EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

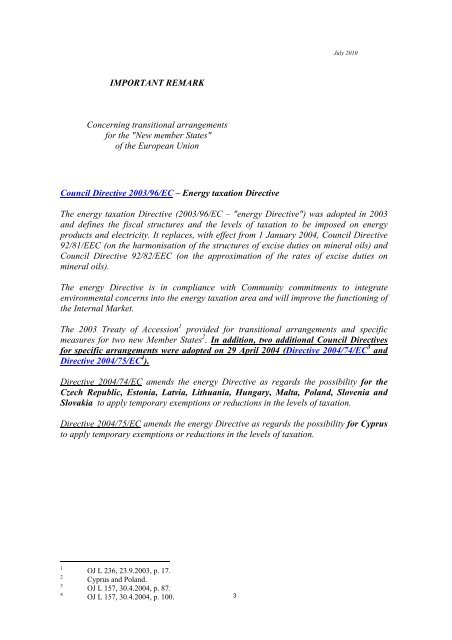

July 2010IMPORTANT REMARKConcerning transitional arrangementsfor the "New member States"of the European UnionCouncil Directive 2003/96/EC – Energy taxation DirectiveThe energy taxation Directive (2003/96/EC – "energy Directive") was adopted in 2003and defines the fiscal structures and the levels of taxation to be imposed on energyproducts and electricity. It replaces, with effect from 1 January 2004, Council Directive92/81/EEC (on the harmonisation of the structures of excise duties on mineral oils) andCouncil Directive 92/82/EEC (on the approximation of the rates of excise duties onmineral oils).The energy Directive is in compliance with Community commitments to integrateenvironmental concerns into the energy taxation area and will improve the functioning ofthe Internal Market.The 2003 Treaty of Accession 1 provided for transitional arrangements and specificmeasures for two new Member States 2 . In addition, two additional Council Directivesfor specific arrangements were adopted on 29 April 2004 (Directive 2004/74/EC 3 andDirective 2004/75/EC 4 ).Directive 2004/74/EC amends the energy Directive as regards the possibility for theCzech Republic, Estonia, Latvia, Lithuania, Hungary, Malta, Poland, Slovenia andSlovakia to apply temporary exemptions or reductions in the levels of taxation.Directive 2004/75/EC amends the energy Directive as regards the possibility for Cyprusto apply temporary exemptions or reductions in the levels of taxation.1234OJ L 236, 23.9.2003, p. 17.Cyprus and Poland.OJ L 157, 30.4.2004, p. 87.OJ L 157, 30.4.2004, p. 100.3