EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

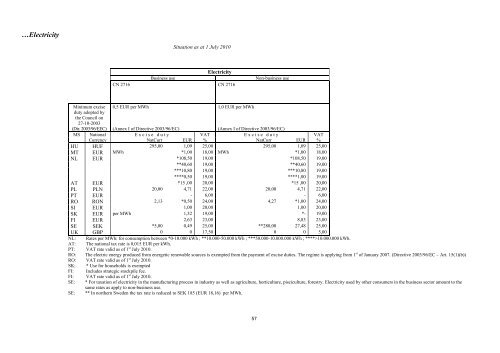

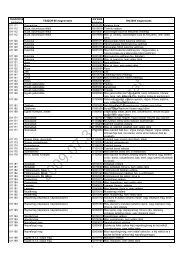

…ElectricitySituation as at 1 July 2010ElectricityBusiness useCN 2716 CN 2716Non-business useMinimum exciseduty adopted bythe Council on27-10-2003(Dir. 2003/96/EEC)0,5 EUR per MWh(Annex I of Directive 2003/96/EC)1,0 EUR per MWh(Annex I of Directive 2003/96/EC)MS National Excise duty VAT Excise duty VATCurrency NatCurr EUR % NatCurr EUR %HU HUF 295,00 1,09 25,00 295,00 1,09 25,00MT EUR MWh *1,00 18,00 MWh *1,00 18,00NL EUR *108,50 19,00 *108,50 19,00**40,60 19,00 **40,60 19,00***10,80 19,00 ***10,80 19,00****0,50 19,00 ****1,00 19,00AT EUR *15 ,00 20,00 *15 ,00 20,00PL PLN 20,00 4,71 22,00 20,00 4,71 22,00PT EUR - 6,00 - 6,00RO RON 2,13 *0,50 24,00 4,27 *1,00 24,00SI EUR 1,00 20,00 1,00 20,00SK EUR per MWh 1,32 19,00 *- 19,00FI EUR 2,63 23,00 8,83 23,00SE SEK *5,00 0,49 25,00 **280,00 27,48 25,00UK GBP 0 0 17,50 0 0 5,00NL: Rates per MWh: for consumption between *0-10.000 kWh ; **10.000-50.000 kWh ; ***50.000-10.000.000 kWh ; ****>10.000.000 kWh.AT: The national tax rate is 0,015 EUR per kWh.PT: VAT rate valid as of 1 st July 2010.RO: The electric energy produced from energetic renewable sources is exempted from the payment of excise duties. The regime is applying from 1 st of January 2007. (Directive 2003/96/EC – Art. 15(1)(b))RO: VAT rate valid as of 1 st July 2010.SK: * Use for households is exemptedFI: Includes strategic stockpile fee.FI: VAT rate valid as of 1 st July 2010.SE: * For taxation of electricity in the manufacturing process in industry as well as agriculture, horticulture, pisciculture, forestry. Electricity used by other consumers in the business sector amount to thesame rates as apply to non-business use.SE: ** In northern Sweden the tax rate is reduced to SEK 185 (EUR 18,16) per MWh.57