EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

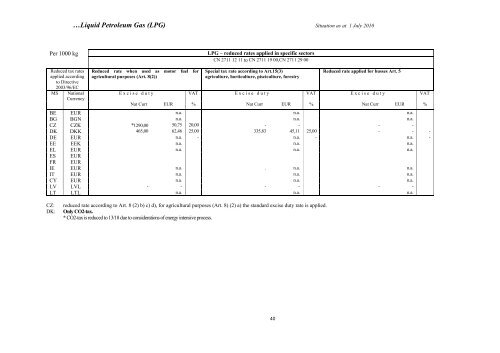

…Liquid Petroleum Gas (LPG) Situation as at 1 July 2010Per 1000 kgLPG – reduced rates applied in specific sectorsCN 2711 12 11 to CN 2711 19 00,CN 2711 29 00Reduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencyReduced rate when used as motor fuel foragricultural purposes (Art. 8(2))Special tax rate according to Art.15(3)agriculture, horticulture, pisciculture, forestryReduced rate applied for busses Art. 5Excise duty VAT Excise duty VAT Excise duty VATNat Curr EUR % Nat Curr EUR % Nat Curr EUR %BE EUR n.a. n.a. n.a.BG BGN n.a. n.a. n.a.CZ CZK *1290,00 50,75 20,00 - - - -DK DKK 465,00 62,46 25,00 335,83 45,11 25,00 - - -DE EUR n.a. - n.a. - n.a. -EE EEK n.a. n.a. n.a.EL EUR n.a. n.a. n.a.ES EURFR EURIE EUR n.a. . n.a. n.a.IT EUR n.a. n.a. n.a.CY EUR n.a. n.a. n.a.LV LVL - - - - - -LT LTL n.a. n.a. n.a.CZ:DK:reduced rate according to Art. 8 (2) b) c) d), for agricultural purposes (Art. 8) (2) a) the standard excise duty rate is applied.Only CO2-tax.* CO2-tax is reduced to 13/18 due to considerations of energy intensive process.40