EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

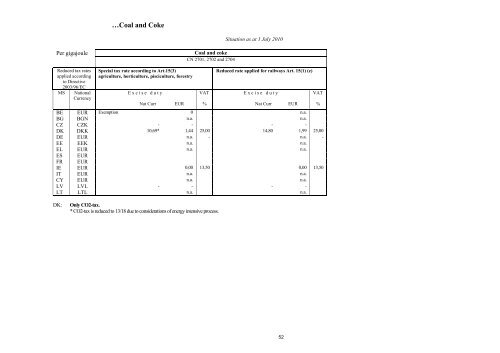

…Coal and CokeSituation as at 1 July 2010Per gigajouleCoal and cokeCN 2701, 2702 and 2704Reduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencySpecial tax rate according to Art.15(3)agriculture, horticulture, pisciculture, forestryReduced rate applied for railways Art. 15(1) (e)Excise duty VAT Excise duty VATNat Curr EUR % Nat Curr EUR %BE EUR Exemption 0 n.a.BG BGN n.a. n.a.CZ CZK - - - -DK DKK 10,69* 1,44 25,00 14,80 1,99 25,00DE EUR n.a. - n.a. -EE EEK n.a. n.a.EL EUR n.a. n.a.ES EURFR EURIE EUR 0,00 13,50 0,00 13,50IT EUR n.a. n.a.CY EUR n.a. n.a.LV LVL - - - -LT LTL n.a. n.a.DK:Only CO2-tax.* CO2-tax is reduced to 13/18 due to considerations of energy intensive process.52