On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

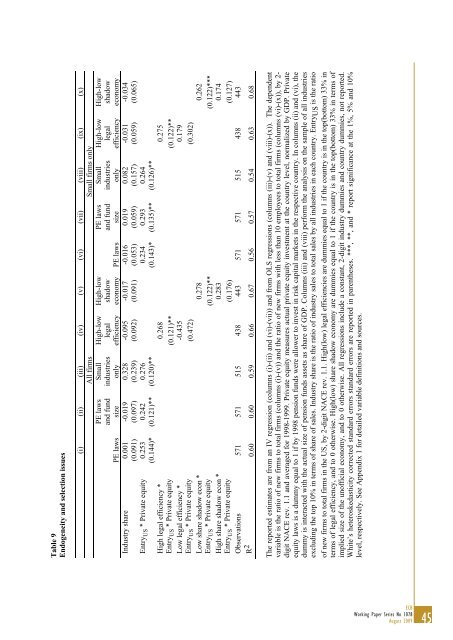

Table 9Endogeneity and selection issuesIndustry shareEntry US * Private <strong>equity</strong>High legal efficiency *(i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x)All firms Small firms onlyPE lawsand fundsizeSmallindustriesonlyHigh-lowlegalefficiencyHigh-lowshadoweconomy PE lawsPE lawsand fundsizeSmallindustriesonlyHigh-lowlegalefficiencyHigh-lowshadoweconomyPE laws0.001 -0.019 0.328 -0.095 -0.017 -0.016 0.019 0.082 -0.031 -0.034(0.091) (0.097) (0.239) (0.092) (0.091) (0.053) (0.059) (0.157) (0.059) (0.065)0.253 0.242 0.276 0.234 0.293 0.264(0.144)* (0.121)** (0.120)** (0.143)* (0.135)** (0.126)**0.268 0.275Entry US * Private <strong>equity</strong> (0.121)** (0.122)**Low legal efficiency *-0.435 0.179Entry US * Private <strong>equity</strong> (0.472) (0.302)Low share shadow econ *0.278 0.262Entry US * Private <strong>equity</strong> (0.122)** (0.122)***High share shadow econ *0.283 0.174Entry US * Private <strong>equity</strong> (0.176) (0.127)Observations 571 571 515 438 443 571 571 515 438 443R 2 0.60 0.60 0.59 0.66 0.67 0.56 0.57 0.54 0.63 0.68The reported estimates are <strong>from</strong> an IV regression (columns (i)-(ii) and (vi)-(vii)) and <strong>from</strong> OLS regressions (columns (iii)-(v) and (viii)-(x)). The dependentvariable is <strong>the</strong> ratio <strong>of</strong> <strong>new</strong> firms to total firms (columns (i)-(v)) and <strong>the</strong> ratio <strong>of</strong> <strong>new</strong> firms with less than 10 employees to total firms (columns (vi)-(x)), by 2-digit NACE rev. 1.1 and averaged for 1998-1999. Private <strong>equity</strong> measures actual <strong>private</strong> <strong>equity</strong> <strong>investment</strong> at <strong>the</strong> country level, normalized by GDP. Private<strong>equity</strong> laws is a dummy equal to 1 if by 1998 pension funds were allower to invest in risk capital markets in <strong>the</strong> respective country. In columns (ii) and (vi), <strong>the</strong>dummy is interacted with <strong>the</strong> actual size <strong>of</strong> pension funds assets as share <strong>of</strong> GDP. Columns (iii) and (viii) perform <strong>the</strong> analysis on <strong>the</strong> sample <strong>of</strong> all industriesexcluding <strong>the</strong> top 10% in terms <strong>of</strong> share <strong>of</strong> sales. Industry share is <strong>the</strong> ratio <strong>of</strong> industry sales to total sales by all industries in each country. Entry US is <strong>the</strong> ratio<strong>of</strong> <strong>new</strong> firms to total firms in <strong>the</strong> US, by 2-digit NACE rev. 1.1. High(low) legal efficiencies are dummies equal to 1 if <strong>the</strong> country is in <strong>the</strong> top(bottom) 33% interms <strong>of</strong> legal efficiency, and to 0 o<strong>the</strong>rwise. High(low) share shadow economy are dummies equal to 1 if <strong>the</strong> country is in <strong>the</strong> top(bottom) 33% in terms <strong>of</strong>implied size <strong>of</strong> <strong>the</strong> un<strong>of</strong>ficial economy, and to 0 o<strong>the</strong>rwise. All regressions include a constant, 2-digit industry dummies and country dummies, not reported.White’s heteroskedasticity corrected standard errors standard errors are reported in paren<strong>the</strong>ses. ***, **, and * report significance at <strong>the</strong> 1%, 5% and 10%level, respectively. See Appendix 1 for detailed variable definitions and sources.ECBWorking Paper Series No 1078August 200945