IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

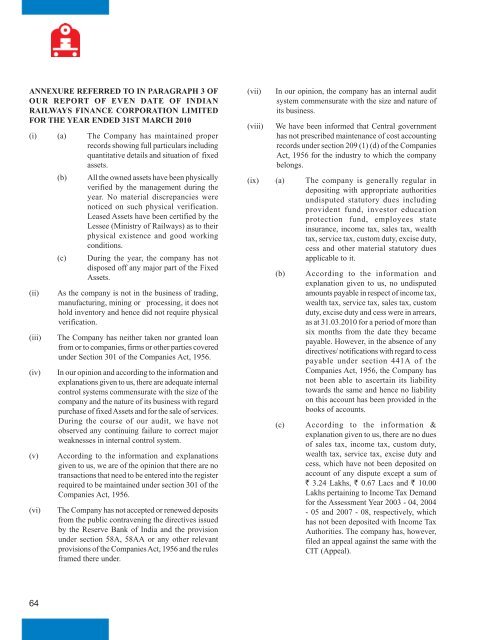

ANNEXURE REFERRED TO IN PARAGRAPH 3 OFOUR REPORT OF EVEN DATE OF INDIANRAILWAYS FINANCE CORPORATION LIMITEDFOR THE YEAR ENDED 31ST MARCH 2010(i) (a) The Company has maintained properrecords showing full particulars includingquantitative details and situation of fixedassets.(b) All the owned assets have been physicallyverified by the management during theyear. No material discrepancies werenoticed on such physical verification.Leased Assets have been certified by theLessee (Ministry of <strong>Railway</strong>s) as to theirphysical existence and good workingconditions.(c) During the year, the company has notdisposed off any major part of the FixedAssets.(ii)(iii)(iv)(v)(vi)As the company is not in the business of trading,manufacturing, mining or processing, it does nothold inventory and hence did not require physicalverification.The Company has neither taken nor granted loanfrom or to companies, firms or other parties coveredunder Section 301 of the Companies Act, 1956.In our opinion and according to the information andexplanations given to us, there are adequate internalcontrol systems commensurate with the size of thecompany and the nature of its business with regardpurchase of fixed Assets and for the sale of services.During the course of our audit, we have notobserved any continuing failure to correct majorweaknesses in internal control system.According to the information and explanationsgiven to us, we are of the opinion that there are notransactions that need to be entered into the registerrequired to be maintained under section 301 of theCompanies Act, 1956.The Company has not accepted or renewed depositsfrom the public contravening the directives issuedby the Reserve Bank of India and the provisionunder section 58A, 58AA or any other relevantprovisions of the Companies Act, 1956 and the rulesframed there under.(vii)(viii)In our opinion, the company has an internal auditsystem commensurate with the size and nature ofits business.We have been informed that Central governmenthas not prescribed maintenance of cost accountingrecords under section 209 (1) (d) of the CompaniesAct, 1956 for the industry to which the companybelongs.(ix) (a) The company is generally regular indepositing with appropriate authoritiesundisputed statutory dues includingprovident fund, investor educationprotection fund, employees stateinsurance, income tax, sales tax, wealthtax, service tax, custom duty, excise duty,cess and other material statutory duesapplicable to it.(b)(c)According to the information andexplanation given to us, no undisputedamounts payable in respect of income tax,wealth tax, service tax, sales tax, customduty, excise duty and cess were in arrears,as at 31.03.2010 for a period of more thansix months from the date they becamepayable. However, in the absence of anydirectives/ notifications with regard to cesspayable under section 441A of theCompanies Act, 1956, the Company hasnot been able to ascertain its liabilitytowards the same and hence no liabilityon this account has been provided in thebooks of accounts.According to the information &explanation given to us, there are no duesof sales tax, income tax, custom duty,wealth tax, service tax, excise duty andcess, which have not been deposited onaccount of any dispute except a sum ofR 3.24 Lakhs, R 0.67 Lacs and R 10.00Lakhs pertaining to Income Tax Demandfor the Assessment Year 2003 - 04, 2004- 05 and 2007 - 08, respectively, whichhas not been deposited with Income TaxAuthorities. The company has, however,filed an appeal against the same with theCIT (Appeal).64