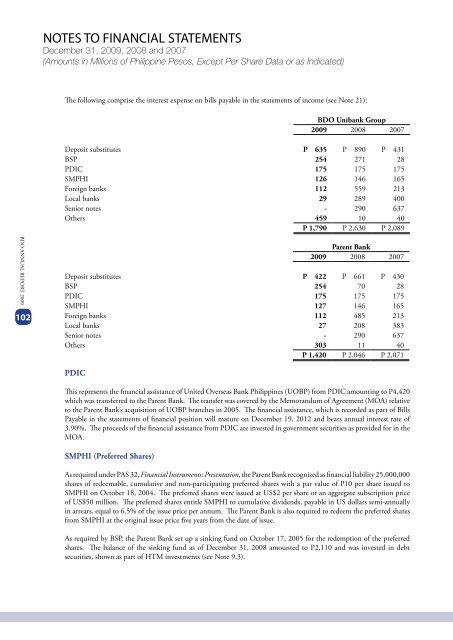

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)The following comprise the interest expense on bills payable in the statements of income (see Note 21):<strong>BDO</strong> Unibank Group<strong>2009</strong> 2008 2007Deposit substitutes P 635 P 890 P 431BSP 254 271 28PDIC 175 175 175SMPHI 126 146 165Foreign banks 112 559 213Local banks 29 289 400Senior notes - 290 637Others 459 10 40P 1,790 P 2,630 P 2,089<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>102Parent Bank<strong>2009</strong> 2008 2007Deposit substitutes P 422 P 661 P 430BSP 254 70 28PDIC 175 175 175SMPHI 127 146 165Foreign banks 112 485 213Local banks 27 208 383Senior notes - 290 637Others 303 11 40P 1,420 P 2,046 P 2,071PDICThis represents the financial assistance of United Overseas Bank Philippines (UOBP) from PDIC amounting to P4,420which was transferred to the Parent Bank. The transfer was covered by the Memorandum of Agreement (MOA) relativeto the Parent Bank’s acquisition of UOBP branches in 2005. The financial assistance, which is recorded as part of BillsPayable in the statements of financial position will mature on December 19, 2012 and bears annual interest rate of3.90%. The proceeds of the financial assistance from PDIC are invested in government securities as provided for in theMOA.SMPHI (Preferred Shares)As required under PAS 32, Financial Instruments: Presentation, the Parent Bank recognized as financial liability 25,000,000shares of redeemable, cumulative and non-participating preferred shares with a par value of P10 per share issued toSMPHI on October 18, 2004. The preferred shares were issued at US$2 per share or an aggregate subscription priceof US$50 million. The preferred shares entitle SMPHI to cumulative dividends, payable in US dollars semi-annuallyin arrears, equal to 6.5% of the issue price per annum. The Parent Bank is also required to redeem the preferred sharesfrom SMPHI at the original issue price five years from the date of issue.As required by BSP, the Parent Bank set up a sinking fund on October 17, 2005 for the redemption of the preferredshares. The balance of the sinking fund as of December 31, 2008 amounted to P2,110 and was invested in debtsecurities, shown as part of HTM investments (see Note 9.3).

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)Dividends in arrears (recognized as interest expense) as of December 31, 2008 amounted to P31 computed using theexchange rate at year end and are presented as part of Bills Payable account in the statement of financial position.On October 19, <strong>2009</strong>, the preferred shares were redeemed in full by the Parent Bank at P2,446 inclusive of remainingdividends in arrears of P77 (see Note 19.7).17. SUBORDINATED NOTES PAYABLEOn November 21, 2007, the Parent Bank issued P10,000 unsecured subordinated notes eligible as Lower Tier 2 Capitaldue on 2017, callable with step-up in 2012 (the Notes) pursuant to the authority granted by the BSP to the ParentBank on October 8, 2007 and BSP Circular No. 280 Series of 2001, as amended. The issuance was approved by theBoard of Directors, in its special meeting held on June 1, 2007.On May 20, 2008, the Parent Bank issued another tranche of P10,000 unsecured subordinated notes eligible as LowerTier 2 Capital due on 2018, callable with step-up in 2013 pursuant to the authority granted by the BSP to the ParentBank on April 3, 2008 and BSP Circular No. 280 Series of 2001, as amended. This issuance was approved by the Boardof Directors, in its special meeting held on February 23, 2008.On March 20, <strong>2009</strong>, the Parent Bank issued the third tranche of unsecured subordinated debt qualifying asTier 2 Capital of the Parent Bank with face of P3,000. This issuance was approved by the Board of Directors onJanuary 31, <strong>2009</strong>.The Notes represent direct, unconditional unsecured and subordinated peso-denominated obligations of the ParentBank, issued in accordance with the Terms and Conditions under the Master Note. The Notes, like other subordinatedindebtedness of the Parent Bank, are subordinated to the claims of depositors and ordinary creditors, are not a deposit,and are not guaranteed nor insured by the Parent Bank or any party related to the Parent Bank, such as its subsidiariesand affiliates, or the PDIC, or any other person. The Notes shall not be used as collateral for any loan made by theParent Bank or any of its subsidiaries or affiliates. The Notes carry interest rates based on prevailing market rates, with astep-up provision if not called on the fifth year from issue date. The Parent Bank has the option to call the Notes on thefifth year, subject to prior notice to Noteholders. The Notes were used further to expand the Parent Bank’s consumerloan portfolio and to refinance an existing issue of Lower Tier 2 debt. The Notes also increased and strengthened theParent Bank’s capital base, in anticipation of continued growth in the coming years.<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>103As of December 31, <strong>2009</strong> and 2008, the outstanding balance of the Notes amounted to P23,152 and P20,146,respectively.Total interest expense on subordinated notes payable amounted to P1,725, P1,687 and P971 in <strong>2009</strong>, 2008 and 2007,respectively, both in the <strong>BDO</strong> Unibank Group and Parent Bank financial statements (see Note 21).