EXCISE DUTY TABLES

EXCISE DUTY TABLES

EXCISE DUTY TABLES

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

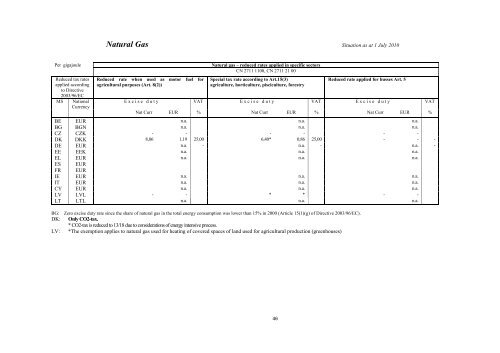

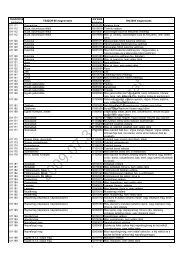

Natural Gas Situation as at 1 July 2010Per gigajouleReduced tax ratesapplied accordingto Directive2003/96/ECMS NationalCurrencyReduced rate when used as motor fuel foragricultural purposes (Art. 8(2))Natural gas – reduced rates applied in specific sectorsCN 2711 1100, CN 2711 21 00Special tax rate according to Art.15(3)agriculture, horticulture, pisciculture, forestryReduced rate applied for busses Art. 5Excise duty VAT Excise duty VAT Excise duty VATNat Curr EUR % Nat Curr EUR % Nat Curr EUR %BE EUR n.a. n.a. n.a.BG BGN n.a. n.a. n.a.CZ CZK - - - - - -DK DKK 8,86 1,19 25,00 6,40* 0,86 25,00 - - -DE EUR n.a. - n.a. - n.a. -EE EEK n.a. n.a. n.a.EL EUR n.a. n.a. n.a.ES EURFR EURIE EUR n.a. n.a. n.a.IT EUR n.a. n.a. n.a.CY EUR n.a. n.a. n.a.LV LVL - - * * - -LT LTL n.a. n.a. n.a.BG:DK:LV:Zero excise duty rate since the share of natural gas in the total energy consumption was lower than 15% in 2000 (Article 15(1)(g) of Directive 2003/96/EC).Only CO2-tax.* CO2-tax is reduced to 13/18 due to considerations of energy intensive process.*The exemption applies to natural gas used for heating of covered spaces of land used for agricultural production (greenhouses)46