UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

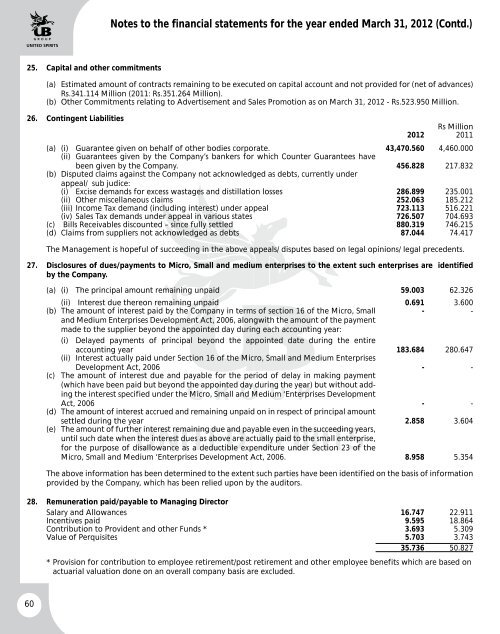

Notes to the financial statements for the year ended March 31, 2012 (Contd.)25. Capital and other commitments(a) Estimated amount of contracts remaining to be executed on capital account and not provided for (net of advances)Rs.341.114 Million (2011: Rs.351.264 Million).(b) Other Commitments relating to Advertisement and Sales Promotion as on March 31, 2012 - Rs.523.950 Million.26. Contingent LiabilitiesRs Million2012 2011(a) (i) Guarantee given on behalf of other bodies corporate. 43,470.560 4,460.000(ii) Guarantees given by the Company’s bankers for which Counter Guarantees havebeen given by the Company. 456.828 217.832(b) Disputed claims against the Company not acknowledged as debts, currently underappeal/ sub judice:(i) Excise demands for excess wastages and distillation losses 286.899 235.001(ii) Other miscellaneous claims 252.063 185.212(iii) Income Tax demand (including interest) under appeal 723.113 516.221(iv) Sales Tax demands under appeal in various states 726.507 704.693(c) Bills Receivables discounted – since fully settled 880.319 746.215(d) Claims from suppliers not acknowledged as debts 87.044 74.417The Management is hopeful of succeeding in the above appeals/ disputes based on legal opinions/ legal precedents.27. Disclosures of dues/payments to Micro, Small and medium enterprises to the extent such enterprises are identifiedby the Company.(a) (i) The principal amount remaining unpaid 59.003 62.326(ii) Interest due thereon remaining unpaid 0.691 3.600(b) The amount of interest paid by the Company in terms of section 16 of the Micro, Small- -and Medium Enterprises Development Act, 2006, alongwith the amount of the paymentmade to the supplier beyond the appointed day during each accounting year:(i) Delayed payments of principal beyond the appointed date during the entireaccounting year 183.684 280.647(ii) Interest actually paid under Section 16 of the Micro, Small and Medium EnterprisesDevelopment Act, 2006 - -(c) The amount of interest due and payable for the period of delay in making payment(which have been paid but beyond the appointed day during the year) but without addingthe interest specified under the Micro, Small and Medium ‘Enterprises DevelopmentAct, 2006 - -(d) The amount of interest accrued and remaining unpaid on in respect of principal amountsettled during the year 2.858 3.604(e) The amount of further interest remaining due and payable even in the succeeding years,until such date when the interest dues as above are actually paid to the small enterprise,for the purpose of disallowance as a deductible expenditure under Section 23 of theMicro, Small and Medium ‘Enterprises Development Act, 2006. 8.958 5.354The above information has been determined to the extent such parties have been identified on the basis of informationprovided by the Company, which has been relied upon by the auditors.28. Remuneration paid/payable to Managing DirectorSalary and Allowances 16.747 22.911Incentives paid 9.595 18.864Contribution to Provident and other Funds * 3.693 5.309Value of Perquisites 5.703 3.74335.736 50.827* Provision for contribution to employee retirement/post retirement and other employee benefits which are based onactuarial valuation done on an overall company basis are excluded.60