IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

IRFC COVER-final - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

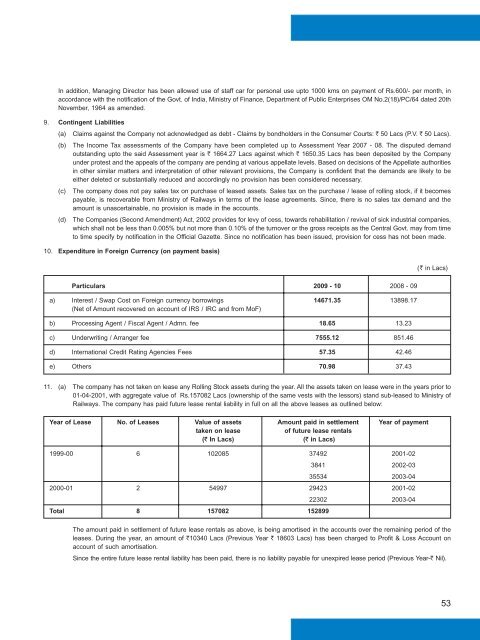

In addition, Managing Director has been allowed use of staff car for personal use upto 1000 kms on payment of Rs.600/- per month, inaccordance with the notification of the Govt. of India, Ministry of <strong>Finance</strong>, Department of Public Enterprises OM No.2(18)/PC/64 dated 20thNovember, 1964 as amended.9. Contingent Liabilities(a) Claims against the Company not acknowledged as debt - Claims by bondholders in the Consumer Courts: R 50 Lacs (P.V. R 50 Lacs).(b) The Income Tax assessments of the Company have been completed up to Assessment Year 2007 - 08. The disputed demandoutstanding upto the said Assessment year is R 1664.27 Lacs against which R 1650.35 Lacs has been deposited by the Companyunder protest and the appeals of the company are pending at various appellate levels. Based on decisions of the Appellate authoritiesin other similar matters and interpretation of other relevant provisions, the Company is confident that the demands are likely to beeither deleted or substantially reduced and accordingly no provision has been considered necessary.(c) The company does not pay sales tax on purchase of leased assets. Sales tax on the purchase / lease of rolling stock, if it becomespayable, is recoverable from Ministry of <strong>Railway</strong>s in terms of the lease agreements. Since, there is no sales tax demand and theamount is unascertainable, no provision is made in the accounts.(d) The Companies (Second Amendment) Act, 2002 provides for levy of cess, towards rehabilitation / revival of sick industrial companies,which shall not be less than 0.005% but not more than 0.10% of the turnover or the gross receipts as the Central Govt. may from timeto time specify by notification in the Official Gazette. Since no notification has been issued, provision for cess has not been made.10. Expenditure in Foreign Currency (on payment basis)(R in Lacs)Particulars 2009 - 10 2008 - 09a) Interest / Swap Cost on Foreign currency borrowings 14671.35 13898.17(Net of Amount recovered on account of IRS / IRC and from MoF)b) Processing Agent / Fiscal Agent / Admn. fee 18.65 13.23c) Underwriting / Arranger fee 7555.12 851.46d) International Credit Rating Agencies Fees 57.35 42.46e) Others 70.98 37.4311. (a) The company has not taken on lease any Rolling Stock assets during the year. All the assets taken on lease were in the years prior to01-04-2001, with aggregate value of Rs.157082 Lacs (ownership of the same vests with the lessors) stand sub-leased to Ministry of<strong>Railway</strong>s. The company has paid future lease rental liability in full on all the above leases as outlined below:Year of Lease No. of Leases Value of assets Amount paid in settlement Year of paymenttaken on leaseof future lease rentals(R In Lacs) (R in Lacs)1999-00 6 102085 37492 2001-023841 2002-0335534 2003-042000-01 2 54997 29423 2001-0222302 2003-04Total 8 157082 152899The amount paid in settlement of future lease rentals as above, is being amortised in the accounts over the remaining period of theleases. During the year, an amount of R10340 Lacs (Previous Year R 18603 Lacs) has been charged to Profit & Loss Account onaccount of such amortisation.Since the entire future lease rental liability has been paid, there is no liability payable for unexpired lease period (Previous Year-R Nil).53