EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

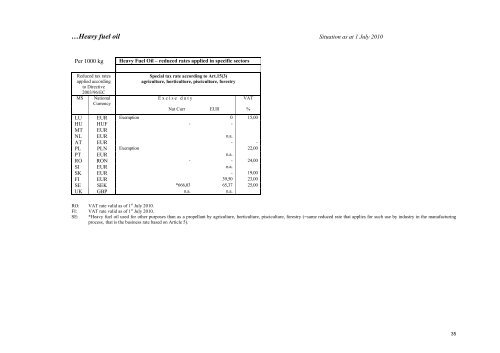

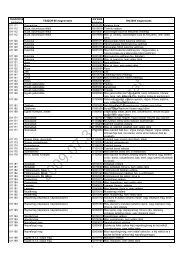

…Heavy fuel oil Situation as at 1 July 2010Per 1000 kgHeavy Fuel Oil – reduced rates applied in specific sectorsReduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencySpecial tax rate according to Art.15(3)agriculture, horticulture, pisciculture, forestryExcise dutyVATNat Curr EUR %LU EUR Exemption 0 15,00HU HUF - -MT EURNL EUR n.a.AT EUR - -PL PLN Exemption 22,00PT EUR n.a.RO RON - - 24,00SI EUR n.a.SK EUR - 19,00FI EUR 39,50 23,00SE SEK *666,03 65,37 25,00UK GBP n.a. n.a.RO: VAT rate valid as of 1 st July 2010.FI: VAT rate valid as of 1 st July 2010.SE: *Heavy fuel oil used for other purposes than as a propellant by agriculture, horticulture, pisciculture, forestry (=same reduced rate that applies for such use by industry in the manufacturingprocess, that is the business rate based on Article 5).35