Environmental Law in Pakistan - IUCN

Environmental Law in Pakistan - IUCN

Environmental Law in Pakistan - IUCN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

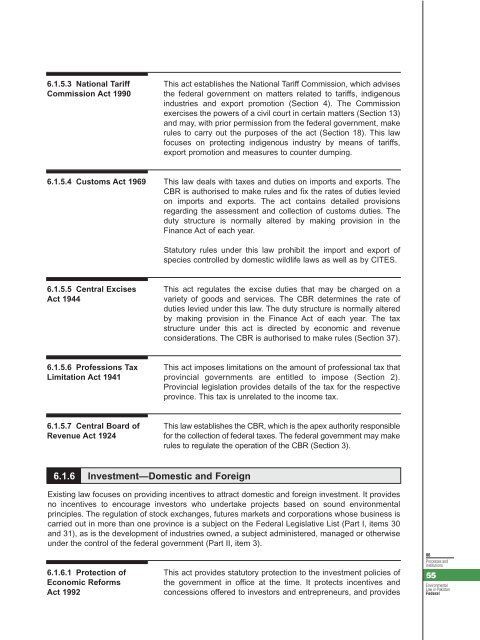

6.1.5.3 National TariffCommission Act 1990This act establishes the National Tariff Commission, which advisesthe federal government on matters related to tariffs, <strong>in</strong>digenous<strong>in</strong>dustries and export promotion (Section 4). The Commissionexercises the powers of a civil court <strong>in</strong> certa<strong>in</strong> matters (Section 13)and may, with prior permission from the federal government, makerules to carry out the purposes of the act (Section 18). This lawfocuses on protect<strong>in</strong>g <strong>in</strong>digenous <strong>in</strong>dustry by means of tariffs,export promotion and measures to counter dump<strong>in</strong>g.6.1.5.4 Customs Act 1969This law deals with taxes and duties on imports and exports. TheCBR is authorised to make rules and fix the rates of duties leviedon imports and exports. The act conta<strong>in</strong>s detailed provisionsregard<strong>in</strong>g the assessment and collection of customs duties. Theduty structure is normally altered by mak<strong>in</strong>g provision <strong>in</strong> theF<strong>in</strong>ance Act of each year.Statutory rules under this law prohibit the import and export ofspecies controlled by domestic wildlife laws as well as by CITES.6.1.5.5 Central ExcisesAct 1944This act regulates the excise duties that may be charged on avariety of goods and services. The CBR determ<strong>in</strong>es the rate ofduties levied under this law. The duty structure is normally alteredby mak<strong>in</strong>g provision <strong>in</strong> the F<strong>in</strong>ance Act of each year. The taxstructure under this act is directed by economic and revenueconsiderations. The CBR is authorised to make rules (Section 37).6.1.5.6 Professions TaxLimitation Act 1941This act imposes limitations on the amount of professional tax thatprov<strong>in</strong>cial governments are entitled to impose (Section 2).Prov<strong>in</strong>cial legislation provides details of the tax for the respectiveprov<strong>in</strong>ce. This tax is unrelated to the <strong>in</strong>come tax.6.1.5.7 Central Board ofRevenue Act 1924This law establishes the CBR, which is the apex authority responsiblefor the collection of federal taxes. The federal government may makerules to regulate the operation of the CBR (Section 3).6.1.6 Investment—Domestic and ForeignExist<strong>in</strong>g law focuses on provid<strong>in</strong>g <strong>in</strong>centives to attract domestic and foreign <strong>in</strong>vestment. It providesno <strong>in</strong>centives to encourage <strong>in</strong>vestors who undertake projects based on sound environmentalpr<strong>in</strong>ciples. The regulation of stock exchanges, futures markets and corporations whose bus<strong>in</strong>ess iscarried out <strong>in</strong> more than one prov<strong>in</strong>ce is a subject on the Federal Legislative List (Part I, items 30and 31), as is the development of <strong>in</strong>dustries owned, a subject adm<strong>in</strong>istered, managed or otherwiseunder the control of the federal government (Part II, item 3).6.1.6.1 Protection ofEconomic ReformsAct 1992This act provides statutory protection to the <strong>in</strong>vestment policies ofthe government <strong>in</strong> office at the time. It protects <strong>in</strong>centives andconcessions offered to <strong>in</strong>vestors and entrepreneurs, and provides06Processes andInstitutions55<strong>Environmental</strong><strong>Law</strong> <strong>in</strong> <strong>Pakistan</strong>Federal