UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

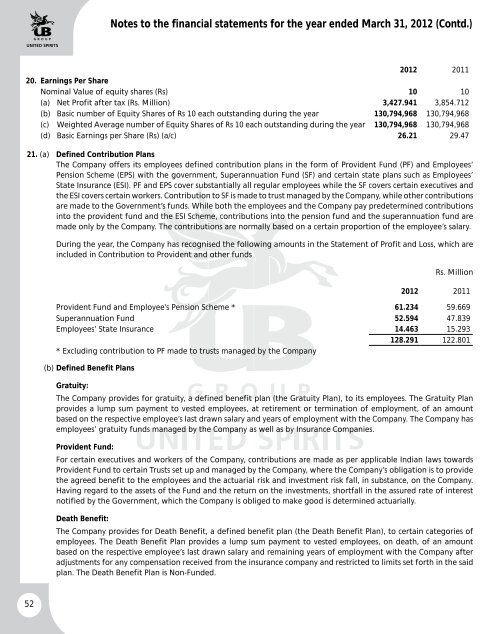

Notes to the financial statements for the year ended March 31, 2012 (Contd.)2012 201120. Earnings Per ShareNominal Value of equity shares (Rs) 10 10(a) Net Profit after tax (Rs. Million) 3,427.941 3,854.712(b) Basic number of Equity Shares of Rs 10 each outstanding during the year 130,794,968 130,794,968(c) Weighted Average number of Equity Shares of Rs 10 each outstanding during the year 130,794,968 130,794,968(d) Basic Earnings per Share (Rs) (a/c) 26.21 29.4721. (a) Defined Contribution PlansThe Company offers its employees defined contribution plans in the form of Provident Fund (PF) and Employees’Pension Scheme (EPS) with the government, Superannuation Fund (SF) and certain state plans such as Employees’State Insurance (ESI). PF and EPS cover substantially all regular employees while the SF covers certain executives andthe ESI covers certain workers. Contribution to SF is made to trust managed by the Company, while other contributionsare made to the Government’s funds. While both the employees and the Company pay predetermined contributionsinto the provident fund and the ESI Scheme, contributions into the pension fund and the superannuation fund aremade only by the Company. The contributions are normally based on a certain proportion of the employee’s salary.During the year, the Company has recognised the following amounts in the Statement of Profit and Loss, which areincluded in Contribution to Provident and other fundsRs. Million2012 2011Provident Fund and Employee’s Pension Scheme * 61.234 59.669Superannuation Fund 52.594 47.839Employees’ State Insurance 14.463 15.293128.291 122.801* Excluding contribution to PF made to trusts managed by the Company(b) Defined Benefit PlansGratuity:The Company provides for gratuity, a defined benefit plan (the Gratuity Plan), to its employees. The Gratuity Planprovides a lump sum payment to vested employees, at retirement or termination of employment, of an amountbased on the respective employee’s last drawn salary and years of employment with the Company. The Company hasemployees’ gratuity funds managed by the Company as well as by Insurance Companies.Provident Fund:For certain executives and workers of the Company, contributions are made as per applicable Indian laws towardsProvident Fund to certain Trusts set up and managed by the Company, where the Company’s obligation is to providethe agreed benefit to the employees and the actuarial risk and investment risk fall, in substance, on the Company.Having regard to the assets of the Fund and the return on the investments, shortfall in the assured rate of interestnotified by the Government, which the Company is obliged to make good is determined actuarially.Death Benefit:The Company provides for Death Benefit, a defined benefit plan (the Death Benefit Plan), to certain categories ofemployees. The Death Benefit Plan provides a lump sum payment to vested employees, on death, of an amountbased on the respective employee’s last drawn salary and remaining years of employment with the Company afteradjustments for any compensation received from the insurance company and restricted to limits set forth in the saidplan. The Death Benefit Plan is Non-Funded.52