UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

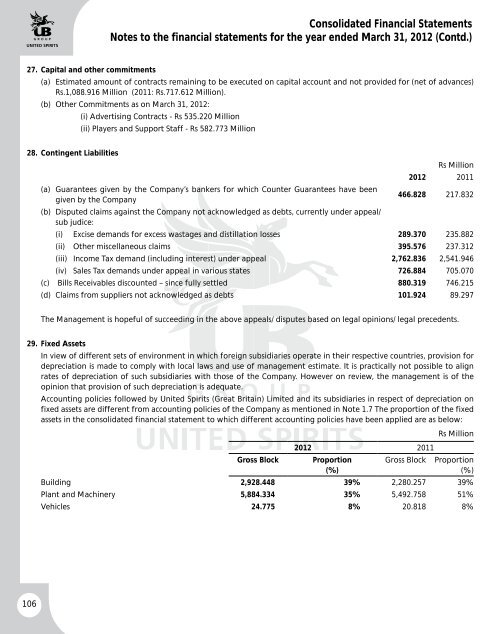

Consolidated Financial StatementsNotes to the financial statements for the year ended March 31, 2012 (Contd.)27. Capital and other commitments(a) Estimated amount of contracts remaining to be executed on capital account and not provided for (net of advances)Rs.1,088.916 Million (2011: Rs.717.612 Million).(b) Other Commitments as on March 31, 2012:(i) Advertising Contracts - Rs 535.220 Million(ii) Players and Support Staff - Rs 582.773 Million28. Contingent LiabilitiesRs Million2012 2011(a) Guarantees given by the Company’s bankers for which Counter Guarantees have beengiven by the Company466.828 217.832(b) Disputed claims against the Company not acknowledged as debts, currently under appeal/sub judice:(i) Excise demands for excess wastages and distillation losses 289.370 235.882(ii) Other miscellaneous claims 395.576 237.312(iii) Income Tax demand (including interest) under appeal 2,762.836 2,541.946(iv) Sales Tax demands under appeal in various states 726.884 705.070(c) Bills Receivables discounted – since fully settled 880.319 746.215(d) Claims from suppliers not acknowledged as debts 101.924 89.297The Management is hopeful of succeeding in the above appeals/ disputes based on legal opinions/ legal precedents.29. Fixed AssetsIn view of different sets of environment in which foreign subsidiaries operate in their respective countries, provision fordepreciation is made to comply with local laws and use of management estimate. It is practically not possible to alignrates of depreciation of such subsidiaries with those of the Company. However on review, the management is of theopinion that provision of such depreciation is adequate.Accounting policies followed by <strong>United</strong> <strong>Spirits</strong> (Great Britain) <strong>Limited</strong> and its subsidiaries in respect of depreciation onfixed assets are different from accounting policies of the Company as mentioned in Note 1.7 The proportion of the fixedassets in the consolidated financial statement to which different accounting policies have been applied are as below:Rs Million2012 2011Gross Block Proportion(%)Gross Block Proportion(%)Building 2,928.448 39% 2,280.257 39%Plant and Machinery 5,884.334 35% 5,492.758 51%Vehicles 24.775 8% 20.818 8%106