On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

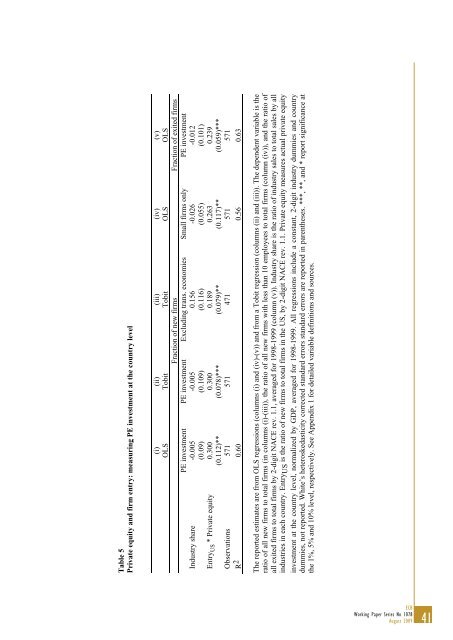

Table 5Private <strong>equity</strong> and firm entry: measuring PE <strong>investment</strong> at <strong>the</strong> country levelIndustry shareEntry US * Private <strong>equity</strong>(i)OLS(ii)Tobit(iii)TobitFraction <strong>of</strong> <strong>new</strong> firms Fraction <strong>of</strong> exited firmsPE <strong>investment</strong> PE <strong>investment</strong> Excluding trans. economies Small firms only PE <strong>investment</strong>-0.005 -0.005 0.156 -0.026 -0.012(0.09) (0.109) (0.116) (0.055) (0.101)0.300 0.300 0.189 0.263 0.239(0.112)** (0.078)*** (0.079)** (0.117)** (0.059)***Observations 571 571 471 571 571R 2 0.60 0.56 0.63(iv)OLS(v)OLSThe reported estimates are <strong>from</strong> OLS regressions (columns (i) and (iv)-(v)) and <strong>from</strong> a Tobit regression (columns (ii) and (iii)). The dependent variable is <strong>the</strong>ratio <strong>of</strong> all <strong>new</strong> firms to total firms (in columns (i)-(iii)), <strong>the</strong> ratio <strong>of</strong> all <strong>new</strong> firms with less than 10 employees to total firms (column (iv)), and <strong>the</strong> ratio <strong>of</strong>all exited firms to total firms by 2-digit NACE rev. 1.1, averaged for 1998-1999 (column (v)). Industry share is <strong>the</strong> ratio <strong>of</strong> industry sales to total sales by allindustries in each country. Entry US is <strong>the</strong> ratio <strong>of</strong> <strong>new</strong> firms to total firms in <strong>the</strong> US, by 2-digit NACE rev. 1.1. Private <strong>equity</strong> measures actual <strong>private</strong> <strong>equity</strong><strong>investment</strong> at <strong>the</strong> country level, normalized by GDP, averaged for 1998-1999. All regressions include a constant, 2-digit industry dummies and countrydummies, not reported. White’s heteroskedasticity corrected standard errors standard errors are reported in paren<strong>the</strong>ses. ***, **, and * report significance at<strong>the</strong> 1%, 5% and 10% level, respectively. See Appendix 1 for detailed variable definitions and sources.ECBWorking Paper Series No 1078August 200941