- Page 1 and 2:

TÜİKİSTATİSTİKGÖSTERGELERStat

- Page 3 and 4:

İSTATİSTİK GÖSTERGELER19232009S

- Page 5 and 6:

İÇİNDEKİLERCONTENTSÖnsözİçi

- Page 7 and 8:

Uluslararası Para FonuIMFInternati

- Page 9 and 10:

1.21 Cinsiyete göre nüfusun okury

- Page 11 and 12:

Yaş: Kişinin bitirmiş (tamamlam

- Page 13 and 14:

(Milyon-Million)501.3 Yaş gruplar

- Page 15 and 16:

1.1 Nüfus, yıllık nüfus artış

- Page 17 and 18:

1.5 Cinsiyete göre il/ilçe merkez

- Page 19 and 20:

1.6 Cinsiyet ve yaş gruplarına g

- Page 21 and 22:

1.8 Yaş bağımlılık oranıAge d

- Page 23 and 24:

1.12 Medeni durum ve cinsiyete gör

- Page 25 and 26:

1.15 Yetişkin nüfusun cinsiyet ve

- Page 27 and 28:

1.19 Cinsiyet ve okuryazarlık duru

- Page 29 and 30:

1.23 Ekonomik faaliyet ve cinsiyete

- Page 31 and 32:

1.24 Ekonomik faaliyet ve cinsiyete

- Page 33 and 34:

1.25 İşgücü durumu ve cinsiyete

- Page 35 and 36:

1.27 Yaş grubu ve cinsiyete göre

- Page 37 and 38:

HAYATİ İSTATİSTİKLERBu bölümd

- Page 39 and 40:

(Onbinde - Perten thousand)2.1 Kaba

- Page 41 and 42:

(Kişi - Persons)2.5 İntihar sayı

- Page 43 and 44:

2.2 Boşanma sayısı ve kaba boşa

- Page 45 and 46:

2.3 Evlilik süresine göre boşanm

- Page 47 and 48:

2.4 Nedene göre boşanmalar (devam

- Page 49 and 50:

2.5 Cinsiyet ve yaş grubuna göre

- Page 51 and 52:

2.6 Cinsiyet ve yaş grubuna göre

- Page 53 and 54:

2.7 Cinsiyete göre intiharlar ve k

- Page 55 and 56:

2.9 Nedene göre intihar oranıProp

- Page 57 and 58:

SayfaPageAçıklama 51 ExplanationG

- Page 59 and 60:

3.1 Hekim başına düşen kişi sa

- Page 61 and 62:

3.1 Yataklı ve yataksız sağlık

- Page 63 and 64:

3.3 Türlerine göre hastane sayıs

- Page 65 and 66:

3.5 Kamu ve özel yataklı sağlık

- Page 67 and 68:

3.7 Eczane ve eczacı sayısıNumbe

- Page 69 and 70:

SayfaPageAçıklama 63 ExplanationG

- Page 71 and 72:

(Öğrenci sayısı-Number of stude

- Page 73 and 74:

4.5 Okul başına düşen öğrenci

- Page 75 and 76:

4.1 İlkokul ve İlköğretim okull

- Page 77 and 78:

4.2 Genel ortaokullarda okul ve cin

- Page 79 and 80:

4.3 Genel liselerde okul ve cinsiye

- Page 81 and 82:

4.4 Mesleki ve teknik okullarda oku

- Page 83 and 84:

4.5 Yükseköğretim kurumlarında

- Page 85 and 86:

4.6 Okul başına düşen öğrenci

- Page 87 and 88:

4.7 Öğretmen başına düşen ö

- Page 89 and 90:

KÜLTÜRBu bölümdeki kültür ist

- Page 91 and 92:

5.3 Sinema salonu sayısıNumber of

- Page 93 and 94:

5.2 Konularına göre yıl içinde

- Page 95 and 96:

5.4 Gazetelerin ve dergilerin yayı

- Page 97 and 98:

5.6 Opera, bale ve tiyatro faaliyet

- Page 99 and 100:

5.8 Sinema, gösterilen film ve sey

- Page 101 and 102:

ADALETBu bölümdeki hukuk ve ceza

- Page 103 and 104:

6.3 Hakim başına düşen dava say

- Page 105 and 106:

6.1 Adalet personeli sayısıNumber

- Page 107 and 108:

6.3 Cinsiyete göre ceza infaz kuru

- Page 109 and 110:

6.4 Yaş grubuna göre ceza infaz k

- Page 111 and 112:

6.6 Okuryazarlık durumuna göre ce

- Page 113 and 114:

6.7 Eğitim durumuna göre ceza inf

- Page 115 and 116:

6.9 Meslek grubuna göre ceza infaz

- Page 117 and 118:

6.9 Meslek grubuna göre ceza infaz

- Page 119 and 120:

SayfaPageAçıklama 113 Explanation

- Page 121 and 122:

7.1 Milletvekili seçimleriNational

- Page 123 and 124:

7.1 Milletvekili genel seçimi sonu

- Page 125 and 126:

7.2 Milletvekili genel seçimi sonu

- Page 127 and 128:

7.3 Milletvekili genel seçimi sonu

- Page 129 and 130:

7.4 Mahalli idareler, il genel mecl

- Page 131 and 132:

7.5 Mahalli idareler, belediye baş

- Page 133 and 134:

7.6 Mahalli idareler, belediye mecl

- Page 135 and 136:

SayfaPageAçıklama 129 Explanation

- Page 137 and 138:

Tanım ve KavramlarKurumsal olmayan

- Page 139 and 140:

8.3 Genel bütçeli kuruluşlardaki

- Page 141 and 142:

8.2 İşgücü durumuna göre kurum

- Page 143 and 144:

8.4 Ekonomik faaliyet koluna göre

- Page 145 and 146:

8.5 Eğitim durumlarına göre iş

- Page 147 and 148:

8.7 Meslek gruplarına göre istihd

- Page 149 and 150:

8.8 İşteki duruma göre istihdam

- Page 151 and 152:

8.10 İşyerinde çalışan kişi s

- Page 153 and 154:

8.12 Aranılan meslek türüne gör

- Page 155 and 156:

8.13 İş arama sürelerine göre i

- Page 157 and 158:

8.15 İşgücüne dahil olmama nede

- Page 159 and 160:

8.17 Genel bütçeli kuruluşlardak

- Page 161 and 162:

8.18 Özel bütçeli kuruluşlardak

- Page 163 and 164:

TARIMÜlkemizin tarımsal varlığ

- Page 165 and 166:

24(Milyon ton - Million tons)9.1 Se

- Page 167 and 168:

Milyon ton-Million tons9.5 Süt ür

- Page 169 and 170:

9.1 İşletme büyüklüğüne gör

- Page 171 and 172:

9.1 İşletme büyüklüğüne gör

- Page 173 and 174:

9.3 Seçilmiş tahılların ekilen

- Page 175 and 176:

9.5 Seçilmiş baklagillerin ekilen

- Page 177 and 178:

9.7 Seçilmiş yağlı tohumların

- Page 179 and 180:

9.9 Seçilmiş diğer bitkisel ür

- Page 181 and 182:

9.11 Seçilmiş tahıllar ve diğer

- Page 183 and 184:

9.11 Seçilmiş tahıllar ve diğer

- Page 185 and 186:

9.12 Seçilmiş sebzelerin üretimi

- Page 187 and 188:

9.13 Seçilmiş meyve veren ağaç

- Page 189 and 190:

9.14 Seçilmiş meyvelerin üretimi

- Page 191 and 192:

9.15 Sert kabuklu meyve veren ağa

- Page 193 and 194:

9.16 Sert kabuklu meyvelerin üreti

- Page 195 and 196:

9.17 Turunçgiller meyve veren ağa

- Page 197 and 198:

9.18 Turunçgillerin üretimiProduc

- Page 199 and 200:

9.19 Seçilmiş tarımsal alet ve m

- Page 201 and 202:

9.20 Canlı hayvanlar (devam)Livest

- Page 203 and 204:

9.21 Süt üretimi (devam)Milk prod

- Page 205 and 206:

9.22 Et üretimi (devam)Meat produc

- Page 207 and 208:

9.23 Arıcılık ve ipekböcekçili

- Page 209 and 210:

9.25 Kümes hayvanları sayısı ve

- Page 211 and 212:

9.26 Çiftçinin eline geçen fiyat

- Page 213 and 214:

9.26 Çiftçinin eline geçen fiyat

- Page 215 and 216:

9.26 Çiftçinin eline geçen fiyat

- Page 217 and 218:

9.26 Çiftçinin eline geçen fiyat

- Page 219 and 220:

9.26 Çiftçinin eline geçen fiyat

- Page 221 and 222:

9.26 Çiftçinin eline geçen fiyat

- Page 223 and 224:

9.26 Çiftçinin eline geçen fiyat

- Page 225 and 226:

ENERJİBu bölümdeki birincil ener

- Page 227 and 228:

180(Milyar kWh-Billions kWh)10.3 El

- Page 229 and 230:

10.2 Elektrik santrallarında kurul

- Page 231 and 232:

10.3 Santrallara göre elektrik ene

- Page 233 and 234:

10.4 Birincil enerji üretimiPrimar

- Page 235 and 236:

10.5 Birincil enerji üretimi (deva

- Page 237 and 238:

SayfaPageAçıklama 232 Explanation

- Page 239 and 240:

İMALAT SANAYİMANUFACTURING INDUST

- Page 241 and 242:

6. Çıktı : Satışlar ve başkal

- Page 243 and 244:

2003, 2004, 2005 ve 2006 Yıllık S

- Page 245 and 246:

YöntemYıllık Sanayi Ürün İsta

- Page 247 and 248:

TANIM VE KAVRAMLARUlusal yayın kur

- Page 249 and 250:

(Milyon ton -Million tons)565248444

- Page 251 and 252:

(Milyon litre-Million liters)4011.7

- Page 253 and 254:

(Bin adet -Thousand units)11.11 Ça

- Page 255 and 256:

11.15 Kağıt, kağıt ürünleri i

- Page 257 and 258:

11.2 İmalat sanayii, devlet sektö

- Page 259 and 260:

11.4 İmalat sanayiinde; işyeri, i

- Page 261 and 262:

11.6 Dokuma, giyim eşyası ve deri

- Page 263 and 264:

11.8 Kağıt, kağıt ürünleri ve

- Page 265 and 266:

11.10 Taş ve toprağa dayalı sana

- Page 267 and 268:

11.12 Metal eşya, makina ve teçhi

- Page 269 and 270:

11.14 Girişim bazında temel göst

- Page 271 and 272:

11.14 Girişim bazında temel göst

- Page 273 and 274:

11.14 Girişim bazında temel göst

- Page 275 and 276:

11.14 Girişim bazında temel göst

- Page 277 and 278:

11.14 Girişim bazında temel göst

- Page 279 and 280:

11.14 Girişim bazında temel göst

- Page 281 and 282:

11.14 Girişim bazında temel göst

- Page 283 and 284:

11.15 Petrol ürünleri üretimiPro

- Page 285 and 286:

11.17 Şeker, çimento ve kağıt m

- Page 287 and 288:

11.19 Alkollü içkiler üretimiAlc

- Page 289 and 290:

11.21 Gübre sanayii üretimiFertil

- Page 291 and 292:

11.23 Demir çelik sanayii üretimi

- Page 293 and 294:

11.25 Motorlu kara taşıt ulaşım

- Page 295 and 296:

11.27 Dayanıklı tüketim malları

- Page 297 and 298:

11.29 İmalat sanayiinde kapasite k

- Page 299 and 300:

11.31 İmalat sanayiinde kapasite k

- Page 301 and 302:

11.32 İmalat sanayiinde kapasite k

- Page 303 and 304:

11.32 İmalat sanayiinde kapasite k

- Page 305 and 306:

11.33 Sanayi üretim endeksiIndustr

- Page 307 and 308:

11.33 Sanayi üretim endeksi (devam

- Page 309 and 310:

11.34 Sanayi üretim endeksi (devam

- Page 311 and 312:

11.35 Sanayi üretim endeksi deği

- Page 313 and 314:

11.35 Sanayi üretim endeksi deği

- Page 315 and 316:

11.36 Sanayi sektöründe faaliyeti

- Page 317 and 318:

11.37 Mali aracı kuruluşların ek

- Page 319 and 320:

11.37 Mali aracı kuruluşların ek

- Page 321 and 322:

11.37 Mali aracı kuruluşların ek

- Page 323 and 324:

11.37 Mali aracı kuruluşların ek

- Page 325 and 326:

11.37 Mali aracı kuruluşların ek

- Page 327 and 328:

11.37 Mali aracı kuruluşların ek

- Page 329 and 330:

11.37 Mali aracı kuruluşların ek

- Page 331 and 332:

11.37 Mali aracı kuruluşların ek

- Page 333 and 334:

11.37 Mali aracı kuruluşların ek

- Page 335 and 336:

11.37 Mali aracı kuruluşların ek

- Page 337 and 338:

11.37 Mali aracı kuruluşların ek

- Page 339 and 340:

11.38 Yayın kurumu sayısı, istih

- Page 341 and 342:

11.38 Yayın kurumu sayısı, istih

- Page 343 and 344:

11.38 Yayın kurumu sayısı, istih

- Page 345 and 346:

11.39 Yayın türlerine göre bazı

- Page 347 and 348:

11.39 Yayın türlerine göre bazı

- Page 349 and 350:

11.39 Yayın türlerine göre bazı

- Page 351 and 352:

BİNA iNŞAATIYapı İzinleriTÜİK

- Page 353 and 354:

Oda: Döşemeden tavana kadar dört

- Page 355 and 356:

12.1 İnşaatı biten yapılarBuild

- Page 357 and 358:

12.5 Yapı kooperatiflerince yapıl

- Page 359 and 360:

12.2 Kullanma amacına göre tamame

- Page 361 and 362:

12.2 Kullanma amacına göre tamame

- Page 363 and 364:

12.3 Kullanma amacına göre yapıl

- Page 365 and 366:

12.4 Yapı kooperatifleri tarafınd

- Page 367 and 368:

12.6 İkamet amaçlı binaların sa

- Page 369 and 370:

ULAŞTIRMA VE HABERLEŞMEBu bölüm

- Page 371 and 372:

(Bin - Thousand)13.1 Karayolu trafi

- Page 373 and 374:

13.5 Hava meydanlarında toplam yol

- Page 375 and 376:

13.2 Köy yolları uzunluklarıLeng

- Page 377 and 378:

13.4 Cinslerine göre motorlu kara

- Page 379 and 380:

13.5 Karayolu trafik kazalarıRoad

- Page 381 and 382:

13.7 Hava meydanlarında toplam yol

- Page 383 and 384:

13.9 Yurt içi ve yurt dışı post

- Page 385 and 386:

13.10 Posta yolları uzunluğuLengt

- Page 387 and 388:

13.11 Karayolu posta hatları sayı

- Page 389 and 390:

13.12 Telefon abone sayısı, telgr

- Page 391 and 392:

13.13 Limanlara giren ve çıkan ge

- Page 393 and 394:

TURİZMBu bölümdeki veriler Türk

- Page 395 and 396:

14.1 Dış ülkelere giden vatanda

- Page 397 and 398:

(Bin - Thousand)7 0006 5006 0005 50

- Page 399 and 400:

14.9 Turizm işletmesi belgeli kona

- Page 401 and 402:

14.2 Geliş amaçlarına göre gide

- Page 403 and 404:

14.4 Yararlandıkları taşıt çe

- Page 405 and 406:

14.6 Dış yolculuk gelir ve giderl

- Page 407 and 408:

14.8 Turizm yatırım belgeli konak

- Page 409 and 410:

ŞİRKETLER, KOOPERATİFLER VE TİC

- Page 411 and 412:

15.3 Madencilik ve taşocakçılı

- Page 413 and 414:

Kurulan-Established(Bin-Thousand)60

- Page 415 and 416:

15.2 Yeni kurulan, sermayeleri değ

- Page 417 and 418:

15.3 Ekonomik faaliyet kollarına g

- Page 419 and 420:

15.4 Ekonomik faaliyet kollarına g

- Page 421 and 422:

15.5 Ekonomik faaliyet kollarına g

- Page 423 and 424:

15.6 Ekonomik faaliyet kollarına g

- Page 425 and 426:

15.7 Ekonomik faaliyet kollarına g

- Page 427 and 428:

15.8 Ekonomik faaliyet kollarına g

- Page 429 and 430:

DIŞ TİCARETBu bölümdeki veriler

- Page 431 and 432:

(Milyar $-Billion $)16.1 İhracat v

- Page 433 and 434:

(%)16.5 Ekonomik faaliyetlere göre

- Page 435 and 436:

(%)3016.9 Seçilmiş ülkelere yap

- Page 437 and 438:

(Milyon $-Million $)5 00016.13 Cari

- Page 439 and 440:

16.1 İthalat ve ihracat (devam)Imp

- Page 441 and 442:

16.2 Dış ticaret göstergeleri (d

- Page 443 and 444:

16.3 Standart uluslararası ticaret

- Page 445 and 446:

16.4 Standart uluslararası ticaret

- Page 447 and 448:

16.6 Geniş ekonomik grupların sı

- Page 449 and 450:

16.7 İhracat fiyat endeksi (Eski s

- Page 451 and 452:

16.9 İhracat miktar endeksi (Eski

- Page 453 and 454:

16.11 Ekonomik faaliyetlere göre d

- Page 455 and 456:

16.12 Seçilmiş ülkelere yapılan

- Page 457 and 458:

16.12 Seçilmiş ülkelere yapılan

- Page 459 and 460:

16.12 Seçilmiş ülkelere yapılan

- Page 461 and 462:

16.12 Seçilmiş ülkelere yapılan

- Page 463 and 464:

16.13 Seçilmiş ülkelerden yapıl

- Page 465 and 466:

16.13 Seçilmiş ülkelerden yapıl

- Page 467 and 468:

16.13 Seçilmiş ülkelerden yapıl

- Page 469 and 470:

16.13 Seçilmiş ülkelerden yapıl

- Page 471 and 472:

16.14 Ödemeler dengesi (Eski seri)

- Page 473 and 474:

16.14 Ödemeler dengesi (Eski seri)

- Page 475 and 476:

16.14 Ödemeler dengesi (Eski seri)

- Page 477 and 478:

16.14 Ödemeler dengesi (Eski seri)

- Page 479 and 480:

16.14 Ödemeler dengesi (Eski seri)

- Page 481 and 482:

16.14 Ödemeler dengesi (Yeni seri)

- Page 483 and 484:

16.14 Ödemeler dengesi (Yeni seri)

- Page 485 and 486:

16.14 Ödemeler dengesi (Yeni seri)

- Page 487 and 488:

16.14 Ödemeler dengesi (Yeni seri)

- Page 489 and 490:

16.14 Ödemeler dengesi (Yeni seri)

- Page 491 and 492:

SayfaPageAçıklama 485 Explanation

- Page 493 and 494:

Ekonomik, sosyal ve kültürel aç

- Page 495 and 496:

(%)17.1 Ankara şehri tüketici fiy

- Page 497 and 498:

17.1 Seçilmiş gıda maddelerinin

- Page 499 and 500:

17.1 Seçilmiş gıda maddelerinin

- Page 501 and 502:

17.2 Seçilmiş gıda maddelerinin

- Page 503 and 504:

17.2 Seçilmiş gıda maddelerinin

- Page 505 and 506:

17.3 Toptan eşya fiyatları endeks

- Page 507 and 508:

17.3 Toptan eşya fiyatları endeks

- Page 509 and 510:

17.3 Toptan eşya fiyatları endeks

- Page 511 and 512:

17.3 Toptan eşya fiyatları endeks

- Page 513 and 514:

17.4 Toptan eşya fiyatları endeks

- Page 515 and 516:

17.4 Toptan eşya fiyatları endeks

- Page 517 and 518:

17.4 Toptan eşya fiyatları endeks

- Page 519 and 520:

17.4 Toptan eşya fiyatları endeks

- Page 521 and 522:

17.5 Toptan eşya fiyatları endeks

- Page 523 and 524:

17.5 Toptan eşya fiyatları endeks

- Page 525 and 526:

17.5 Toptan eşya fiyatları endeks

- Page 527 and 528:

17.5 Toptan eşya fiyatları endeks

- Page 529 and 530:

17.6 Toptan eşya fiyatları endeks

- Page 531 and 532:

17.6 Toptan eşya fiyatları endeks

- Page 533 and 534:

17.6 Toptan eşya fiyatları endeks

- Page 535 and 536:

17.6 Toptan eşya fiyatları endeks

- Page 537 and 538:

17.7 Toptan eşya fiyatları endeks

- Page 539 and 540:

17.7 Toptan eşya fiyatları endeks

- Page 541 and 542:

17.7 Toptan eşya fiyatları endeks

- Page 543 and 544:

17.8 Toptan eşya fiyatları endeks

- Page 545 and 546:

17.8 Toptan eşya fiyatları endeks

- Page 547 and 548:

17.8 Toptan eşya fiyatları endeks

- Page 549 and 550:

17.9 Fiyat endeksleri ve değişim

- Page 551 and 552:

17.10 Ankara tüketici fiyatları e

- Page 553 and 554:

17.11 İstanbul tüketici fiyatlar

- Page 555 and 556:

17.12 Ankara tüketici fiyatları e

- Page 557 and 558:

17.14 Türkiye tüketici fiyatları

- Page 559 and 560:

17.15 Türkiye tüketici fiyatları

- Page 561 and 562:

17.16 Fiyat endeksleri ve değişim

- Page 563 and 564: 17.19 Sektörlere göre üretici fi

- Page 565 and 566: 17.21 Bina inşaatı maliyet endeks

- Page 567 and 568: PARA VE BANKATanım ve KavramlarBu

- Page 569 and 570: (YTL - TRY)18.3 Döviz KurlarıExch

- Page 571 and 572: (YTL/gr -TRY/gr)5018.7 Külçe alt

- Page 573 and 574: (Milyon YTL /Million TRY)120 00018.

- Page 575 and 576: 18.1 Para Stoku (M1,M2) (devam)Mone

- Page 577 and 578: 18.2 Vade ve türlerine göre mevdu

- Page 579 and 580: 18.4 Döviz kurlarıExchange ratesA

- Page 581 and 582: 18.4 Döviz kurları (devam)Exchang

- Page 583 and 584: 18.5 Altın fiyatları (Yıllık or

- Page 585 and 586: 18.7 Faiz oranlarıInterest rates(%

- Page 587 and 588: 18.9 İMKB fiyat endekslerinin yıl

- Page 589 and 590: SayfaPageAçıklama 583 Explanation

- Page 591 and 592: 19.1 Konsolide bütçe gelir ve har

- Page 593 and 594: (Milyon $ - Millon $)300 00019.5 D

- Page 595 and 596: 19.1 Genel bütçe, bütçe ve kesi

- Page 597 and 598: 19.3 Katma bütçeli kuruluşların

- Page 599 and 600: 19.4 Hazine gelirlerinin türlerine

- Page 601 and 602: 19.5 Konsolide bütçe dengesi (Esk

- Page 603 and 604: 19.5 Konsolide bütçe dengesi (Esk

- Page 605 and 606: 19.5 Konsolide bütçe dengesi (Esk

- Page 607 and 608: 19.5 Konsolide bütçe dengesi ve f

- Page 609 and 610: 19.6 Konsolide bütçe gelir ve har

- Page 611 and 612: 19.6 Konsolide bütçe gelir ve har

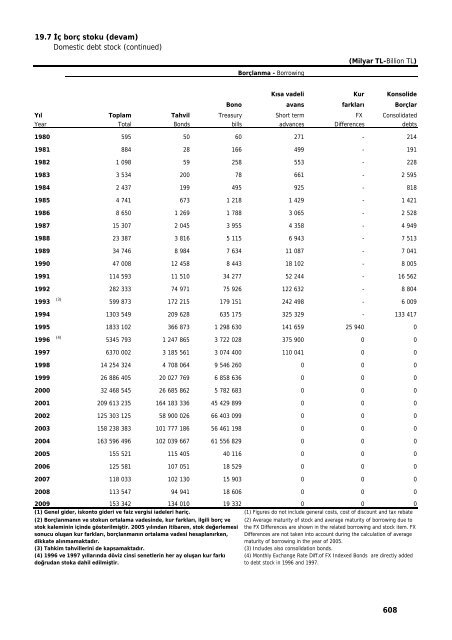

- Page 613: 19.7 İç borç stokuDomestic debt

- Page 617 and 618: 19.7 İç borç stoku (devam)Domest

- Page 619 and 620: 19.8 İç borç stokuna ait bazı g

- Page 621 and 622: 19.9 Dış borçlara ait bazı gös

- Page 623 and 624: 19.10 Dış Borç Stokunun Profili

- Page 625 and 626: 19.10 Dış Borç Stokunun Profili

- Page 627 and 628: 19.11 Dış borç stoku (devam)Outs

- Page 629 and 630: 19.11 Dış borç stoku (devam)Outs

- Page 631 and 632: 19.11 Dış borç stoku (devam)Outs

- Page 633 and 634: 19.11 Dış borç stoku (devam)Outs

- Page 635 and 636: 19.11 Dış borç stoku (devam)Outs

- Page 637 and 638: 19.12 Borçluya göre dış borç s

- Page 639 and 640: 19.12 Borçluya göre dış borç s

- Page 641 and 642: 19.13 Alacaklıya göre dış borç

- Page 643 and 644: 19.13 Alacaklıya göre dış borç

- Page 645 and 646: 20.19 GSYH sektörel büyüme hızl

- Page 647 and 648: 2(Bin YTL-Thousand TRY)20.1 Kişi b

- Page 649 and 650: 100(%)20.5 Sabit fiyatlarla GSYH se

- Page 651 and 652: 20.1 Ana iktisadi faaliyet kolları

- Page 653 and 654: 20.2 Ana iktisadi faaliyet kolları

- Page 655 and 656: 20.3 Kişi başına Gayri Safi Yurt

- Page 657 and 658: 20.6 Ana iktisadi faaliyet kolları

- Page 659 and 660: 20.8 İktisadi faaliyet kollarına

- Page 661 and 662: 20.8 İktisadi faaliyet kollarına

- Page 663 and 664: 20.8 İktisadi faaliyet kollarına

- Page 665 and 666:

20.8 İktisadi faaliyet kollarına

- Page 667 and 668:

20.8 İktisadi faaliyet kollarına

- Page 669 and 670:

20.8 İktisadi faaliyet kollarına

- Page 671 and 672:

20.9 İktisadi faaliyet kollarına

- Page 673 and 674:

20.10 İktisadi faaliyet kollarına

- Page 675 and 676:

20.10 İktisadi faaliyet kollarına

- Page 677 and 678:

20.11 İktisadi faaliyet kollarına

- Page 679 and 680:

20.11 İktisadi faaliyet kollarına

- Page 681 and 682:

20.12 İktisadi faaliyet kollarına

- Page 683 and 684:

20.12 İktisadi faaliyet kollarına

- Page 685 and 686:

20.13 İktisadi faaliyet kollarına

- Page 687 and 688:

20.14 Kişi başına Gayri Safi Mil

- Page 689 and 690:

20.16 Sektörlerin Gayri Safi Milli

- Page 691 and 692:

20.17 Sektörlerin Gayri Safi Yurti

- Page 693 and 694:

20.18 Sektörlerin Gayri Safi Yurti

- Page 695 and 696:

20.19 GSYH sektörel büyüme hızl

- Page 697 and 698:

20.20 GSYH sektörel büyüme hızl

- Page 699 and 700:

20.21 Harcamalar yöntemiyle Gayri

- Page 701 and 702:

20.22 Harcamalar yöntemiyle Gayri

- Page 703 and 704:

20.22 Harcamalar yöntemiyle Gayri

- Page 705 and 706:

20.23 Harcamalar yöntemiyle Gayri

- Page 707 and 708:

20.24 Harcamalar yöntemiyle Gayri

- Page 709 and 710:

20.24 Harcamalar yöntemiyle Gayri

- Page 711 and 712:

20.25 Harcamalar yöntemiyle Gayri

- Page 713 and 714:

20.26 Harcamalar yöntemiyle Gayri

- Page 715 and 716:

20.26 Harcamalar yöntemiyle Gayri

- Page 717 and 718:

20.28 Harcamalar yöntemiyle Gayri

- Page 719 and 720:

20.30 Harcamalar yöntemiyle Gayri

- Page 721 and 722:

20.32 Harcamalar yöntemiyle Gayri

- Page 723 and 724:

20.34 Yerleşik ve yerleşik olmaya

- Page 725 and 726:

20.36 Gelir yöntemiyle Gayri Safi

- Page 727:

İlgili bilgilere ulaşmak için…