California Biomedical Industry - California Healthcare Institute

California Biomedical Industry - California Healthcare Institute

California Biomedical Industry - California Healthcare Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

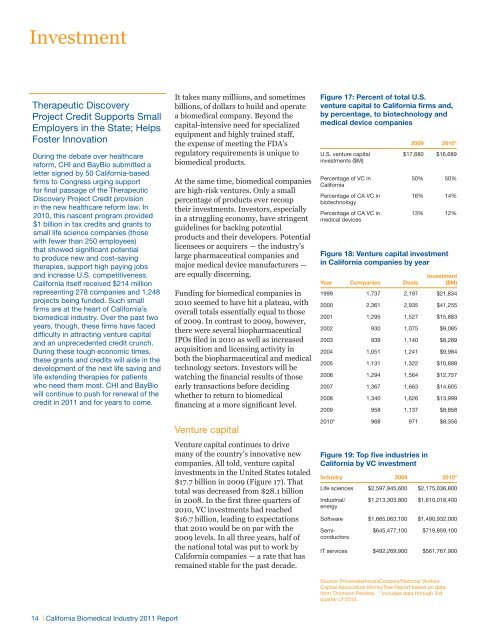

InvestmentTherapeutic DiscoveryProject Credit Supports SmallEmployers in the State; HelpsFoster InnovationDuring the debate over healthcarereform, CHI and BayBio submitted aletter signed by 50 <strong>California</strong>-basedfirms to Congress urging supportfor final passage of the TherapeuticDiscovery Project Credit provisionin the new healthcare reform law. In2010, this nascent program provided$1 billion in tax credits and grants tosmall life science companies (thosewith fewer than 250 employees)that showed significant potentialto produce new and cost-savingtherapies, support high paying jobsand increase U.S. competitiveness.<strong>California</strong> itself received $214 millionrepresenting 278 companies and 1,248projects being funded. Such smallfirms are at the heart of <strong>California</strong>’sbiomedical industry. Over the past twoyears, though, these firms have faceddifficulty in attracting venture capitaland an unprecedented credit crunch.During these tough economic times,these grants and credits will aide in thedevelopment of the next life saving andlife extending therapies for patientswho need them most. CHI and BayBiowill continue to push for renewal of thecredit in 2011 and for years to come.It takes many millions, and sometimesbillions, of dollars to build and operatea biomedical company. Beyond thecapital-intensive need for specializedequipment and highly trained staff,the expense of meeting the FDA’sregulatory requirements is unique tobiomedical products.At the same time, biomedical companiesare high-risk ventures. Only a smallpercentage of products ever recouptheir investments. Investors, especiallyin a struggling economy, have stringentguidelines for backing potentialproducts and their developers. Potentiallicensees or acquirers — the industry’slarge pharmaceutical companies andmajor medical device manufacturers —are equally discerning.Funding for biomedical companies in2010 seemed to have hit a plateau, withoverall totals essentially equal to thoseof 2009. In contrast to 2009, however,there were several biopharmaceuticalIPOs filed in 2010 as well as increasedacquisition and licensing activity inboth the biopharmaceutical and medicaltechnology sectors. Investors will bewatching the financial results of thoseearly transactions before decidingwhether to return to biomedicalfinancing at a more significant level.Venture capitalVenture capital continues to drivemany of the country’s innovative newcompanies. All told, venture capitalinvestments in the United States totaled$17.7 billion in 2009 (Figure 17). Thattotal was decreased from $28.1 billionin 2008. In the first three quarters of2010, VC investments had reached$16.7 billion, leading to expectationsthat 2010 would be on par with the2009 levels. In all three years, half ofthe national total was put to work by<strong>California</strong> companies — a rate that hasremained stable for the past decade.Figure 17: Percent of total U.S.venture capital to <strong>California</strong> firms and,by percentage, to biotechnology andmedical device companiesU.S. venture capitalinvestments ($M)Percentage of VC in<strong>California</strong>Percentage of CA VC inbiotechnologyPercentage of CA VC inmedical devices2009 2010*$17,680 $16,68950% 50%16% 14%13% 12%Figure 18: Venture capital investmentin <strong>California</strong> companies by yearYear Companies DealsInvestment($M)1999 1,737 2,197 $21,8342000 2,361 2,935 $41,2552001 1,295 1,527 $15,8832002 930 1,075 $9,0852003 939 1,140 $8,2892004 1,051 1,241 $9,9842005 1,131 1,322 $10,8882006 1,294 1,564 $12,7572007 1,367 1,663 $14,6052008 1,340 1,626 $13,9992009 958 1,137 $8,8582010* 968 971 $8,356Figure 19: Top five industries in<strong>California</strong> by VC investment<strong>Industry</strong> 2009 2010*Life sciences $2,597,945,600 $2,175,036,800Industrial/energy$1,213,303,800 $1,610,018,400Software $1,665,063,100 $1,490,932,000Semi-$645,477,100 $719,859,100conductorsIT services $492,269,900 $561,767,900Source: PricewaterhouseCoopers/National VentureCapital Association MoneyTree Report based on datafrom Thomson Reuters. * Includes data through 3rdquarter of 2010.14 | <strong>California</strong> <strong>Biomedical</strong> <strong>Industry</strong> 2011 Report