California Biomedical Industry - California Healthcare Institute

California Biomedical Industry - California Healthcare Institute

California Biomedical Industry - California Healthcare Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

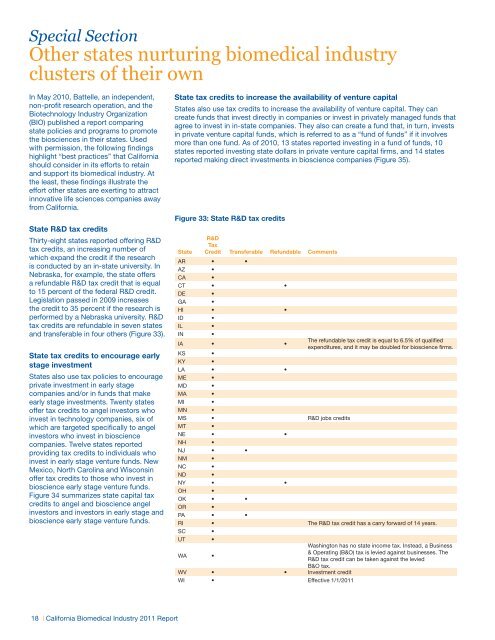

Special SectionOther states nurturing biomedical industryclusters of their ownIn May 2010, Battelle, an independent,non-profit research operation, and theBiotechnology <strong>Industry</strong> Organization(BIO) published a report comparingstate policies and programs to promotethe biosciences in their states. Usedwith permission, the following findingshighlight “best practices” that <strong>California</strong>should consider in its efforts to retainand support its biomedical industry. Atthe least, these findings illustrate theeffort other states are exerting to attractinnovative life sciences companies awayfrom <strong>California</strong>.State R&D tax creditsThirty-eight states reported offering R&Dtax credits, an increasing number ofwhich expand the credit if the researchis conducted by an in-state university. InNebraska, for example, the state offersa refundable R&D tax credit that is equalto 15 percent of the federal R&D credit.Legislation passed in 2009 increasesthe credit to 35 percent if the research isperformed by a Nebraska university. R&Dtax credits are refundable in seven statesand transferable in four others (Figure 33).State tax credits to encourage earlystage investmentStates also use tax policies to encourageprivate investment in early stagecompanies and/or in funds that makeearly stage investments. Twenty statesoffer tax credits to angel investors whoinvest in technology companies, six ofwhich are targeted specifically to angelinvestors who invest in biosciencecompanies. Twelve states reportedproviding tax credits to individuals whoinvest in early stage venture funds. NewMexico, North Carolina and Wisconsinoffer tax credits to those who invest inbioscience early stage venture funds.Figure 34 summarizes state capital taxcredits to angel and bioscience angelinvestors and investors in early stage andbioscience early stage venture funds.State tax credits to increase the availability of venture capitalStates also use tax credits to increase the availability of venture capital. They cancreate funds that invest directly in companies or invest in privately managed funds thatagree to invest in in-state companies. They also can create a fund that, in turn, investsin private venture capital funds, which is referred to as a “fund of funds” if it involvesmore than one fund. As of 2010, 13 states reported investing in a fund of funds, 10states reported investing state dollars in private venture capital firms, and 14 statesreported making direct investments in bioscience companies (Figure 35).Figure 33: State R&D tax creditsStateR&DTaxCredit Transferable Refundable CommentsAR • •AZ •CA •CT • •DE •GA •HI • •ID •IL•IN •IA • •KS •KY •The refundable tax credit is equal to 6.5% of qualifiedexpenditures, and it may be doubled for bioscience firms.LA • •ME •MD •MA •MI •MN •MS • R&D jobs creditsMT •NE • •NH •NJ • •NM •NC •ND •NY • •OH •OK • •OR •PA • •RI • The R&D tax credit has a carry forward of 14 years.SC •UT •WA •Washington has no state income tax. Instead, a Business& Operating (B&O) tax is levied against businesses. TheR&D tax credit can be taken against the leviedB&O tax.WV • • Investment creditWI • Effective 1/1/201118 | <strong>California</strong> <strong>Biomedical</strong> <strong>Industry</strong> 2011 Report