On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

On the real effects of private equity investment: evidence from new ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

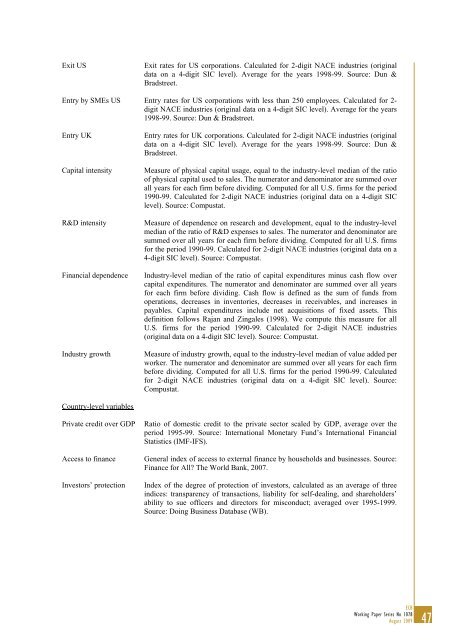

Exit USExit rates for US corporations. Calculated for 2-digit NACE industries (originaldata on a 4-digit SIC level). Average for <strong>the</strong> years 1998-99. Source: Dun &Bradstreet.Entry by SMEs US Entry rates for US corporations with less than 250 employees. Calculated for 2-digit NACE industries (original data on a 4-digit SIC level). Average for <strong>the</strong> years1998-99. Source: Dun & Bradstreet.Entry UKCapital intensityR&D intensityFinancial dependenceIndustry growthEntry rates for UK corporations. Calculated for 2-digit NACE industries (originaldata on a 4-digit SIC level). Average for <strong>the</strong> years 1998-99. Source: Dun &Bradstreet.Measure <strong>of</strong> physical capital usage, equal to <strong>the</strong> industry-level median <strong>of</strong> <strong>the</strong> ratio<strong>of</strong> physical capital used to sales. The numerator and denominator are summed overall years for each firm before dividing. Computed for all U.S. firms for <strong>the</strong> period1990-99. Calculated for 2-digit NACE industries (original data on a 4-digit SIClevel). Source: Compustat.Measure <strong>of</strong> dependence on research and development, equal to <strong>the</strong> industry-levelmedian <strong>of</strong> <strong>the</strong> ratio <strong>of</strong> R&D expenses to sales. The numerator and denominator aresummed over all years for each firm before dividing. Computed for all U.S. firmsfor <strong>the</strong> period 1990-99. Calculated for 2-digit NACE industries (original data on a4-digit SIC level). Source: Compustat.Industry-level median <strong>of</strong> <strong>the</strong> ratio <strong>of</strong> capital expenditures minus cash flow overcapital expenditures. The numerator and denominator are summed over all yearsfor each firm before dividing. Cash flow is defined as <strong>the</strong> sum <strong>of</strong> funds <strong>from</strong>operations, decreases in inventories, decreases in receivables, and increases inpayables. Capital expenditures include net acquisitions <strong>of</strong> fixed assets. Thisdefinition follows Rajan and Zingales (1998). We compute this measure for allU.S. firms for <strong>the</strong> period 1990-99. Calculated for 2-digit NACE industries(original data on a 4-digit SIC level). Source: Compustat.Measure <strong>of</strong> industry growth, equal to <strong>the</strong> industry-level median <strong>of</strong> value added perworker. The numerator and denominator are summed over all years for each firmbefore dividing. Computed for all U.S. firms for <strong>the</strong> period 1990-99. Calculatedfor 2-digit NACE industries (original data on a 4-digit SIC level). Source:Compustat.Country-level variablesPrivate credit over GDPAccess to financeInvestors’ protectionRatio <strong>of</strong> domestic credit to <strong>the</strong> <strong>private</strong> sector scaled by GDP, average over <strong>the</strong>period 1995-99. Source: International Monetary Fund’s International FinancialStatistics (IMF-IFS).General index <strong>of</strong> access to external finance by households and businesses. Source:Finance for All? The World Bank, 2007.Index <strong>of</strong> <strong>the</strong> degree <strong>of</strong> protection <strong>of</strong> investors, calculated as an average <strong>of</strong> threeindices: transparency <strong>of</strong> transactions, liability for self-dealing, and shareholders’ability to sue <strong>of</strong>ficers and directors for misconduct; averaged over 1995-1999.Source: Doing Business Database (WB).ECBWorking Paper Series No 1078August 200947