Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

Annual Report 2009 - Von Roll

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

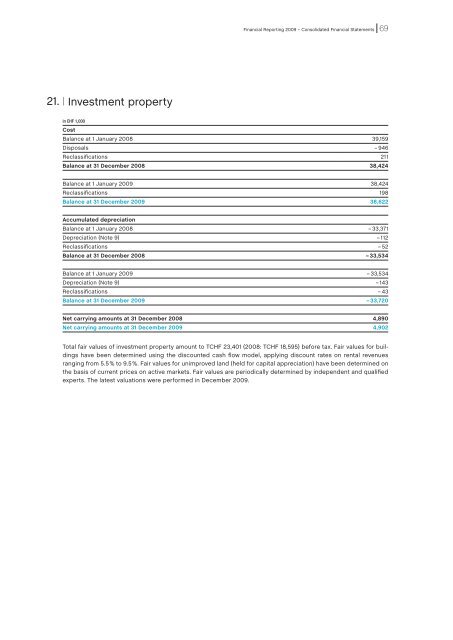

Financial <strong>Report</strong>ing <strong>2009</strong> – Consolidated Financial Statements 6921.| Investment propertyin CHF 1,000CostBalance at 1 January 2008 39,159Disposals – 946Reclassifications 211Balance at 31 December 2008 38,424Balance at 1 January <strong>2009</strong> 38,424Reclassifications 198Balance at 31 December <strong>2009</strong> 38,622Accumulated depreciationBalance at 1 January 2008 – 33,371Depreciation (Note 9) – 112Reclassifications – 52Balance at 31 December 2008 – 33,534Balance at 1 January <strong>2009</strong> – 33,534Depreciation (Note 9) – 143Reclassifications – 43Balance at 31 December <strong>2009</strong> – 33,720Net carrying amounts at 31 December 2008 4,890Net carrying amounts at 31 December <strong>2009</strong> 4,902Total fair values of investment property amount to TCHF 23,401 (2008: TCHF 18,595) before tax. Fair values for buildingshave been determined using the discounted cash flow model, applying discount rates on rental revenuesranging from 5.5 % to 9.5 %. Fair values for unimproved land (held for capital appreciation) have been determined onthe basis of current prices on active markets. Fair values are periodically determined by independent and qualifiedexperts. The latest valuations were performed in December <strong>2009</strong>.