- Page 2:

Introduction to Nonextensive Statis

- Page 6:

Constantino TsallisCentro Brasileir

- Page 10:

PrefaceIn 1902, after three decades

- Page 14:

Prefaceixequation inspired by the p

- Page 18:

Prefacexinearby. 4 Nonextensive sta

- Page 22:

Prefacexiiicircular epicycles. So w

- Page 26:

ContentsPart IBasics or How the The

- Page 30:

Contentsxvii5.2 Low-Dimensional Con

- Page 34:

Part IBasics or How the Theory Work

- Page 38:

4 1 Historical Background and Physi

- Page 42:

6 1 Historical Background and Physi

- Page 46:

8 1 Historical Background and Physi

- Page 50:

10 1 Historical Background and Phys

- Page 54:

12 1 Historical Background and Phys

- Page 58:

14 1 Historical Background and Phys

- Page 62:

16 1 Historical Background and Phys

- Page 66:

Chapter 2Learning with Boltzmann-Gi

- Page 70:

2.1 Boltzmann-Gibbs Entropy 212.1.2

- Page 74:

2.1 Boltzmann-Gibbs Entropy 232.1.2

- Page 78:

2.1 Boltzmann-Gibbs Entropy 25where

- Page 82:

2.1 Boltzmann-Gibbs Entropy 27the s

- Page 86:

2.2 Kullback-Leibler Relative Entro

- Page 90:

2.3 Constraints and Entropy Optimiz

- Page 94:

2.4 Boltzmann-Gibbs Statistical Mec

- Page 98:

2.4 Boltzmann-Gibbs Statistical Mec

- Page 102:

Chapter 3Generalizing What We Learn

- Page 106:

3.1 Playing with Differential Equat

- Page 110:

3.2 Nonadditive Entropy S q 41We sh

- Page 114:

3.2 Nonadditive Entropy S q 43This

- Page 118:

3.2 Nonadditive Entropy S q 453.2.2

- Page 122:

3.2 Nonadditive Entropy S q 47we ca

- Page 126:

3.2 Nonadditive Entropy S q 49S BG

- Page 130:

3.2 Nonadditive Entropy S q 51with

- Page 134:

3.2 Nonadditive Entropy S q 53whose

- Page 138:

3.3 Correlations, Occupancy of Phas

- Page 142:

3.3 Correlations, Occupancy of Phas

- Page 146:

3.3 Correlations, Occupancy of Phas

- Page 150:

3.3 Correlations, Occupancy of Phas

- Page 154:

3.3 Correlations, Occupancy of Phas

- Page 158:

3.3 Correlations, Occupancy of Phas

- Page 162:

3.3 Correlations, Occupancy of Phas

- Page 166:

3.3 Correlations, Occupancy of Phas

- Page 170:

3.3 Correlations, Occupancy of Phas

- Page 174:

3.3 Correlations, Occupancy of Phas

- Page 178:

3.3 Correlations, Occupancy of Phas

- Page 182:

3.3 Correlations, Occupancy of Phas

- Page 186:

3.3 Correlations, Occupancy of Phas

- Page 190:

3.3 Correlations, Occupancy of Phas

- Page 194:

3.3 Correlations, Occupancy of Phas

- Page 198:

3.4 q-Generalization of the Kullbac

- Page 202:

3.4 q-Generalization of the Kullbac

- Page 206:

3.5 Constraints and Entropy Optimiz

- Page 210:

3.6 Nonextensive Statistical Mechan

- Page 214:

3.6 Nonextensive Statistical Mechan

- Page 218:

3.6 Nonextensive Statistical Mechan

- Page 222:

3.6 Nonextensive Statistical Mechan

- Page 226:

3.7 About the Escort Distribution a

- Page 230:

3.7 About the Escort Distribution a

- Page 234:

3.8 About Universal Constants in Ph

- Page 238:

3.9 Various Other Entropic Forms 10

- Page 242:

Part IIFoundations or Why the Theor

- Page 246:

110 4 Stochastic Dynamical Foundati

- Page 250:

112 4 Stochastic Dynamical Foundati

- Page 254:

114 4 Stochastic Dynamical Foundati

- Page 258:

116 4 Stochastic Dynamical Foundati

- Page 262:

118 4 Stochastic Dynamical Foundati

- Page 266:

120 4 Stochastic Dynamical Foundati

- Page 270:

122 4 Stochastic Dynamical Foundati

- Page 274:

124 4 Stochastic Dynamical Foundati

- Page 278:

126 4 Stochastic Dynamical Foundati

- Page 282:

128 4 Stochastic Dynamical Foundati

- Page 286:

130 4 Stochastic Dynamical Foundati

- Page 290:

132 4 Stochastic Dynamical Foundati

- Page 294:

134 4 Stochastic Dynamical Foundati

- Page 298:

136 4 Stochastic Dynamical Foundati

- Page 302:

138 4 Stochastic Dynamical Foundati

- Page 306:

140 4 Stochastic Dynamical Foundati

- Page 310:

142 4 Stochastic Dynamical Foundati

- Page 314:

144 4 Stochastic Dynamical Foundati

- Page 318:

146 4 Stochastic Dynamical Foundati

- Page 322:

148 4 Stochastic Dynamical Foundati

- Page 326:

150 4 Stochastic Dynamical Foundati

- Page 330:

152 5 Deterministic Dynamical Found

- Page 334:

154 5 Deterministic Dynamical Found

- Page 338:

156 5 Deterministic Dynamical Found

- Page 342:

158 5 Deterministic Dynamical Found

- Page 346:

160 5 Deterministic Dynamical Found

- Page 350:

162 5 Deterministic Dynamical Found

- Page 354:

164 5 Deterministic Dynamical Found

- Page 358:

166 5 Deterministic Dynamical Found

- Page 362:

10 -5 1 10 100 100010 -5 1 10 100 1

- Page 366:

170 5 Deterministic Dynamical Found

- Page 370:

172 5 Deterministic Dynamical Found

- Page 374:

174 5 Deterministic Dynamical Found

- Page 378:

176 5 Deterministic Dynamical Found

- Page 382:

178 5 Deterministic Dynamical Found

- Page 386:

180 5 Deterministic Dynamical Found

- Page 390:

182 5 Deterministic Dynamical Found

- Page 394:

184 5 Deterministic Dynamical Found

- Page 398:

186 5 Deterministic Dynamical Found

- Page 402:

188 5 Deterministic Dynamical Found

- Page 406:

190 5 Deterministic Dynamical Found

- Page 410:

192 5 Deterministic Dynamical Found

- Page 414:

194 5 Deterministic Dynamical Found

- Page 418:

196 5 Deterministic Dynamical Found

- Page 422:

198 5 Deterministic Dynamical Found

- Page 426:

200 5 Deterministic Dynamical Found

- Page 430:

202 5 Deterministic Dynamical Found

- Page 434:

204 5 Deterministic Dynamical Found

- Page 438:

206 5 Deterministic Dynamical Found

- Page 442:

Chapter 6Generalizing Nonextensive

- Page 446:

6.2 Further Generalizing 211dydx =

- Page 450:

6.2 Further Generalizing 213∫ W{

- Page 454:

6.2 Further Generalizing 215Then, f

- Page 458:

6.2 Further Generalizing 217If f (

- Page 462:

Part IIIApplications or What for th

- Page 466:

222 7 Thermodynamical and Nonthermo

- Page 470:

224 7 Thermodynamical and Nonthermo

- Page 474:

226 7 Thermodynamical and Nonthermo

- Page 478:

228 7 Thermodynamical and Nonthermo

- Page 482:

230 7 Thermodynamical and Nonthermo

- Page 486:

232 7 Thermodynamical and Nonthermo

- Page 490:

234 7 Thermodynamical and Nonthermo

- Page 494:

236 7 Thermodynamical and Nonthermo

- Page 498:

238 7 Thermodynamical and Nonthermo

- Page 502:

240 7 Thermodynamical and Nonthermo

- Page 506:

242 7 Thermodynamical and Nonthermo

- Page 510:

244 7 Thermodynamical and Nonthermo

- Page 514:

246 7 Thermodynamical and Nonthermo

- Page 518:

248 7 Thermodynamical and Nonthermo

- Page 522:

250 7 Thermodynamical and Nonthermo

- Page 526:

252 7 Thermodynamical and Nonthermo

- Page 530:

254 7 Thermodynamical and Nonthermo

- Page 534:

256 7 Thermodynamical and Nonthermo

- Page 538:

258 7 Thermodynamical and Nonthermo

- Page 542:

260 7 Thermodynamical and Nonthermo

- Page 546:

262 7 Thermodynamical and Nonthermo

- Page 550:

264 7 Thermodynamical and Nonthermo

- Page 554:

266 7 Thermodynamical and Nonthermo

- Page 558:

268 7 Thermodynamical and Nonthermo

- Page 562:

270 7 Thermodynamical and Nonthermo

- Page 566:

272 7 Thermodynamical and Nonthermo

- Page 570:

274 7 Thermodynamical and Nonthermo

- Page 574:

276 7 Thermodynamical and Nonthermo

- Page 578:

278 7 Thermodynamical and Nonthermo

- Page 582:

280 7 Thermodynamical and Nonthermo

- Page 586:

282 7 Thermodynamical and Nonthermo

- Page 590:

284 7 Thermodynamical and Nonthermo

- Page 594:

286 7 Thermodynamical and Nonthermo

- Page 598:

288 7 Thermodynamical and Nonthermo

- Page 602:

290 7 Thermodynamical and Nonthermo

- Page 606:

292 7 Thermodynamical and Nonthermo

- Page 610:

294 7 Thermodynamical and Nonthermo

- Page 614:

296 7 Thermodynamical and Nonthermo

- Page 618:

298 7 Thermodynamical and Nonthermo

- Page 622:

300 7 Thermodynamical and Nonthermo

- Page 626:

Part IVLast (But Not Least)

- Page 630:

306 8 Final Comments and Perspectiv

- Page 634:

308 8 Final Comments and Perspectiv

- Page 638:

310 8 Final Comments and Perspectiv

- Page 642:

312 8 Final Comments and Perspectiv

- Page 646:

314 8 Final Comments and Perspectiv

- Page 650:

316 8 Final Comments and Perspectiv

- Page 654:

318 8 Final Comments and Perspectiv

- Page 658:

320 8 Final Comments and Perspectiv

- Page 662:

322 8 Final Comments and Perspectiv

- Page 666:

324 8 Final Comments and Perspectiv

- Page 670:

326 8 Final Comments and Perspectiv

- Page 674:

Appendix AUseful Mathematical Formu

- Page 678:

Appendix A Useful Mathematical Form

- Page 682:

Appendix A Useful Mathematical Form

- Page 686:

Appendix BEscort Distributions and

- Page 690:

B.1 First Example 33721.5< x > (n)<

- Page 694:

B.3 Remarks 339B.2 Second ExampleIn

- Page 698: B.3 Remarks 341However, it has been

- Page 702: 344 Bibliography20. A. Einstein, Th

- Page 706: 346 Bibliography64. S. Abe and Y. O

- Page 710: 348 BibliographyDiversity in Theory

- Page 714: 350 Bibliography148. F.A.B.F. de Mo

- Page 718: 352 Bibliographyand C. Tsallis, Ame

- Page 722: 354 Bibliography253. S.M.D. Queiros

- Page 726: 356 Bibliography302. N.G. van Kampe

- Page 730: 358 Bibliography356. F. Baldovin, E

- Page 734: 360 Bibliography405. I. Bediaga, E.

- Page 738: 362 Bibliography455. M.S. Reis, J.P

- Page 742: 364 Bibliography502. C. Castro, A n

- Page 746: 366 Bibliography552. C. Tsallis, D.

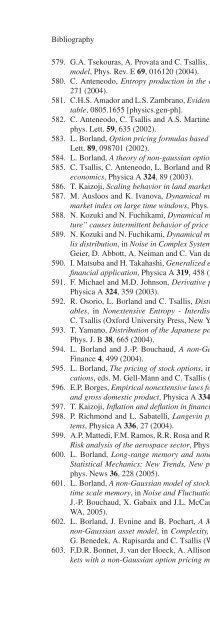

- Page 752: Bibliography 369631. J. Schulte, No

- Page 756: Bibliography 371678. D. Fuks, S. Do

- Page 760: Bibliography 373723. L.J. Yang, M.P

- Page 764: Bibliography 375767. S. Sun, L. Zha

- Page 768: Bibliography 377813. S. Abe, Tsalli

- Page 772: Bibliography 379862. S. Boccaletti,

- Page 776: 382 IndexKekule, ixKepler, xiiKrylo