UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

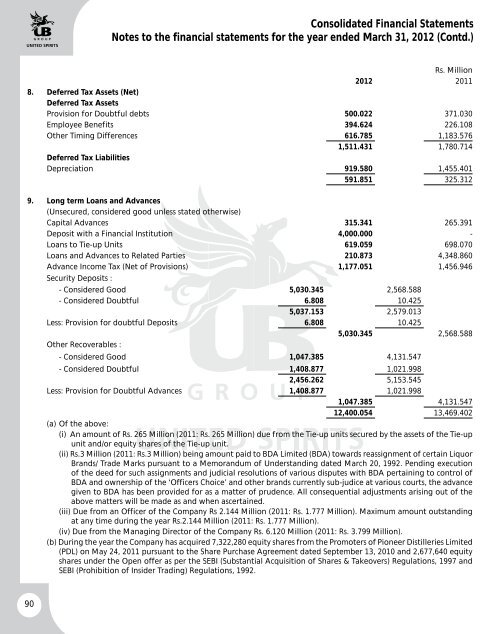

Consolidated Financial StatementsNotes to the financial statements for the year ended March 31, 2012 (Contd.)Rs. Million2012 20118. Deferred Tax Assets (Net)Deferred Tax AssetsProvision for Doubtful debts 500.022 371.030Employee Benefits 394.624 226.108Other Timing Differences 616.785 1,183.5761,511.431 1,780.714Deferred Tax LiabilitiesDepreciation 919.580 1,455.401591.851 325.3129. Long term Loans and Advances(Unsecured, considered good unless stated otherwise)Capital Advances 315.341 265.391Deposit with a Financial Institution 4,000.000 -Loans to Tie-up Units 619.059 698.070Loans and Advances to Related Parties 210.873 4,348.860Advance Income Tax (Net of Provisions) 1,177.051 1,456.946Security Deposits :- Considered Good 5,030.345 2,568.588- Considered Doubtful 6.808 10.4255,037.153 2,579.013Less: Provision for doubtful Deposits 6.808 10.4255,030.345 2,568.588Other Recoverables :- Considered Good 1,047.385 4,131.547- Considered Doubtful 1,408.877 1,021.9982,456.262 5,153.545Less: Provision for Doubtful Advances 1,408.877 1,021.9981,047.385 4,131.54712,400.054 13,469.402(a) Of the above:(i) An amount of Rs. 265 Million (2011: Rs. 265 Million) due from the Tie-up units secured by the assets of the Tie-upunit and/or equity shares of the Tie-up unit.(ii) Rs.3 Million (2011: Rs.3 Million) being amount paid to BDA <strong>Limited</strong> (BDA) towards reassignment of certain LiquorBrands/ Trade Marks pursuant to a Memorandum of Understanding dated March 20, 1992. Pending executionof the deed for such assignments and judicial resolutions of various disputes with BDA pertaining to control ofBDA and ownership of the ‘Officers Choice’ and other brands currently sub-judice at various courts, the advancegiven to BDA has been provided for as a matter of prudence. All consequential adjustments arising out of theabove matters will be made as and when ascertained.(iii) Due from an Officer of the Company Rs 2.144 Million (2011: Rs. 1.777 Million). Maximum amount outstandingat any time during the year Rs.2.144 Million (2011: Rs. 1.777 Million).(iv) Due from the Managing Director of the Company Rs. 6.120 Million (2011: Rs. 3.799 Million).(b) During the year the Company has acquired 7,322,280 equity shares from the Promoters of Pioneer Distilleries <strong>Limited</strong>(PDL) on May 24, 2011 pursuant to the Share Purchase Agreement dated September 13, 2010 and 2,677,640 equityshares under the Open offer as per the SEBI (Substantial Acquisition of Shares & Takeovers) Regulations, 1997 andSEBI (Prohibition of Insider Trading) Regulations, 1992.90