On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

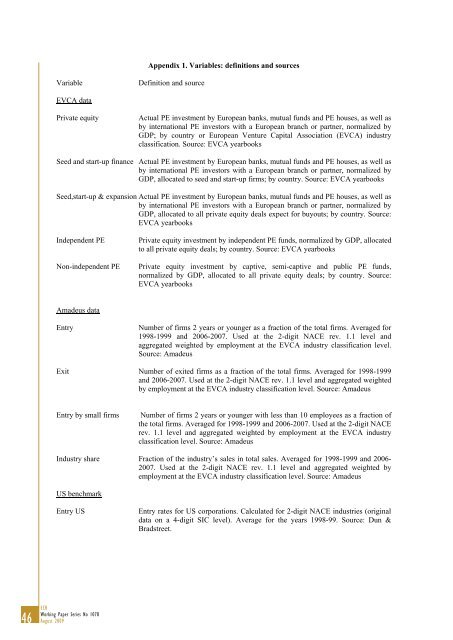

Appendix 1. Variables: definitions and sourcesVariableDefinition and sourceEVCA dataPrivate <strong>equity</strong>Actual PE <strong>investment</strong> by European banks, mutual funds and PE houses, as well asby international PE investors with a European branch or partner, normalized byGDP; by country or European Venture Capital Association (EVCA) industryclassification. Source: EVCA yearbooksSeed and start-up finance Actual PE <strong>investment</strong> by European banks, mutual funds and PE houses, as well asby international PE investors with a European branch or partner, normalized byGDP, allocated to seed and start-up firms; by country. Source: EVCA yearbooksSeed,start-up & expansion Actual PE <strong>investment</strong> by European banks, mutual funds and PE houses, as well asby international PE investors with a European branch or partner, normalized byGDP, allocated to all <strong>private</strong> <strong>equity</strong> deals expect for buyouts; by country. Source:EVCA yearbooksIndependent PENon-independent PEPrivate <strong>equity</strong> <strong>investment</strong> by independent PE funds, normalized by GDP, allocatedto all <strong>private</strong> <strong>equity</strong> deals; by country. Source: EVCA yearbooksPrivate <strong>equity</strong> <strong>investment</strong> by captive, semi-captive and public PE funds,normalized by GDP, allocated to all <strong>private</strong> <strong>equity</strong> deals; by country. Source:EVCA yearbooksAmadeus dataEntryNumber <strong>of</strong> firms 2 years or younger as a fraction <strong>of</strong> <strong>the</strong> total firms. Averaged for1998-1999 and 2006-2007. Used at <strong>the</strong> 2-digit NACE rev. 1.1 level andaggregated weighted by employment at <strong>the</strong> EVCA industry classification level.Source: AmadeusExit Number <strong>of</strong> exited firms as a fraction <strong>of</strong> <strong>the</strong> total firms. Averaged for 1998-1999and 2006-2007. Used at <strong>the</strong> 2-digit NACE rev. 1.1 level and aggregated weightedby employment at <strong>the</strong> EVCA industry classification level. Source: AmadeusEntry by small firmsNumber <strong>of</strong> firms 2 years or younger with less than 10 employees as a fraction <strong>of</strong><strong>the</strong> total firms. Averaged for 1998-1999 and 2006-2007. Used at <strong>the</strong> 2-digit NACErev. 1.1 level and aggregated weighted by employment at <strong>the</strong> EVCA industryclassification level. Source: AmadeusIndustry share Fraction <strong>of</strong> <strong>the</strong> industry’s sales in total sales. Averaged for 1998-1999 and 2006-2007. Used at <strong>the</strong> 2-digit NACE rev. 1.1 level and aggregated weighted byemployment at <strong>the</strong> EVCA industry classification level. Source: AmadeusUS benchmarkEntry USEntry rates for US corporations. Calculated for 2-digit NACE industries (originaldata on a 4-digit SIC level). Average for <strong>the</strong> years 1998-99. Source: Dun &Bradstreet.46 ECBWorking Paper Series No 1078August 2009