On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

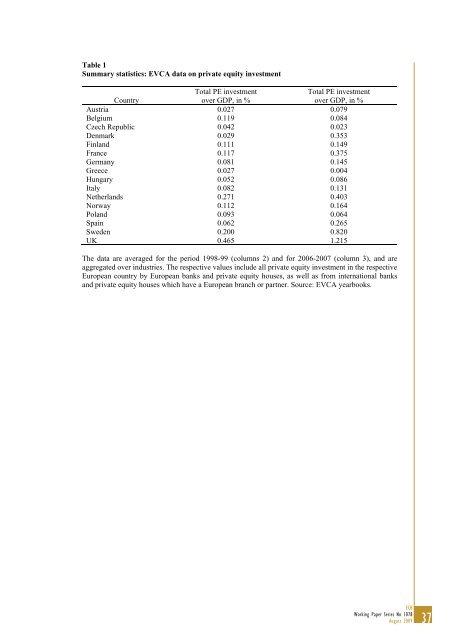

Table 1Summary statistics: EVCA data on <strong>private</strong> <strong>equity</strong> <strong>investment</strong>CountryTotal PE <strong>investment</strong>over GDP, in %Total PE <strong>investment</strong>over GDP, in %Austria 0.027 0.079Belgium 0.119 0.084Czech Republic 0.042 0.023Denmark 0.029 0.353Finland 0.111 0.149France 0.117 0.375Germany 0.081 0.145Greece 0.027 0.004Hungary 0.052 0.086Italy 0.082 0.131Ne<strong>the</strong>rlands 0.271 0.403Norway 0.112 0.164Poland 0.093 0.064Spain 0.062 0.265Sweden 0.200 0.820UK 0.465 1.215The data are averaged for <strong>the</strong> period 1998-99 (columns 2) and for 2006-2007 (column 3), and areaggregated over industries. The respective values include all <strong>private</strong> <strong>equity</strong> <strong>investment</strong> in <strong>the</strong> respectiveEuropean country by European banks and <strong>private</strong> <strong>equity</strong> houses, as well as <strong>from</strong> international banksand <strong>private</strong> <strong>equity</strong> houses which have a European branch or partner. Source: EVCA yearbooks.ECBWorking Paper Series No 1078August 200937