Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

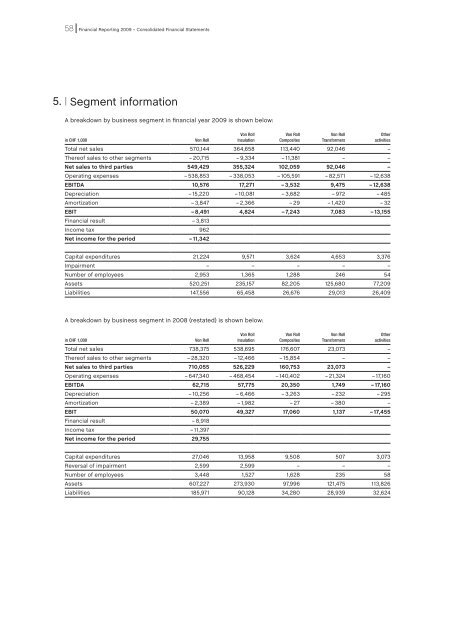

58 Financial <strong>Report</strong>ing <strong>2009</strong> – Consolidated Financial Statements5.| Segment informationA breakdown by business segment in financial year <strong>2009</strong> is shown below:in CHF 1,000<strong>Von</strong> <strong>Roll</strong>Total net sales 570,144 364,658 113,440 92,046 –Thereof sales to other segments – 20,715 – 9,334 – 11,381 – –Net sales to third parties 549,429 355,324 102,059 92,046 –Operating expenses – 538,853 – 338,053 – 105,591 – 82,571 – 12,638EBITDA 10,576 17,271 – 3,532 9,475 – 12,638Depreciation – 15,220 – 10,081 – 3,682 – 972 – 485Amortization – 3,847 – 2,366 – 29 – 1,420 – 32EBIT – 8,491 4,824 – 7, 243 7,083 – 13,155Financial result – 3,813Income tax 962Net income for the period – 11,342<strong>Von</strong> <strong>Roll</strong>Insulation<strong>Von</strong> <strong>Roll</strong>Composites<strong>Von</strong> <strong>Roll</strong>TransformersOtheractivitiesCapital expenditures 21,224 9,571 3,624 4,653 3,376Impairment – – – – –Number of employees 2,953 1,365 1,288 246 54Assets 520,251 235,157 82,205 125,680 77,209Liabilities 147,556 65,458 26,676 29,013 26,409A breakdown by business segment in 2008 (restated) is shown below:in CHF 1,000<strong>Von</strong> <strong>Roll</strong><strong>Von</strong> <strong>Roll</strong>Insulation<strong>Von</strong> <strong>Roll</strong>Composites<strong>Von</strong> <strong>Roll</strong>TransformersOtheractivitiesTotal net sales 738,375 538,695 176,607 23,073 –Thereof sales to other segments – 28,320 – 12,466 – 15,854 – –Net sales to third parties 710,055 526,229 160,753 23,073 –Operating expenses – 647,340 – 468,454 – 140,402 – 21,324 – 17,160EBITDA 62,715 57,775 20,350 1,749 – 17,160Depreciation – 10,256 – 6,466 – 3,263 – 232 – 295Amortization – 2,389 – 1,982 – 27 – 380 –EBIT 50,070 49,327 17,060 1,137 – 17,455Financial result – 8,918Income tax – 11,397Net income for the period 29,755Capital expenditures 27,046 13,958 9,508 507 3,073Reversal of impairment 2,599 2,599 – – –Number of employees 3,448 1,527 1,628 235 58Assets 607,227 273,930 97,996 121,475 113,826Liabilities 185,971 90,128 34,280 28,939 32,624