EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

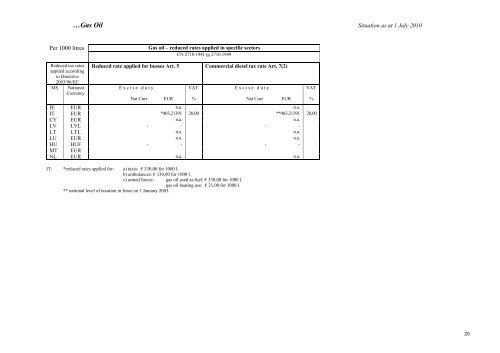

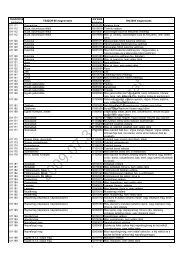

…Gas Oil Situation as at 1 July 2010Per 1000 litresGas oil – reduced rates applied in specific sectorsCN 2710 1941 to 2710 1949Reduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencyReduced rate applied for busses Art. 5 Commercial diesel tax rate Art. 7(2)Excise duty VAT Excise duty VATNat Curr EUR % Nat Curr EUR %IE EUR n.a. n.a.IT EUR *403,21391 20,00 **403,21391 20,00CY EUR n.a. n.a.LV LVL - - - -LT LTL n.a. n.a.LU EUR n.a. n.a.HU HUF - - - -MT EURNL EUR n.a. n.a.IT: *reduced rates applied for: a) taxis: € 330,00 for 1000 l.b) ambulances: € 330,00 for 1000 l.c) armed forces: gas oil used as fuel: € 330,00 for 1000 l.gas oil heating use: € 21,00 for 1000 l.** national level of taxation in force on 1 January 2003.20