2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

2009 ANNUAL REPORT FINANCIAL SUPPLEMENTS - BDO

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

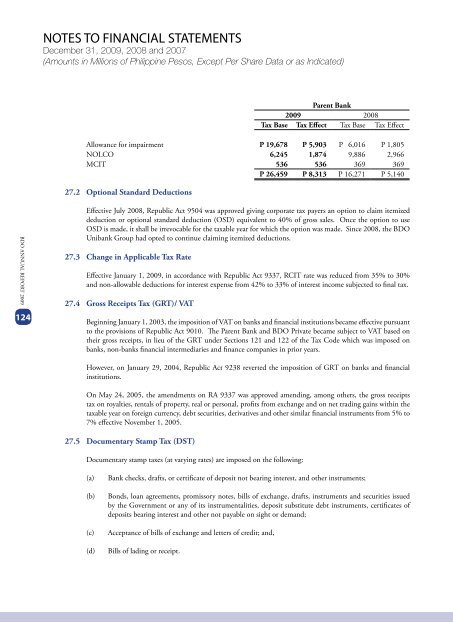

NOTES TO <strong>FINANCIAL</strong> STATEMENTSDecember 31, <strong>2009</strong>, 2008 and 2007(Amounts in Millions of Philippine Pesos, Except Per Share Data or as Indicated)Parent Bank<strong>2009</strong> 2008Tax Base Tax Effect Tax Base Tax EffectAllowance for impairment P 19,678 P 5,903 P 6,016 P 1,805NOLCO 6,245 1,874 9,886 2,966MCIT 536 536 369 369P 26,459 P 8,313 P 16,271 P 5,14027.2 Optional Standard Deductions<strong>BDO</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2009</strong>124Effective July 2008, Republic Act 9504 was approved giving corporate tax payers an option to claim itemizeddeduction or optional standard deduction (OSD) equivalent to 40% of gross sales. Once the option to useOSD is made, it shall be irrevocable for the taxable year for which the option was made. Since 2008, the <strong>BDO</strong>Unibank Group had opted to continue claiming itemized deductions.27.3 Change in Applicable Tax RateEffective January 1, <strong>2009</strong>, in accordance with Republic Act 9337, RCIT rate was reduced from 35% to 30%and non-allowable deductions for interest expense from 42% to 33% of interest income subjected to final tax.27.4 Gross Receipts Tax (GRT)/ VATBeginning January 1, 2003, the imposition of VAT on banks and financial institutions became effective pursuantto the provisions of Republic Act 9010. The Parent Bank and <strong>BDO</strong> Private became subject to VAT based ontheir gross receipts, in lieu of the GRT under Sections 121 and 122 of the Tax Code which was imposed onbanks, non-banks financial intermediaries and finance companies in prior years.However, on January 29, 2004, Republic Act 9238 reverted the imposition of GRT on banks and financialinstitutions.On May 24, 2005, the amendments on RA 9337 was approved amending, among others, the gross receiptstax on royalties, rentals of property, real or personal, profits from exchange and on net trading gains within thetaxable year on foreign currency, debt securities, derivatives and other similar financial instruments from 5% to7% effective November 1, 2005.27.5 Documentary Stamp Tax (DST)Documentary stamp taxes (at varying rates) are imposed on the following:(a)(b)(c)(d)Bank checks, drafts, or certificate of deposit not bearing interest, and other instruments;Bonds, loan agreements, promissory notes, bills of exchange, drafts, instruments and securities issuedby the Government or any of its instrumentalities, deposit substitute debt instruments, certificates ofdeposits bearing interest and other not payable on sight or demand;Acceptance of bills of exchange and letters of credit; and,Bills of lading or receipt.