On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

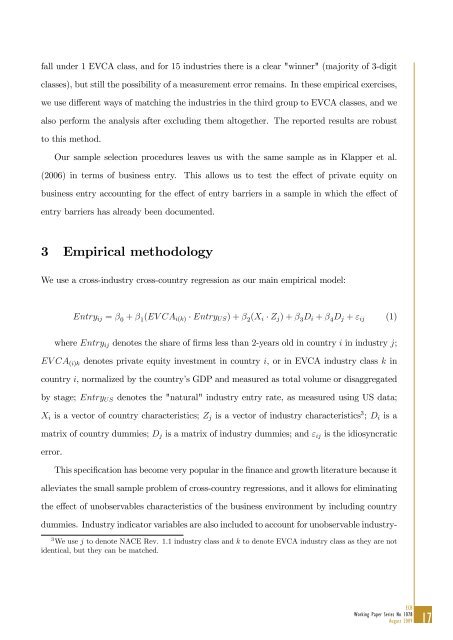

fall under 1 EVCA class, and for 15 industries <strong>the</strong>re is a clear "winner" (majority <strong>of</strong> 3-digitclasses), but still <strong>the</strong> possibility <strong>of</strong> a measurement error remains. In <strong>the</strong>se empirical exercises,we use di¤erent ways <strong>of</strong> matching <strong>the</strong> industries in <strong>the</strong> third group to EVCA classes, and wealso perform <strong>the</strong> analysis after excluding <strong>the</strong>m altoge<strong>the</strong>r. The reported results are robustto this method.Our sample selection procedures leaves us with <strong>the</strong> same sample as in Klapper et al.(2006) in terms <strong>of</strong> business entry. This allows us to test <strong>the</strong> e¤ect <strong>of</strong> <strong>private</strong> <strong>equity</strong> onbusiness entry accounting for <strong>the</strong> e¤ect <strong>of</strong> entry barriers in a sample in which <strong>the</strong> e¤ect <strong>of</strong>entry barriers has already been documented.3 Empirical methodologyWe use a cross-industry cross-country regression as our main empirical model:Entry ij = 0 + 1 (EV CA i(k) Entry US ) + 2 (X i Z j ) + 3 D i + 4 D j + " ij (1)where Entry ij denotes <strong>the</strong> share <strong>of</strong> …rms less than 2-years old in country i in industry j;EV CA (i)k denotes <strong>private</strong> <strong>equity</strong> <strong>investment</strong> in country i, or in EVCA industry class k incountry i, normalized by <strong>the</strong> country’s GDP and measured as total volume or disaggregatedby stage; Entry US denotes <strong>the</strong> "natural" industry entry rate, as measured using US data;X i is a vector <strong>of</strong> country characteristics; Z j is a vector <strong>of</strong> industry characteristics 3 ; D i is amatrix <strong>of</strong> country dummies; D j is a matrix <strong>of</strong> industry dummies; and " ij is <strong>the</strong> idiosyncraticerror.This speci…cation has become very popular in <strong>the</strong> …nance and growth literature because italleviates <strong>the</strong> small sample problem <strong>of</strong> cross-country regressions, and it allows for eliminating<strong>the</strong> e¤ect <strong>of</strong> unobservables characteristics <strong>of</strong> <strong>the</strong> business environment by including countrydummies. Industry indicator variables are also included to account for unobservable industry-3 We use j to denote NACE Rev. 1.1 industry class and k to denote EVCA industry class as <strong>the</strong>y are notidentical, but <strong>the</strong>y can be matched.ECBWorking Paper Series No 1078August 200917