UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

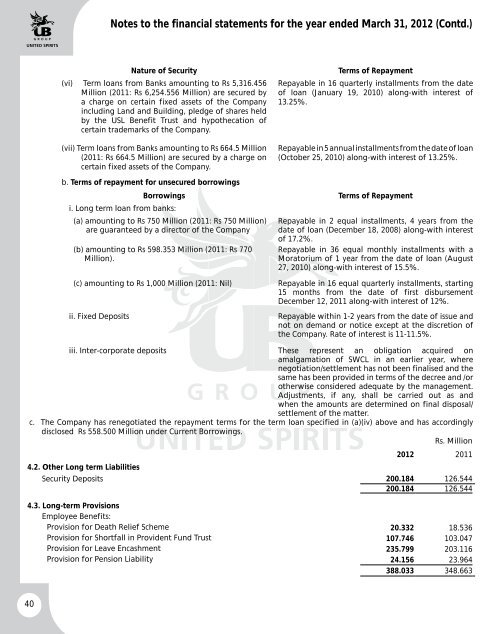

Notes to the financial statements for the year ended March 31, 2012 (Contd.)Nature of Security(vi) Term loans from Banks amounting to Rs 5,316.456Million (2011: Rs 6,254.556 Million) are secured bya charge on certain fixed assets of the Companyincluding Land and Building, pledge of shares heldby the USL Benefit Trust and hypothecation ofcertain trademarks of the Company.(vii) Term loans from Banks amounting to Rs 664.5 Million(2011: Rs 664.5 Million) are secured by a charge oncertain fixed assets of the Company.b. Terms of repayment for unsecured borrowingsBorrowingsi. Long term loan from banks:(a) amounting to Rs 750 Million (2011: Rs 750 Million)are guaranteed by a director of the Company(b) amounting to Rs 598.353 Million (2011: Rs 770Million).(c) amounting to Rs 1,000 Million (2011: Nil)ii. Fixed DepositsTerms of RepaymentRepayable in 16 quarterly installments from the dateof loan (January 19, 2010) along-with interest of13.25%.Repayable in 5 <strong>annual</strong> installments from the date of loan(October 25, 2010) along-with interest of 13.25%.Terms of RepaymentRepayable in 2 equal installments, 4 years from thedate of loan (December 18, 2008) along-with interestof 17.2%.Repayable in 36 equal monthly installments with aMoratorium of 1 year from the date of loan (August27, 2010) along-with interest of 15.5%.Repayable in 16 equal quarterly installments, starting15 months from the date of first disbursementDecember 12, 2011 along-with interest of 12%.Repayable within 1-2 years from the date of issue andnot on demand or notice except at the discretion ofthe Company. Rate of interest is 11-11.5%.iii. Inter-corporate deposits These represent an obligation acquired onamalgamation of SWCL in an earlier year, wherenegotiation/settlement has not been finalised and thesame has been provided in terms of the decree and /orotherwise considered adequate by the management.Adjustments, if any, shall be carried out as andwhen the amounts are determined on final disposal/settlement of the matter.c. The Company has renegotiated the repayment terms for the term loan specified in (a)(iv) above and has accordinglydisclosed Rs 558.500 Million under Current Borrowings.Rs. Million2012 20114.2. Other Long term LiabilitiesSecurity Deposits 200.184 126.544200.184 126.5444.3. Long-term ProvisionsEmployee Benefits:Provision for Death Relief Scheme 20.332 18.536Provision for Shortfall in Provident Fund Trust 107.746 103.047Provision for Leave Encashment 235.799 203.116Provision for Pension Liability 24.156 23.964388.033 348.66340