acfe fraud prevention check-up - BKD

acfe fraud prevention check-up - BKD

acfe fraud prevention check-up - BKD

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

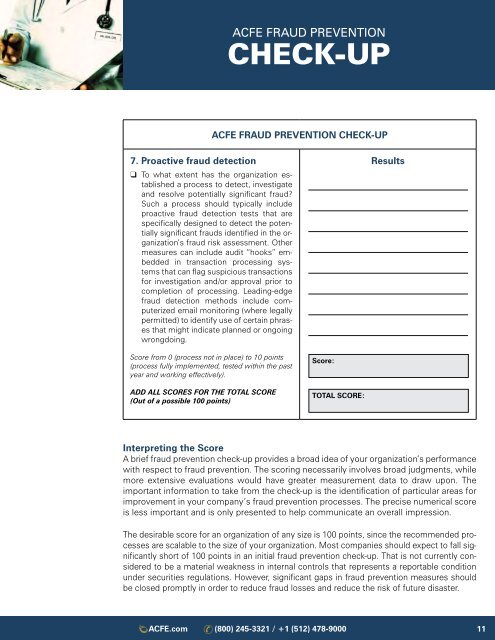

ACFE FRAUD PREVENTIONCHECK-UPACFE FRAUD PREVENTION CHECK-UP7. Proactive <strong>fraud</strong> detection❑❑To what extent has the organization establisheda process to detect, investigateand resolve potentially significant <strong>fraud</strong>?Such a process should typically includeproactive <strong>fraud</strong> detection tests that arespecifically designed to detect the potentiallysignificant <strong>fraud</strong>s identified in the organization’s<strong>fraud</strong> risk assessment. Othermeasures can include audit “hooks” embeddedin transaction processing systemsthat can flag suspicious transactionsfor investigation and/or approval prior tocompletion of processing. Leading-edge<strong>fraud</strong> detection methods include computerizedemail monitoring (where legallypermitted) to identify use of certain phrasesthat might indicate planned or ongoingwrongdoing.ResultsScore from 0 (process not in place) to 10 points(process fully implemented, tested within the pastyear and working effectively).ADD ALL SCORES FOR THE TOTAL SCORE(Out of a possible 100 points)Score:total Score:Interpreting the ScoreA brief <strong>fraud</strong> <strong>prevention</strong> <strong>check</strong>-<strong>up</strong> provides a broad idea of your organization’s performancewith respect to <strong>fraud</strong> <strong>prevention</strong>. The scoring necessarily involves broad judgments, whilemore extensive evaluations would have greater measurement data to draw <strong>up</strong>on. Theimportant information to take from the <strong>check</strong>-<strong>up</strong> is the identification of particular areas forimprovement in your company’s <strong>fraud</strong> <strong>prevention</strong> processes. The precise numerical scoreis less important and is only presented to help communicate an overall impression.The desirable score for an organization of any size is 100 points, since the recommended processesare scalable to the size of your organization. Most companies should expect to fall significantlyshort of 100 points in an initial <strong>fraud</strong> <strong>prevention</strong> <strong>check</strong>-<strong>up</strong>. That is not currently consideredto be a material weakness in internal controls that represents a reportable conditionunder securities regulations. However, significant gaps in <strong>fraud</strong> <strong>prevention</strong> measures shouldbe closed promptly in order to reduce <strong>fraud</strong> losses and reduce the risk of future disaster.ACFE.com (800) 245-3321 / +1 (512) 478-9000 11