Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

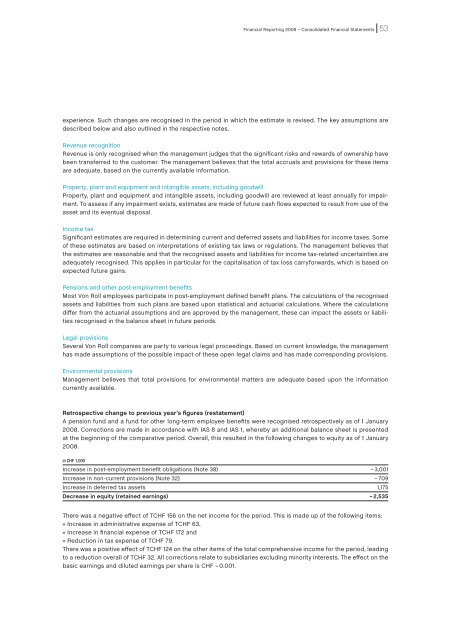

Financial <strong>Report</strong>ing <strong>2009</strong> – Consolidated Financial Statements 53experience. Such changes are recognised in the period in which the estimate is revised. The key assumptions aredescribed below and also outlined in the respective notes.Revenue recognitionRevenue is only recognised when the management judges that the significant risks and rewards of ownership havebeen transferred to the customer. The management believes that the total accruals and provisions for these itemsare adequate, based on the currently available information.Property, plant and equipment and intangible assets, including goodwillProperty, plant and equipment and intangible assets, including goodwill are reviewed at least annually for impairment.To assess if any impairment exists, estimates are made of future cash flows expected to result from use of theasset and its eventual disposal.Income taxSignificant estimates are required in determining current and deferred assets and liabilities for income taxes. Someof these estimates are based on interpretations of existing tax laws or regulations. The management believes thatthe estimates are reasonable and that the recognised assets and liabilities for income tax-related uncertainties areadequately recognised. This applies in particular for the capitalisation of tax loss carryforwards, which is based onexpected future gains.Pensions and other post-employment benefitsMost <strong>Von</strong> <strong>Roll</strong> employees participate in post-employment defined benefit plans. The calculations of the recognisedassets and liabilities from such plans are based upon statistical and actuarial calculations. Where the calculationsdiffer from the actuarial assumptions and are approved by the management, these can impact the assets or liabilitiesrecognised in the balance sheet in future periods.Legal provisionsSeveral <strong>Von</strong> <strong>Roll</strong> companies are party to various legal proceedings. Based on current knowledge, the managementhas made assumptions of the possible impact of these open legal claims and has made corresponding pro visions.Environmental provisionsManagement believes that total provisions for environmental matters are adequate based upon the informationcurrently available.Retrospective change to previous year’s figures (restatement)A pension fund and a fund for other long-term employee benefits were recognised retrospectively as of 1 January2008. Corrections are made in accordance with IAS 8 and IAS 1, whereby an additional balance sheet is presentedat the beginning of the comparative period. Overall, this resulted in the following changes to equity as of 1 January2008.in CHF 1,000Increase in post-employment benefit obligations (Note 38) – 3,001Increase in non-current provisions (Note 32) – 709Increase in deferred tax assets 1,175Decrease in equity (retained earnings) – 2,535There was a negative effect of TCHF 156 on the net income for the period. This is made up of the following items:» Increase in administrative expense of TCHF 63,» Increase in financial expense of TCHF 172 and» Reduction in tax expense of TCHF 79.There was a positive effect of TCHF 124 on the other items of the total comprehensive income for the period, leadingto a reduction overall of TCHF 32. All corrections relate to subsidiaries excluding minority interests. The effect on thebasic earnings and diluted earnings per share is CHF – 0.001.