EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

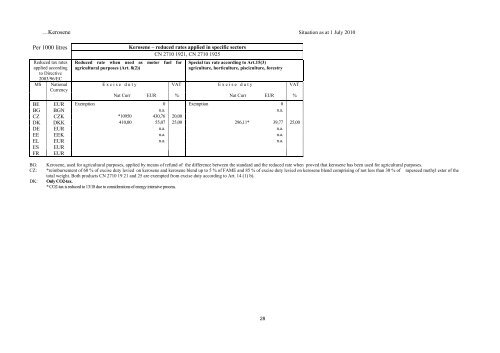

…Kerosene Situation as at 1 July 2010Per 1000 litresReduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencyReduced rate when used as motor fuel foragricultural purposes (Art. 8(2))Kerosene – reduced rates applied in specific sectorsCN 2710 1921, CN 2710 1925Special tax rate according to Art.15(3)agriculture, horticulture, pisciculture, forestryExcise duty VAT Excise duty VATNat Curr EUR % Nat Curr EUR %BE EUR Exemption 0 Exemption 0BG BGN n.a. n.a.CZ CZK *10950 430,76 20,00DK DKK 410,00 55,07 25,00 296,11* 39,77 25,00DE EUR n.a. n.a.EE EEK n.a. n.a.EL EUR n.a. n.a.ES EURFR EURBG:CZ:DK:Kerosene, used for agricultural purposes, applied by means of refund of the difference between the standard and the reduced rate when proved that kerosene has been used for agricultural purposes.*reimbursement of 60 % of excise duty levied on kerosene and kerosene blend up to 5 % of FAME and 85 % of excise duty levied on kerosene blend comprising of not less than 30 % of rapeseed methyl ester of thetotal weight. Both products CN 2710 19 21 and 25 are exempted from excise duty according to Art. 14 (1) b).Only CO2-tax.* CO2-tax is reduced to 13/18 due to considerations of energy intensive process.28