Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

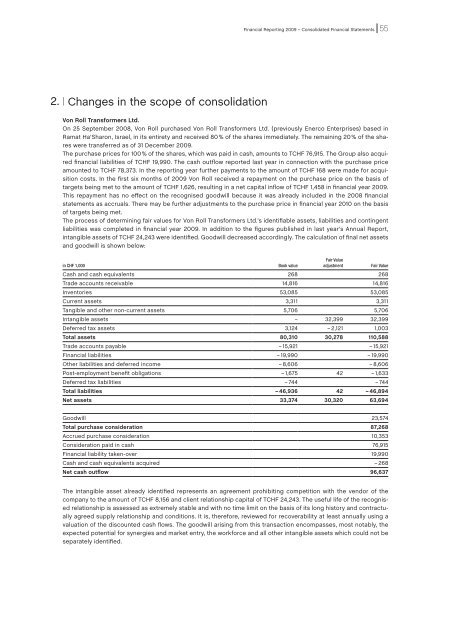

Financial <strong>Report</strong>ing <strong>2009</strong> – Consolidated Financial Statements 552.| Changes in the scope of consolidation<strong>Von</strong> <strong>Roll</strong> Transformers Ltd.On 25 September 2008, <strong>Von</strong> <strong>Roll</strong> purchased <strong>Von</strong> <strong>Roll</strong> Transformers Ltd. (previously Enerco Enterprises) based inRamat Ha’Sharon, Israel, in its entirety and received 80 % of the shares immediately. The remaining 20 % of the shareswere transferred as of 31 December <strong>2009</strong>.The purchase prices for 100 % of the shares, which was paid in cash, amounts to TCHF 76,915. The Group also acquiredfinancial liabilities of TCHF 19,990. The cash outflow reported last year in connection with the purchase priceamounted to TCHF 78,373. In the reporting year further payments to the amount of TCHF 168 were made for acquisitioncosts. In the first six months of <strong>2009</strong> <strong>Von</strong> <strong>Roll</strong> received a repayment on the purchase price on the basis oftargets being met to the amount of TCHF 1,626, resulting in a net capital inflow of TCHF 1,458 in financial year <strong>2009</strong>.This repayment has no effect on the recognised goodwill because it was already included in the 2008 financialstatements as accruals. There may be further adjustments to the purchase price in financial year 2010 on the basisof targets being met.The process of determining fair values for <strong>Von</strong> <strong>Roll</strong> Transformers Ltd.’s identifiable assets, liabilities and contingentliabilities was completed in financial year <strong>2009</strong>. In addition to the figures published in last year’s <strong>Annual</strong> <strong>Report</strong>,intangible assets of TCHF 24,243 were identified. Goodwill decreased accordingly. The calculation of final net assetsand goodwill is shown below:in CHF 1,000Book valueFair ValueadjustmentFair ValueCash and cash equivalents 268 268Trade accounts receivable 14,816 14,816Inventories 53,085 53,085Current assets 3,311 3,311Tangible and other non-current assets 5,706 5,706Intangible assets – 32,399 32,399Deferred tax assets 3,124 – 2,121 1,003Total assets 80,310 30,278 110,588Trade accounts payable – 15,921 – 15,921Financial liabilities – 19,990 – 19,990Other liabilities and deferred income – 8,606 – 8,606Post-employment benefit obligations – 1,675 42 – 1,633Deferred tax liabilities – 744 – 744Total liabilities – 46,936 42 – 46,894Net assets 33,374 30,320 63,694Goodwill 23,574Total purchase consideration 87,268Accrued purchase consideration 10,353Consideration paid in cash 76,915Financial liability taken-over 19,990Cash and cash equivalents acquired – 268Net cash outflow 96,637The intangible asset already identified represents an agreement prohibiting competition with the vendor of thecompany to the amount of TCHF 8,156 and client relationship capital of TCHF 24,243. The useful life of the recognisedrelationship is assessed as extremely stable and with no time limit on the basis of its long history and contractuallyagreed supply relationship and conditions. It is, therefore, reviewed for recoverability at least annually using avaluation of the discounted cash flows. The goodwill arising from this transaction encompasses, most notably, theexpected potential for synergies and market entry, the workforce and all other intangible assets which could not beseparately identified.