medic<strong>in</strong>es andcompanies are free to set prices of generic medic<strong>in</strong>es. This system led to price competitionbetween generic medic<strong>in</strong>es and fall<strong>in</strong>g prices for those medic<strong>in</strong>es supplied by multiple companies

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 34<strong>in</strong> the late 1990s. For drugs <strong>in</strong> short supply, price <strong>in</strong>creases were observed <strong>in</strong> 1999 (Kay andBa<strong>in</strong>es, 2000). In response to this, the Government <strong>in</strong>troduced a statutory price ceil<strong>in</strong>g for thema<strong>in</strong> generic medic<strong>in</strong>es <strong>in</strong> 2000.A new pric<strong>in</strong>g system for Category M generic medic<strong>in</strong>es came <strong>in</strong>to effect <strong>in</strong> 2005 which allowsfreedom of pric<strong>in</strong>g. It also <strong>in</strong>corporates an additional measure to stimulate price competitionbetween generic medic<strong>in</strong>es by enabl<strong>in</strong>g the Department of Health to <strong>in</strong>tervene <strong>in</strong> the marketplaceif trends <strong>in</strong> medic<strong>in</strong>e expenditure suggest that market mechanisms have failed to create pricecompetition. To date, the Department of Health has not availed itself of this measure.6.2.2 Reference pric<strong>in</strong>gThe United K<strong>in</strong>gdom does not have a RPS.6.2.3 Incentives for physiciansA pr<strong>in</strong>cipal factor <strong>in</strong> stimulat<strong>in</strong>g generic medic<strong>in</strong>es use has been the fact that medical students aretaught to prescribe by INN <strong>in</strong> British medical schools. In 2004, 79% of all prescription items wereprescribed by INN <strong>in</strong> England (Health and Social Care Information Centre, 2005).The United K<strong>in</strong>gdom has used medic<strong>in</strong>e budgets to control pharmaceutical expenditure and to<strong>in</strong>cite generic prescrib<strong>in</strong>g by GPs. Initially, medic<strong>in</strong>e budgets were set at the level of the generalpractice under the fundhold<strong>in</strong>g scheme which ran from 1991 to 1997. Although budgets for GPswho did not become fundholders were <strong>in</strong>dicative only, prescrib<strong>in</strong>g behaviour was controlled bypeer pressure and the threat of sanctions for GPs who overspent. Fundhold<strong>in</strong>g practices held anactual budget not only for medic<strong>in</strong>es, but also for outpatient care, diagnostic test<strong>in</strong>g, electivesurgery and community care. Sav<strong>in</strong>gs on the budget could be re<strong>in</strong>vested <strong>in</strong> patient care or couldbe used to upgrade premises and practice-based facilities. Review<strong>in</strong>g the fundhold<strong>in</strong>gexperience, Gosden and Torgerson (1997) concluded that medic<strong>in</strong>e costs of fundhold<strong>in</strong>gpractices had <strong>in</strong>creased at a lower rate as a consequence of <strong>in</strong>creased generic prescrib<strong>in</strong>g thanthose of non-fundholders. However, as fundhold<strong>in</strong>g practices had different characteristics thannon-fundholders, this effect may have stemmed from selection bias rather than from fundhold<strong>in</strong>g.Budgets have also been set for groups of general practices as for example <strong>in</strong> the case of GP andlocality commission<strong>in</strong>g groups, total purchas<strong>in</strong>g pilots and, more recently, primary care trusts. Areview of the first three years of operation of a sample of primary care trusts showed that manytrusts had set generic prescrib<strong>in</strong>g targets supported by <strong>in</strong>centive schemes, prescrib<strong>in</strong>g guidel<strong>in</strong>es

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 35and formularies, and guidance issued through the National Institute of Cl<strong>in</strong>ical Excellence, theRoyal Colleges and National Service Frameworks (Wilk<strong>in</strong> et al., 1999, 2001 and 2002).<strong>Generic</strong> prescrib<strong>in</strong>g by GPs has been supported by computer programmes such as PRODIGY(PRescrib<strong>in</strong>g ratiOnally with Decision support In General practice studY) which <strong>in</strong>dicates genericalternatives to the GP. Prelim<strong>in</strong>ary f<strong>in</strong>d<strong>in</strong>gs po<strong>in</strong>ted to a 3.2% <strong>in</strong>crease <strong>in</strong> generic prescrib<strong>in</strong>gfollow<strong>in</strong>g the <strong>in</strong>troduction of PRODIGY (Purves, 1996).6.2.4 Incentives for pharmacists<strong>Generic</strong> substitution by pharmacists is not permitted. Pharmacists earn a fixed fee perprescription item for a m<strong>in</strong>ority of medic<strong>in</strong>es and the difference between NHS reimbursement (socalled‘Drug Tariff’) and the purchase price. In the case of an INN prescription, the reimbursementlevel is listed <strong>in</strong> Part VIII of the Drug Tariff and depends on the category <strong>in</strong> which a medic<strong>in</strong>e isplaced. Category A consists of generic medic<strong>in</strong>es that are readily available. The correspond<strong>in</strong>gDrug tariff is calculated as the average price charged by two major wholesalers and threecompanies. Drug Tariff reimbursement levels tend to be well below the price level of orig<strong>in</strong>atormedic<strong>in</strong>es. Therefore, pharmacists generally fill INN prescriptions with generic medic<strong>in</strong>es and<strong>in</strong>crease their <strong>in</strong>come by dispens<strong>in</strong>g generic medic<strong>in</strong>es that offer discounts.In response to this, companies of orig<strong>in</strong>ator medic<strong>in</strong>es compiled a ‘brand equalisation formulary’,a list consist<strong>in</strong>g of orig<strong>in</strong>ator medic<strong>in</strong>es that may be substituted for INN prescriptions. Thisenables companies to sell orig<strong>in</strong>ator medic<strong>in</strong>es at Drug Tariff level that otherwise would have ledto the dispens<strong>in</strong>g of a generic medic<strong>in</strong>e. In addition, pharmacists receive a discount, whichappears to be attractive enough to pharmacists to not dispense a generic medic<strong>in</strong>e.As competition <strong>in</strong> the generic medic<strong>in</strong>es market takes the form of discounts to pharmacists andthe NHS does not fully benefit from the cost-sav<strong>in</strong>g potential of generic medic<strong>in</strong>es, a claw-backsystem was <strong>in</strong>troduced that aims to recover the discounts that pharmacists receive. However, astudy of the United K<strong>in</strong>gdom generic medic<strong>in</strong>es market estimated that a significant portion ofdiscounts is not recouped by the NHS (Senior et al., 2000). To reduce NHS reimbursement, anew category M of generic medic<strong>in</strong>es was added to Part VIII of the Drug Tariff <strong>in</strong> 2005 which<strong>in</strong>cludes some medic<strong>in</strong>es previously <strong>in</strong> Category A. The reimbursement level for Category Mmedic<strong>in</strong>es is set at a volume-weighted, average price charged by pharmaceutical companies netof discounts.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 366.2.5 Incentives for patientsPatient co-payment consists of a fixed fee per prescription item for a m<strong>in</strong>ority of medic<strong>in</strong>es. TheGovernment has attempted to <strong>in</strong>form patients of generic medic<strong>in</strong>es through leaflets.6.3 Policy analysisRegulation govern<strong>in</strong>g profits rather than prices of medic<strong>in</strong>es has led to high medic<strong>in</strong>e prices andstimulated market entry of generic medic<strong>in</strong>es.The economic viability of the generic medic<strong>in</strong>es market derives from low prices and high volumeof generic medic<strong>in</strong>es use. The United K<strong>in</strong>gdom has moved away from a reimbursement systemthat rewarded pharmacists for seek<strong>in</strong>g discounts to a system that determ<strong>in</strong>es reimbursement <strong>in</strong>relation to market prices. This creates the conditions for a competitive generic medic<strong>in</strong>es marketthat has low prices, is transparent, rewards companies that atta<strong>in</strong> efficiency ga<strong>in</strong>s, and enablesthe NHS to capture the cost-sav<strong>in</strong>g potential of generic medic<strong>in</strong>es.The high volume of generic medic<strong>in</strong>es sales orig<strong>in</strong>ates from strong <strong>in</strong>centives for physicians toprescribe generic medic<strong>in</strong>es. INN prescrib<strong>in</strong>g is common practice, even for patented medic<strong>in</strong>es.Budgetary <strong>in</strong>centives at the level of <strong>in</strong>dividual general practices and groups of practices haveencouraged generic prescrib<strong>in</strong>g by GPs. <strong>Generic</strong> prescrib<strong>in</strong>g is further supported by the<strong>in</strong>stallation of software packages <strong>in</strong> general practice. However, demand is <strong>in</strong>hibited by the lack of<strong>in</strong>centives for patients to buy generic medic<strong>in</strong>es.Key factors aid<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• <strong>Generic</strong> medic<strong>in</strong>es companies compete with each other on price, enabl<strong>in</strong>g the NHS tocapture the cost-sav<strong>in</strong>g potential of generic medic<strong>in</strong>es• Medical students are taught to prescribe by INN and INN prescrib<strong>in</strong>g by physicians iscommon practice• <strong>Generic</strong> prescrib<strong>in</strong>g has been stimulated by sett<strong>in</strong>g physician budgets <strong>in</strong> comb<strong>in</strong>ation withgeneric medic<strong>in</strong>es prescrib<strong>in</strong>g targets, <strong>in</strong>centive schemes, and prescrib<strong>in</strong>g guidel<strong>in</strong>esKey factors h<strong>in</strong>der<strong>in</strong>g the development of the generic medic<strong>in</strong>es market:• Patients have no <strong>in</strong>centives to buy generic medic<strong>in</strong>es

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 37PART IIGENERIC MEDICINES POLICYIN COUNTRIES WITH DEVELOPING MARKETS

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 387 Austria7.1 <strong>Generic</strong> medic<strong>in</strong>es marketIn the context of a generic medic<strong>in</strong>es policy that consists of some supply-side measures, but nodemand-side measures, the Austrian generic medic<strong>in</strong>es market has developed slowly over theyears. Market share of generic medic<strong>in</strong>es has grown from 5.5% <strong>in</strong> 1994 to 8.8% <strong>in</strong> 2004 <strong>in</strong> termsof value of consumption and from 9.2% <strong>in</strong> 1994 to 15.8% <strong>in</strong> 2004 <strong>in</strong> terms of volume ofconsumption.Figure 8. Market share of generic medic<strong>in</strong>es by value <strong>in</strong> Austria, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%5,5% 5,8% 5,9% 6,1% 5,8% 5,7% 5,8% 6,1% 6,5% 7,6% 8,8%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004YearFigure 9. Market share of generic medic<strong>in</strong>es by volume <strong>in</strong> Austria, 1994-2004Market share of generic medic<strong>in</strong>es100%80%60%40%20%0%9,2%9,8%10,2%10,6%10,7%11,0%11,5%12,3%13,1%15,8%14,3%1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004Year

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 397.2 <strong>Generic</strong> medic<strong>in</strong>es policy7.2.1 Pric<strong>in</strong>gThe Austrian medic<strong>in</strong>e market is characterised by low prices (Pharmig, 2002). In the 1990s,generic medic<strong>in</strong>es were <strong>in</strong>cluded <strong>in</strong> the social <strong>in</strong>surance fund’s approved list of reimbursedmedic<strong>in</strong>es if they were priced at least 30% lower than the orig<strong>in</strong>ator medic<strong>in</strong>e. This was followedby a demand to reduce the price of the orig<strong>in</strong>ator medic<strong>in</strong>e by 23%. This means that genericmedic<strong>in</strong>es tended to be around 7%-10% cheaper than orig<strong>in</strong>ator medic<strong>in</strong>es.In 2004, a new pharmaceutical pric<strong>in</strong>g policy came <strong>in</strong>to force, with medic<strong>in</strong>e prices based onaverage prices of some EU countries. Furthermore, prices of generic medic<strong>in</strong>es and orig<strong>in</strong>atormedic<strong>in</strong>es that are off-patent were regulated as follows. The first generic medic<strong>in</strong>e is priced 44%<strong>in</strong> 2004, 46% <strong>in</strong> 2005, and 48% from 2006 onwards below the price level of the orig<strong>in</strong>atormedic<strong>in</strong>e. The price of the orig<strong>in</strong>ator medic<strong>in</strong>e needs to decrease by 30% three months afterentry of the first generic medic<strong>in</strong>e. The price of the second generic medic<strong>in</strong>e is 15% below theprice level of the first generic and the third generic medic<strong>in</strong>e is priced 10% below the level of thesecond generic medic<strong>in</strong>e. Additionally, the prices of the orig<strong>in</strong>ator, first and second genericmedic<strong>in</strong>es need to go down to the price level of the third generic medic<strong>in</strong>e not later than threemonths follow<strong>in</strong>g the market entry of the third generic medic<strong>in</strong>e. The fourth and any subsequentgeneric medic<strong>in</strong>e needs to be at least 0.10 € cheaper than the least expensive generic medic<strong>in</strong>e.7.2.2 Reference pric<strong>in</strong>gAustria does not have a RPS.7.2.3 Incentives for physiciansPhysicians who have a contract with a social <strong>in</strong>surance fund need to observe guidel<strong>in</strong>es on thecost-effective prescrib<strong>in</strong>g of medic<strong>in</strong>es. Adherence to guidel<strong>in</strong>es is monitored by social <strong>in</strong>surancefunds by compar<strong>in</strong>g prescription rates among peers. Failure to comply with guidel<strong>in</strong>es may result<strong>in</strong> a reprimand, obligation to refund the social <strong>in</strong>surance fund or loss of contract with the fund.Physician generic prescrib<strong>in</strong>g targets have been successfully implemented <strong>in</strong> Vienna, but havenot been extended to other prov<strong>in</strong>ces. There is no legal obligation or encouragement forphysicians to prescribe by INN. However, the hospital discharge letter po<strong>in</strong>ts out that physicianscan prescribe a generic medic<strong>in</strong>e. Physicians are assisted <strong>in</strong> their prescrib<strong>in</strong>g by computerisedprescrib<strong>in</strong>g and a medic<strong>in</strong>e database.

<strong>Susta<strong>in</strong><strong>in</strong>g</strong> generic medic<strong>in</strong>es markets 407.2.4 Incentives for pharmacists<strong>Generic</strong> substitution by pharmacists is not permitted by law. In practice, the pharmacist cansubstitute a branded orig<strong>in</strong>ator medic<strong>in</strong>e that is out of patent or a branded generic medic<strong>in</strong>e byany generic medic<strong>in</strong>e with reference to the physician.Austria has <strong>in</strong> place a system of regressive pharmacist marg<strong>in</strong>s, with pharmacy marg<strong>in</strong>s formedic<strong>in</strong>es purchased by <strong>in</strong>sured patients rang<strong>in</strong>g from 27% for pharmacy purchase prices lessthan 10 € to 3.8% for prices above 357.08 € from 2004 onwards. However, pharmacists still earna lower marg<strong>in</strong> on generic medic<strong>in</strong>es <strong>in</strong> absolute terms than on orig<strong>in</strong>ator medic<strong>in</strong>es.7.2.5 Incentives for patientsPatients usually have to pay a fixed fee per prescription (4.6 €) for each prescribed medic<strong>in</strong>e<strong>in</strong>cluded <strong>in</strong> the reimbursement list. In some cases, two packs can be prescribed for a s<strong>in</strong>gle fee.For medic<strong>in</strong>es not <strong>in</strong>cluded <strong>in</strong> the reimbursement list, patients have to pay the full price, unlessthe prescription is permitted by a senior consultant of the social <strong>in</strong>surance fund. Exemption fromco-payment is also granted to patients <strong>in</strong> need of social protection and patients whose <strong>in</strong>comedoes not surpass a specific level.7.3 Policy analysisIn the 1990s, pric<strong>in</strong>g regulation has restricted demand for generic medic<strong>in</strong>es by reduc<strong>in</strong>g prices oforig<strong>in</strong>ator medic<strong>in</strong>es, lead<strong>in</strong>g to a small price differential between generic and orig<strong>in</strong>atormedic<strong>in</strong>es. Added to that, low price levels of medic<strong>in</strong>es <strong>in</strong> Austria limited market entry for genericmedic<strong>in</strong>es.The 2004 pharmaceutical pric<strong>in</strong>g policy is designed to conta<strong>in</strong> public pharmaceutical expenditureby reduc<strong>in</strong>g prices of orig<strong>in</strong>ator and generic medic<strong>in</strong>es. Incentives embodied by the pric<strong>in</strong>g policyfor generic medic<strong>in</strong>es are mixed. On the one hand, this policy stimulates market entry of genericmedic<strong>in</strong>es by enforc<strong>in</strong>g a substantial price difference between the orig<strong>in</strong>ator medic<strong>in</strong>e and the firstthree generic medic<strong>in</strong>es for a limited period of time. On the other hand, the policy imposes pricereductions on successive generic medic<strong>in</strong>es enter<strong>in</strong>g the market, thereby reduc<strong>in</strong>g theirprofitability. Furthermore, price differences between orig<strong>in</strong>ator and generic medic<strong>in</strong>es are nonexistentor limited <strong>in</strong> established markets with three or more generic medic<strong>in</strong>es, respectively. Thisis likely to <strong>in</strong>hibit patient demand for generic medic<strong>in</strong>es.