UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

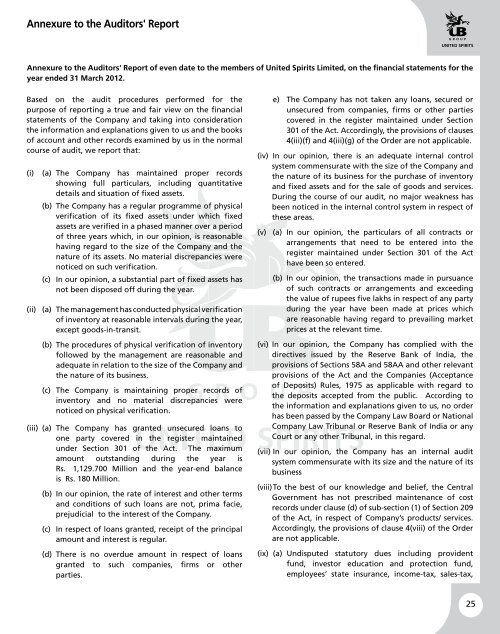

Annexure to the Auditors' ReportAnnexure to the Auditors' Report of even date to the members of <strong>United</strong> <strong>Spirits</strong> <strong>Limited</strong>, on the financial statements for theyear ended 31 March 2012.Based on the audit procedures performed for thepurpose of <strong>report</strong>ing a true and fair view on the financialstatements of the Company and taking into considerationthe information and explanations given to us and the booksof account and other records examined by us in the normalcourse of audit, we <strong>report</strong> that:(i)(a) The Company has maintained proper recordsshowing full particulars, including quantitativedetails and situation of fixed assets.(b) The Company has a regular programme of physicalverification of its fixed assets under which fixedassets are verified in a phased manner over a periodof three years which, in our opinion, is reasonablehaving regard to the size of the Company and thenature of its assets. No material discrepancies werenoticed on such verification.(c) In our opinion, a substantial part of fixed assets hasnot been disposed off during the year.(ii) (a) The management has conducted physical verificationof inventory at reasonable intervals during the year,except goods-in-transit.(b) The procedures of physical verification of inventoryfollowed by the management are reasonable andadequate in relation to the size of the Company andthe nature of its business.(c) The Company is maintaining proper records ofinventory and no material discrepancies werenoticed on physical verification.(iii) (a) The Company has granted unsecured loans toone party covered in the register maintainedunder Section 301 of the Act. The maximumamount outstanding during the year isRs. ₹1,129.700 Million and the year-end balanceis ₹Rs. 180 Million.(b) In our opinion, the rate of interest and other termsand conditions of such loans are not, prima facie,prejudicial to the interest of the Company.(c) In respect of loans granted, receipt of the principalamount and interest is regular.(d) There is no overdue amount in respect of loansgranted to such companies, firms or otherparties.e) The Company has not taken any loans, secured orunsecured from companies, firms or other partiescovered in the register maintained under Section301 of the Act. Accordingly, the provisions of clauses4(iii)(f) and 4(iii)(g) of the Order are not applicable.(iv) In our opinion, there is an adequate internal controlsystem commensurate with the size of the Company andthe nature of its business for the purchase of inventoryand fixed assets and for the sale of goods and services.During the course of our audit, no major weakness hasbeen noticed in the internal control system in respect ofthese areas.(v) (a) In our opinion, the particulars of all contracts orarrangements that need to be entered into theregister maintained under Section 301 of the Acthave been so entered.(b) In our opinion, the transactions made in pursuanceof such contracts or arrangements and exceedingthe value of rupees five lakhs in respect of any partyduring the year have been made at prices whichare reasonable having regard to prevailing marketprices at the relevant time.(vi) In our opinion, the Company has complied with thedirectives issued by the Reserve Bank of India, theprovisions of Sections 58A and 58AA and other relevantprovisions of the Act and the Companies (Acceptanceof Deposits) Rules, 1975 as applicable with regard tothe deposits accepted from the public. According tothe information and explanations given to us, no orderhas been passed by the Company Law Board or NationalCompany Law Tribunal or Reserve Bank of India or anyCourt or any other Tribunal, in this regard.(vii) In our opinion, the Company has an internal auditsystem commensurate with its size and the nature of itsbusiness(viii) To the best of our knowledge and belief, the CentralGovernment has not prescribed maintenance of costrecords under clause (d) of sub-section (1) of Section 209of the Act, in respect of Company’s products/ services.Accordingly, the provisions of clause 4(viii) of the Orderare not applicable.(ix) (a) Undisputed statutory dues including providentfund, investor education and protection fund,employees’ state insurance, income-tax, sales-tax,25