2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

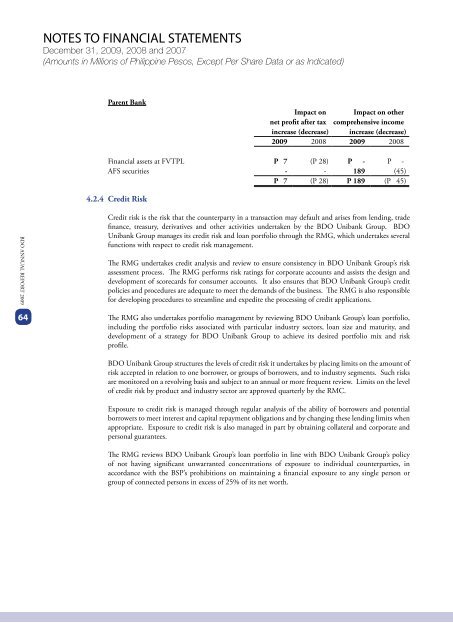

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)Parent BankImpact on Impact on othernet profit after tax comprehensive incomeincrease (decrease) increase (decrease)<strong>2009</strong> 2008 <strong>2009</strong> 2008Financial assets at FVTPL P 7 (P 28) P - P -AFS securities - - 189 (45)P 7 (P 28) P 189 (P 45)4.2.4 Credit Risk<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>Credit risk is the risk that the counterparty in a transaction may default and arises from lending, tradefinance, treasury, derivatives and other activities undertaken by the <strong>BDO</strong> Unibank Group. <strong>BDO</strong>Unibank Group manages its credit risk and loan portfolio through the RMG, which undertakes severalfunctions with respect to credit risk management.The RMG undertakes credit analysis and review to ensure consistency in <strong>BDO</strong> Unibank Group’s riskassessment process. The RMG performs risk ratings for corporate accounts and assists the design anddevelopment of scorecards for consumer accounts. It also ensures that <strong>BDO</strong> Unibank Group’s creditpolicies and procedures are adequate to meet the demands of the business. The RMG is also responsiblefor developing procedures to streamline and expedite the processing of credit applications.64The RMG also undertakes portfolio management by reviewing <strong>BDO</strong> Unibank Group’s loan portfolio,including the portfolio risks associated with particular industry sectors, loan size and maturity, anddevelopment of a strategy for <strong>BDO</strong> Unibank Group to achieve its desired portfolio mix and riskprofile.<strong>BDO</strong> Unibank Group structures the levels of credit risk it undertakes by placing limits on the amount ofrisk accepted in relation to one borrower, or groups of borrowers, and to industry segments. Such risksare monitored on a revolving basis and subject to an annual or more frequent review. Limits on the levelof credit risk by product and industry sector are approved quarterly by the RMC.Exposure to credit risk is managed through regular analysis of the ability of borrowers and potentialborrowers to meet interest and capital repayment obligations and by changing these lending limits whenappropriate. Exposure to credit risk is also managed in part by obtaining collateral and corporate andpersonal guarantees.The RMG reviews <strong>BDO</strong> Unibank Group’s loan portfolio in line with <strong>BDO</strong> Unibank Group’s policyof not having significant unwarranted concentrations of exposure to individual counterparties, inaccordance with the BSP’s prohibitions on maintaining a financial exposure to any single person orgroup of connected persons in excess of 25% of its net worth.