UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

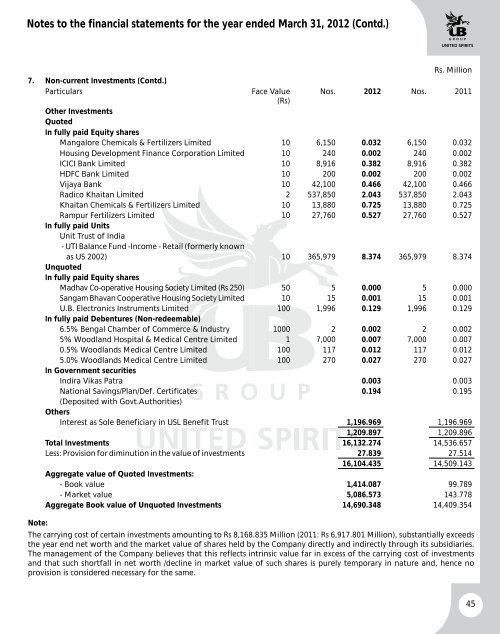

Notes to the financial statements for the year ended March 31, 2012 (Contd.)7. Non-current Investments (Contd.)ParticularsFace Value(Rs)Rs. MillionNos. 2012 Nos. 2011Other InvestmentsQuotedIn fully paid Equity sharesMangalore Chemicals & Fertilizers <strong>Limited</strong> 10 6,150 0.032 6,150 0.032Housing Development Finance Corporation <strong>Limited</strong> 10 240 0.002 240 0.002ICICI Bank <strong>Limited</strong> 10 8,916 0.382 8,916 0.382HDFC Bank <strong>Limited</strong> 10 200 0.002 200 0.002Vijaya Bank 10 42,100 0.466 42,100 0.466Radico Khaitan <strong>Limited</strong> 2 537,850 2.043 537,850 2.043Khaitan Chemicals & Fertilizers <strong>Limited</strong> 10 13,880 0.725 13,880 0.725Rampur Fertilizers <strong>Limited</strong> 10 27,760 0.527 27,760 0.527In fully paid UnitsUnit Trust of India- UTI Balance Fund -Income - Retail (formerly knownas US 2002) 10 365,979 8.374 365,979 8.374UnquotedIn fully paid Equity sharesMadhav Co-operative Housing Society <strong>Limited</strong> (Rs.250) 50 5 0.000 5 0.000Sangam Bhavan Cooperative Housing Society <strong>Limited</strong> 10 15 0.001 15 0.001U.B. Electronics Instruments <strong>Limited</strong> 100 1,996 0.129 1,996 0.129In fully paid Debentures (Non-redeemable)6.5% Bengal Chamber of Commerce & Industry 1000 2 0.002 2 0.0025% Woodland Hospital & Medical Centre <strong>Limited</strong> 1 7,000 0.007 7,000 0.0070.5% Woodlands Medical Centre <strong>Limited</strong> 100 117 0.012 117 0.0125.0% Woodlands Medical Centre <strong>Limited</strong> 100 270 0.027 270 0.027In Government securitiesIndira Vikas Patra 0.003 0.003National Savings/Plan/Def. Certificates 0.194 0.195(Deposited with Govt.Authorities)OthersInterest as Sole Beneficiary in USL Benefit Trust 1,196.969 1,196.9691,209.897 1,209.896Total Investments 16,132.274 14,536.657Less: Provision for diminution in the value of investments 27.839 27.51416,104.435 14,509.143Aggregate value of Quoted Investments:- Book value 1,414.087 99.789- Market value 5,086.573 143.778Aggregate Book value of Unquoted Investments 14,690.348 14,409.354Note:The carrying cost of certain investments amounting to Rs 8,168.835 Million (2011: Rs 6,917.801 Million), substantially exceedsthe year end net worth and the market value of shares held by the Company directly and indirectly through its subsidiaries.The management of the Company believes that this reflects intrinsic value far in excess of the carrying cost of investmentsand that such shortfall in net worth /decline in market value of such shares is purely temporary in nature and, hence noprovision is considered necessary for the same.45