2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

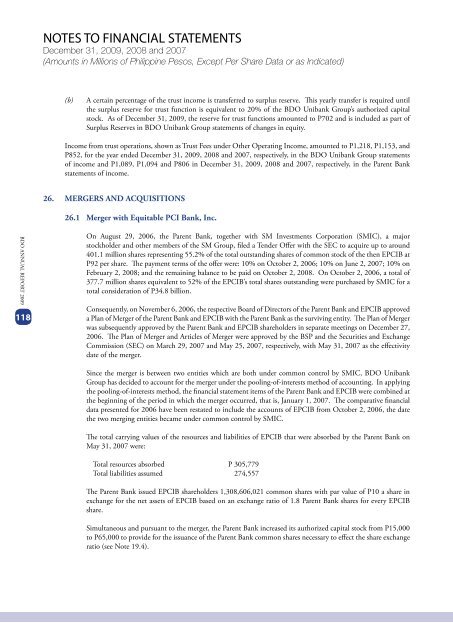

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)(b)A certain percentage of the trust income is transferred to surplus reserve. This yearly transfer is required untilthe surplus reserve for trust function is equivalent to 20% of the <strong>BDO</strong> Unibank Group’s authorized capitalstock. As of December 31, <strong>2009</strong>, the reserve for trust functions amounted to P702 and is included as part ofSurplus Reserves in <strong>BDO</strong> Unibank Group statements of changes in equity.Income from trust operations, shown as Trust Fees under Other Operating Income, amounted to P1,218, P1,153, andP852, for the year ended December 31, <strong>2009</strong>, 2008 and 2007, respectively, in the <strong>BDO</strong> Unibank Group statementsof income and P1,089, P1,094 and P806 in December 31, <strong>2009</strong>, 2008 and 2007, respectively, in the Parent Bankstatements of income.26. MERGERS AND ACQUISITIONS26.1 Merger with Equitable PCI Bank, Inc.<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>118On August 29, 2006, the Parent Bank, together with SM Investments Corporation (SMIC), a majorstockholder and other members of the SM Group, filed a Tender Offer with the SEC to acquire up to around401.1 million shares representing 55.2% of the total outstanding shares of common stock of the then EPCIB atP92 per share. The payment terms of the offer were: 10% on October 2, 2006; 10% on June 2, 2007; 10% onFebruary 2, 2008; and the remaining balance to be paid on October 2, 2008. On October 2, 2006, a total of377.7 million shares equivalent to 52% of the EPCIB’s total shares outstanding were purchased by SMIC for atotal consideration of P34.8 billion.Consequently, on November 6, 2006, the respective Board of Directors of the Parent Bank and EPCIB approveda Plan of Merger of the Parent Bank and EPCIB with the Parent Bank as the surviving entity. The Plan of Mergerwas subsequently approved by the Parent Bank and EPCIB shareholders in separate meetings on December 27,2006. The Plan of Merger and Articles of Merger were approved by the BSP and the Securities and ExchangeCommission (SEC) on March 29, 2007 and May 25, 2007, respectively, with May 31, 2007 as the effectivitydate of the merger.Since the merger is between two entities which are both under common control by SMIC, <strong>BDO</strong> UnibankGroup has decided to account for the merger under the pooling-of-interests method of accounting. In applyingthe pooling-of-interests method, the financial statement items of the Parent Bank and EPCIB were combined atthe beginning of the period in which the merger occurred, that is, January 1, 2007. The comparative financialdata presented for 2006 have been restated to include the accounts of EPCIB from October 2, 2006, the datethe two merging entities became under common control by SMIC.The total carrying values of the resources and liabilities of EPCIB that were absorbed by the Parent Bank onMay 31, 2007 were:Total resources absorbed P 305,779Total liabilities assumed 274,557The Parent Bank issued EPCIB shareholders 1,308,606,021 common shares with par value of P10 a share inexchange for the net assets of EPCIB based on an exchange ratio of 1.8 Parent Bank shares for every EPCIBshare.Simultaneous and pursuant to the merger, the Parent Bank increased its authorized capital stock from P15,000to P65,000 to provide for the issuance of the Parent Bank common shares necessary to effect the share exchangeratio (see Note 19.4).