UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

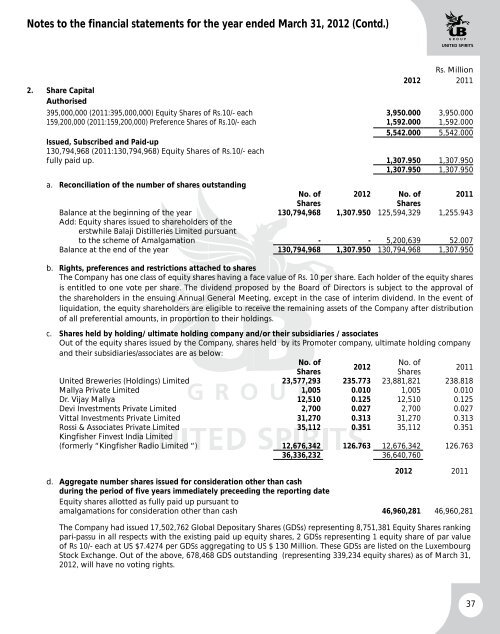

Notes to the financial statements for the year ended March 31, 2012 (Contd.)Rs. Million2012 20112. Share CapitalAuthorised395,000,000 (2011:395,000,000) Equity Shares of Rs.10/- each 3,950.000 3,950.000159,200,000 (2011:159,200,000) Preference Shares of Rs.10/- each 1,592.000 1,592.0005,542.000 5,542.000Issued, Subscribed and Paid-up130,794,968 (2011:130,794,968) Equity Shares of Rs.10/- eachfully paid up. 1,307.950 1,307.9501,307.950 1,307.950a. Reconciliation of the number of shares outstandingNo. of 2012 No. of 2011SharesSharesBalance at the beginning of the year 130,794,968 1,307.950 125,594,329 1,255.943Add: Equity shares issued to shareholders of theerstwhile Balaji Distilleries <strong>Limited</strong> pursuantto the scheme of Amalgamation - - 5,200,639 52.007Balance at the end of the year 130,794,968 1,307.950 130,794,968 1,307.950b. Rights, preferences and restrictions attached to sharesThe Company has one class of equity shares having a face value of Rs. 10 per share. Each holder of the equity sharesis entitled to one vote per share. The dividend proposed by the Board of Directors is subject to the approval ofthe shareholders in the ensuing Annual General Meeting, except in the case of interim dividend. In the event ofliquidation, the equity shareholders are eligible to receive the remaining assets of the Company after distributionof all preferential amounts, in proportion to their holdings.c. Shares held by holding/ ultimate holding company and/or their subsidiaries / associatesOut of the equity shares issued by the Company, shares held by its Promoter company, ultimate holding companyand their subsidiaries/associates are as below:No. ofNo. of2012SharesShares2011<strong>United</strong> Breweries (Holdings) <strong>Limited</strong> 23,577,293 235.773 23,881,821 238.818Mallya Private <strong>Limited</strong> 1,005 0.010 1,005 0.010Dr. Vijay Mallya 12,510 0.125 12,510 0.125Devi Investments Private <strong>Limited</strong> 2,700 0.027 2,700 0.027Vittal Investments Private <strong>Limited</strong> 31,270 0.313 31,270 0.313Rossi & Associates Private <strong>Limited</strong> 35,112 0.351 35,112 0.351Kingfisher Finvest India <strong>Limited</strong>(formerly “Kingfisher Radio <strong>Limited</strong> “) 12,676,342 126.763 12,676,342 126.76336,336,232 36,640,7602012 2011d. Aggregate number shares issued for consideration other than cashduring the period of five years immediately preceeding the <strong>report</strong>ing dateEquity shares allotted as fully paid up pursuant toamalgamations for consideration other than cash 46,960,281 46,960,281The Company had issued 17,502,762 Global Depositary Shares (GDSs) representing 8,751,381 Equity Shares rankingpari-passu in all respects with the existing paid up equity shares, 2 GDSs representing 1 equity share of par valueof Rs 10/- each at US $7.4274 per GDSs aggregating to US $ 130 Million. These GDSs are listed on the LuxembourgStock Exchange. Out of the above, 678,468 GDS outstanding (representing 339,234 equity shares) as of March 31,2012, will have no voting rights.37