Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

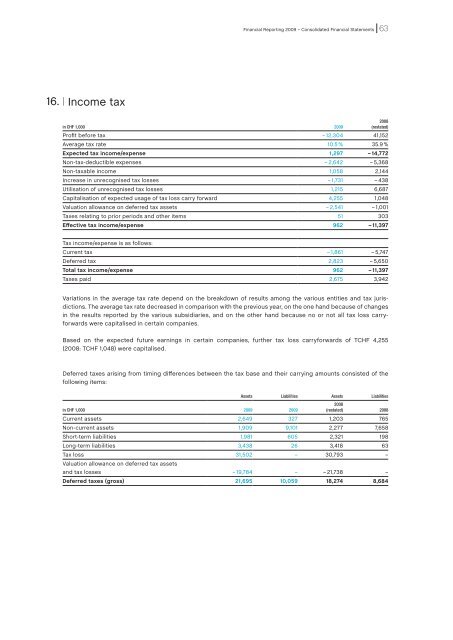

Financial <strong>Report</strong>ing <strong>2009</strong> – Consolidated Financial Statements 6316.| Income taxin CHF 1,000 <strong>2009</strong>2008(restated)Profit before tax – 12,304 41,152Average tax rate 10.5 % 35.9 %Expected tax income/expense 1,297 – 14,772Non-tax-deductible expenses – 2,642 – 5,368Non-taxable income 1,058 2,144Increase in unrecognised tax losses – 1,731 – 438Utilisation of unrecognised tax losses 1,215 6,687Capitalisation of expected usage of tax loss carry forward 4,255 1,048Valuation allowance on deferred tax assets – 2,541 – 1,001Taxes relating to prior periods and other items 51 303Effective tax income/expense 962 – 11,397Tax income/expense is as follows:Current tax – 1,861 – 5,747Deferred tax 2,823 – 5,650Total tax income/expense 962 – 11,397Taxes paid 2,675 3,942Variations in the average tax rate depend on the breakdown of results among the various entities and tax jurisdictions.The average tax rate decreased in comparison with the previous year, on the one hand because of changesin the results reported by the various subsidiaries, and on the other hand because no or not all tax loss carryforwardswere capitalised in certain companies.Based on the expected future earnings in certain companies, further tax loss carryforwards of TCHF 4,255(2008: TCHF 1,048) were capitalised.Deferred taxes arising from timing differences between the tax base and their carrying amounts consisted of thefollowing items:in CHF 1,000 <strong>2009</strong> <strong>2009</strong>Assets Liabilities Assets Liabilities2008(restated) 2008Current assets 2,649 327 1,203 765Non-current assets 1,909 9,101 2,277 7,658Short-term liabilities 1,981 605 2,321 198Long-term liabilities 3,438 26 3,418 63Tax loss 31,502 – 30,793 –Valuation allowance on deferred tax assetsand tax losses – 19,784 – – 21,738 –Deferred taxes (gross) 21,695 10,059 18,274 8,684