EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

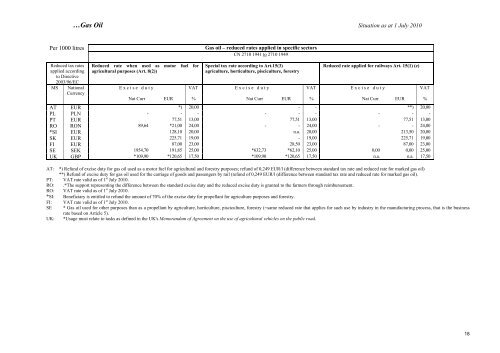

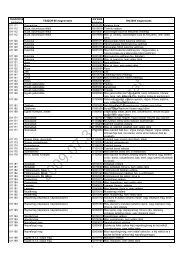

…Gas Oil Situation as at 1 July 2010Per 1000 litresGas oil – reduced rates applied in specific sectorsCN 2710 1941 to 2710 1949Reduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencyReduced rate when used as motor fuel foragricultural purposes (Art. 8(2))Special tax rate according to Art.15(3)agriculture, horticulture, pisciculture, forestryReduced rate applied for railways Art. 15(1) (e)Excise duty VAT Excise duty VAT Excise duty VATNat Curr EUR % Nat Curr EUR % Nat Curr EUR %AT EUR *) 20,00 - - **) 20,00PL PLN - - - - - - - - -PT EUR 77,51 13,00 77,51 13,00 77,51 13,00RO RON 89,64 *21,00 24,00 - - 24,00 - - 24,00*SI EUR 128,10 20,00 n.a. 20,00 213,50 20,00SK EUR 225,71 19,00 - 19,00 225,71 19,00FI EUR 87,00 23,00 28,50 23,00 87,00 23,00SE SEK 1954,70 191,85 25,00 *632,73 *62,10 25,00 0,00 0,00 25,00UK GBP *109,90 *120,65 17,50 *109,90 *120,65 17,50 n.a. n.a. 17,50AT: *) Refund of excise duty for gas oil used as a motor fuel for agricultural and forestry purposes; refund of 0,249 EUR/l (difference between standard tax rate and reduced rate for marked gas oil)**) Refund of excise duty for gas oil used for the carriage of goods and passengers by rail (refund of 0,249 EUR/l (difference between standard tax rate and reduced rate for marked gas oil).PT: VAT rate valid as of 1 st July 2010.RO: .*The support representing the difference between the standard excise duty and the reduced excise duty is granted to the farmers through reimbursement.RO: VAT rate valid as of 1 st July 2010.*SI: Beneficiary is entitled to refund the amount of 70% of the excise duty for propellant for agriculture purposes and forestry.FI: VAT rate valid as of 1 st July 2010.SE * Gas oil used for other purposes than as a propellant by agriculture, horticulture, pisciculture, forestry (=same reduced rate that applies for such use by industry in the manufacturing process, that is the businessrate based on Article 5).UK: *Usage must relate to tasks as defined in the UK's Memorandum of Agreement on the use of agricultural vehicles on the public road.18