IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

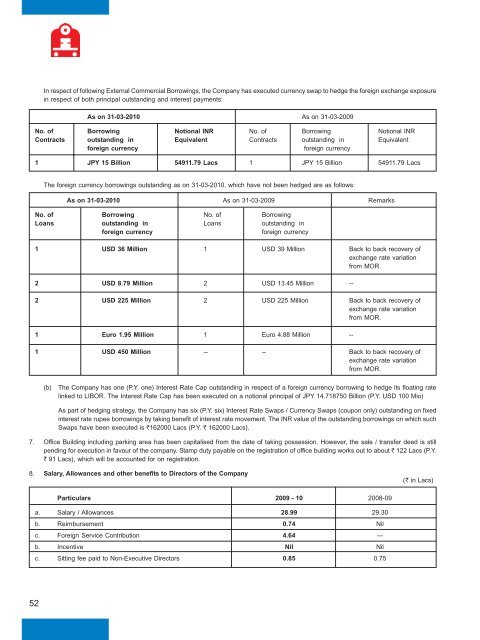

In respect of following External Commercial Borrowings, the Company has executed currency swap to hedge the foreign exchange exposurein respect of both principal outstanding and interest payments:As on 31-03-2010 As on 31-03-2009No. of Borrowing Notional INR No. of Borrowing Notional INRContracts outstanding in Equivalent Contracts outstanding in Equivalentforeign currency foreign currency1 JPY 15 Billion 54911.79 Lacs 1 JPY 15 Billion 54911.79 LacsThe foreign currency borrowings outstanding as on 31-03-2010, which have not been hedged are as follows:As on 31-03-2010 As on 31-03-2009 RemarksNo. of Borrowing No. of BorrowingLoans outstanding in Loans outstanding inforeign currencyforeign currency1 USD 36 Million 1 USD 39 Million Back to back recovery ofexchange rate variationfrom MOR.2 USD 8.79 Million 2 USD 13.45 Million --2 USD 225 Million 2 USD 225 Million Back to back recovery ofexchange rate variationfrom MOR.1 Euro 1.95 Million 1 Euro 4.88 Million --1 USD 450 Million -- -- Back to back recovery ofexchange rate variationfrom MOR.(b)The Company has one (P.Y. one) Interest Rate Cap outstanding in respect of a foreign currency borrowing to hedge its floating ratelinked to LIBOR. The Interest Rate Cap has been executed on a notional principal of JPY 14.718750 Billion (P.Y. USD 100 Mio)As part of hedging strategy, the Company has six (P.Y. six) Interest Rate Swaps / Currency Swaps (coupon only) outstanding on fixedinterest rate rupee borrowings by taking benefit of interest rate movement. The INR value of the outstanding borrowings on which suchSwaps have been executed is R162000 Lacs (P.Y. R 162000 Lacs).7. Office Building including parking area has been capitalised from the date of taking possession. However, the sale / transfer deed is stillpending for execution in favour of the company. Stamp duty payable on the registration of office building works out to about R 122 Lacs (P.Y.R 91 Lacs), which will be accounted for on registration.8. Salary, Allowances and other benefits to Directors of the Company(R in Lacs)Particulars 2009 - 10 2008-09a. Salary / Allowances 28.99 29.30b. Reimbursement 0.74 Nilc. Foreign Service Contribution 4.64 ---b. Incentive Nil Nilc. Sitting fee paid to Non-Executive Directors 0.85 0.7552