IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

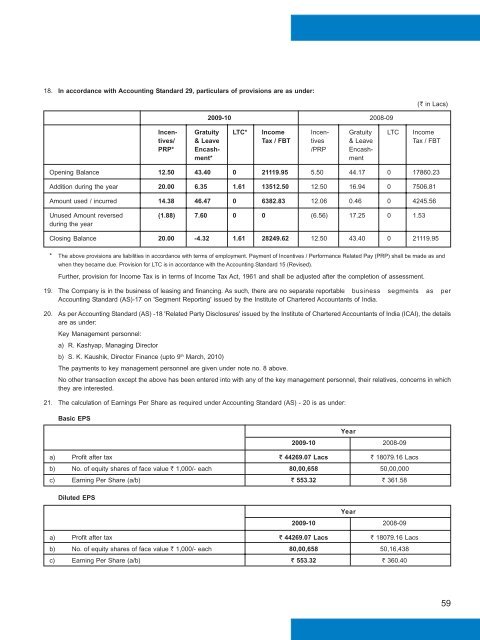

18. In accordance with Accounting Standard 29, particulars of provisions are as under:(R in Lacs)2009-10 2008-09Incen- Gratuity LTC* Income Incen- Gratuity LTC Incometives/ & Leave Tax / FBT tives & Leave Tax / FBTPRP* Encash- /PRP Encashment*mentOpening Balance 12.50 43.40 0 21119.95 5.50 44.17 0 17860.23Addition during the year 20.00 6.35 1.61 13512.50 12.50 16.94 0 7506.81Amount used / incurred 14.38 46.47 0 6382.83 12.06 0.46 0 4245.56Unused Amount reversed (1.88) 7.60 0 0 (6.56) 17.25 0 1.53during the yearClosing Balance 20.00 -4.32 1.61 28249.62 12.50 43.40 0 21119.95* The above provisions are liabilities in accordance with terms of employment. Payment of Incentives / Performance Related Pay (PRP) shall be made as andwhen they became due. Provision for LTC is in accordance with the Accounting Standard 15 (Revised).Further, provision for Income Tax is in terms of Income Tax Act, 1961 and shall be adjusted after the completion of assessment.19. The Company is in the business of leasing and financing. As such, there are no separate reportable business segments as perAccounting Standard (AS)-17 on 'Segment Reporting' issued by the Institute of Chartered Accountants of India.20. As per Accounting Standard (AS) -18 'Related Party Disclosures' issued by the Institute of Chartered Accountants of India (ICAI), the detailsare as under:Key Management personnel:a) R. Kashyap, Managing Directorb) S. K. Kaushik, Director <strong>Finance</strong> (upto 9 th March, 2010)The payments to key management personnel are given under note no. 8 above.No other transaction except the above has been entered into with any of the key management personnel, their relatives, concerns in whichthey are interested.21. The calculation of Earnings Per Share as required under Accounting Standard (AS) - 20 is as under:Basic EPSYear2009-10 2008-09a) Profit after tax R 44269.07 Lacs R 18079.16 Lacsb) No. of equity shares of face value R 1,000/- each 80,00,658 50,00,000c) Earning Per Share (a/b) R 553.32 R 361.58Diluted EPSYear2009-10 2008-09a) Profit after tax R 44269.07 Lacs R 18079.16 Lacsb) No. of equity shares of face value R 1,000/- each 80,00,658 50,16,438c) Earning Per Share (a/b) R 553.32 R 360.4059