IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

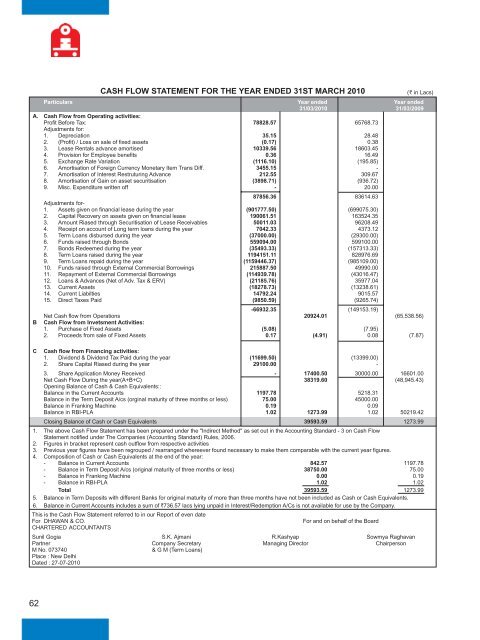

CASH FLOW STATEMENT FOR THE YEAR ENDED 31ST MARCH 2010(R in Lacs)Particulars Year ended Year ended31/03/2010 31/03/2009A. Cash Flow from Operating activities:Profit Before Tax: 78828.57 65768.73Adjustments for:1. Depreciation 35.15 28.482. (Profit) / Loss on sale of fixed assets (0.17) 0.383. Lease Rentals advance amortised 10339.56 18603.454. Provision for Employee benefits 0.36 16.495. Exchange Rate Variation (1116.10) (195.85)6. Amortisation of Foreign Currency Monetary Item Trans Diff. 3455.15 -7. Amortisation of Interest Restruturing Advance 212.55 309.678. Amortisation of Gain on asset securitisation (3898.71) (936.72)9. Misc. Expenditure written off - 20.0087856.36 83614.63Adjustments for-1. Assets given on financial lease during the year (901777.50) (699075.30)2. Capital Recovery on assets given on financial lease 190061.51 163524.353. Amount Riased through Securitisation of Lease Receivables 50011.03 96208.494. Receipt on account of Long term loans during the year 7042.33 4373.125. Term Loans disbursed during the year (37000.00) (29300.00)6. Funds raised through Bonds 559094.00 599100.007. Bonds Redeemed during the year (35493.33) (157313.33)8. Term Loans raised during the year 1194151.11 828976.699. Term Loans repaid during the year (1159446.37) (985109.00)10. Funds raised through External Commercial Borrowings 215887.50 49990.0011. Repayment of External Commercial Borrowings (114939.78) (43016.47)12. Loans & Advances (Net of Adv. Tax & ERV) (21185.76) 35977.0413. Current Assets (18278.73) (13238.61)14. Current Liabilties 14792.24 9015.5715. Direct Taxes Paid (9850.59) (9265.74)-66932.35 (149153.19)Net Cash flow from Operations 20924.01 (65,538.56)B Cash Flow from Invetsment Activities:1. Purchase of Fixed Assets (5.08) (7.95)2. Proceeds from sale of Fixed Assets 0.17 (4.91) 0.08 (7.87)C Cash flow from Financing activities:1. Dividend & Dividend Tax Paid during the year (11699.50) (13399.00)2. Share Capital Riased during the year 29100.00 -3. Share Application Money Received - 17400.50 30000.00 16601.00Net Cash Flow During the year(A+B+C) 38319.60 (48,945.43)Opening Balance of Cash & Cash Equivalents::Balance in the Current Accounts 1197.78 5218.31Balance in the Term Deposit A/cs (orginal maturity of three months or less) 75.00 45000.00Balance in Franking Machine 0.19 0.09Balance in RBI-PLA 1.02 1273.99 1.02 50219.42Closing Balance of Cash or Cash Equivalents 39593.59 1273.991. The above Cash Flow Statement has been prepared under the "Indirect Method" as set out in the Accounting Standard - 3 on Cash FlowStatement notified under The Companies (Accounting Standard) Rules, 2006.2. Figures in bracket represent cash outflow from respective activities3. Previous year figures have been regrouped / rearranged whereever found necessary to make them comparable with the current year figures.4. Composition of Cash or Cash Equivalents at the end of the year:- Balance in Current Accounts 842.57 1197.78- Balance in Term Deposit A/cs (original maturity of three months or less) 38750.00 75.00- Balance in Franking Machine 0.00 0.19- Balance in RBI-PLA 1.02 1.02Total 39593.59 1273.995. Balance in Term Deposits with different Banks for original maturity of more than three months have not been included as Cash or Cash Equivalents.6. Balance in Current Accounts includes a sum of R736.57 lacs lying unpaid in Interest/Redemption A/Cs is not available for use by the Company.This is the Cash Flow Statement referred to in our Report of even dateFor DHAWAN & CO.For and on behalf of the BoardCHARTERED ACCOUNTANTSSunil Gogia S.K. Ajmani R.Kashyap Sowmya RaghavanPartner Company Secretary Managing Director ChairpersonM No. 073740 & G M (Term Loans)Place : New DelhiDated : 27-07-201062