UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

UBHL annual report - United Spirits Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

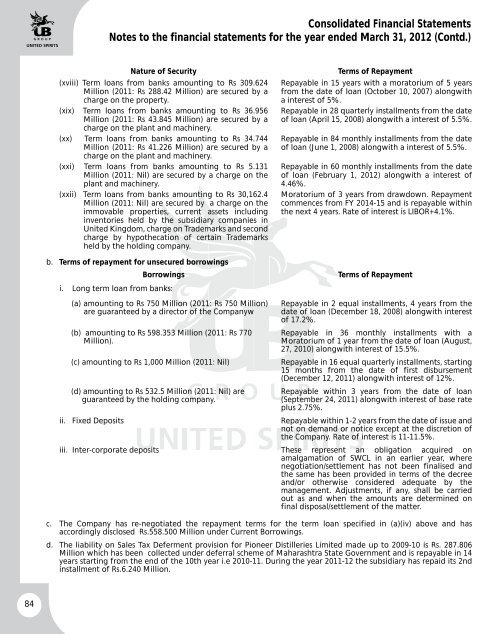

Consolidated Financial StatementsNotes to the financial statements for the year ended March 31, 2012 (Contd.)Nature of Security(xviii) Term loans from banks amounting to Rs 309.624Million (2011: Rs 288.42 Million) are secured by acharge on the property.(xix) Term loans from banks amounting to Rs 36.956Million (2011: Rs 43.845 Million) are secured by acharge on the plant and machinery.(xx) Term loans from banks amounting to Rs 34.744Million (2011: Rs 41.226 Million) are secured by acharge on the plant and machinery.(xxi) Term loans from banks amounting to Rs 5.131Million (2011: Nil) are secured by a charge on theplant and machinery.(xxii) Term loans from banks amounting to Rs 30,162.4Million (2011: Nil) are secured by a charge on theimmovable properties, current assets includinginventories held by the subsidiary companies in<strong>United</strong> Kingdom, charge on Trademarks and secondcharge by hypothecation of certain Trademarksheld by the holding company.Terms of RepaymentRepayable in 15 years with a moratorium of 5 yearsfrom the date of loan (October 10, 2007) alongwitha interest of 5%.Repayable in 28 quarterly installments from the dateof loan (April 15, 2008) alongwith a interest of 5.5%.Repayable in 84 monthly installments from the dateof loan (June 1, 2008) alongwith a interest of 5.5%.Repayable in 60 monthly installments from the dateof loan (February 1, 2012) alongwith a interest of4.46%.Moratorium of 3 years from drawdown. Repaymentcommences from FY 2014-15 and is repayable withinthe next 4 years. Rate of interest is LIBOR+4.1%.b. Terms of repayment for unsecured borrowingsBorrowingsi. Long term loan from banks:(a) amounting to Rs 750 Million (2011: Rs 750 Million)are guaranteed by a director of the Companyw(b) amounting to Rs 598.353 Million (2011: Rs 770Million).(c) amounting to Rs 1,000 Million (2011: Nil)(d) amounting to Rs 532.5 Million (2011: Nil) areguaranteed by the holding company.ii. Fixed DepositsTerms of RepaymentRepayable in 2 equal installments, 4 years from thedate of loan (December 18, 2008) alongwith interestof 17.2%.Repayable in 36 monthly installments with aMoratorium of 1 year from the date of loan (August,27, 2010) alongwith interest of 15.5%.Repayable in 16 equal quarterly installments, starting15 months from the date of first disbursement(December 12, 2011) alongwith interest of 12%.Repayable within 3 years from the date of loan(September 24, 2011) alongwith interest of base rateplus 2.75%.Repayable within 1-2 years from the date of issue andnot on demand or notice except at the discretion ofthe Company. Rate of interest is 11-11.5%.iii. Inter-corporate deposits These represent an obligation acquired onamalgamation of SWCL in an earlier year, wherenegotiation/settlement has not been finalised andthe same has been provided in terms of the decreeand/or otherwise considered adequate by themanagement. Adjustments, if any, shall be carriedout as and when the amounts are determined onfinal disposal/settlement of the matter.c. The Company has re-negotiated the repayment terms for the term loan specified in (a)(iv) above and hasaccordingly disclosed Rs.558.500 Million under Current Borrowings.d. The liability on Sales Tax Deferment provision for Pioneer Distilleries <strong>Limited</strong> made up to 2009-10 is Rs. 287.806Million which has been collected under deferral scheme of Maharashtra State Government and is repayable in 14years starting from the end of the 10th year i.e 2010-11. During the year 2011-12 the subsidiary has repaid its 2ndinstallment of Rs.6.240 Million.84